Newsletter Performance Review : Q3FY25

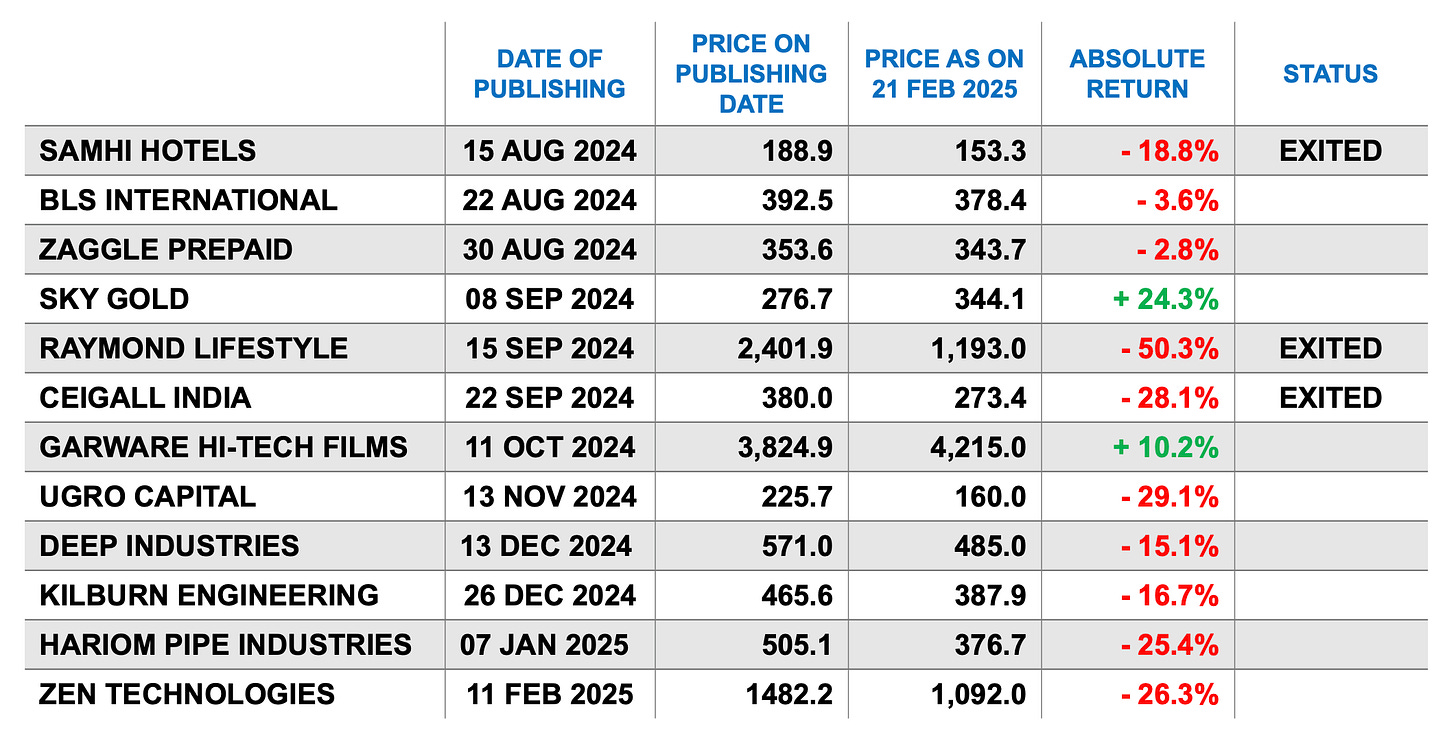

Issue #021 reviews the performance of featured stocks post their Q3FY25 results. This includes SAMHI, BLS, Zaggle, Sky Gold, Raymond, Ceigall, Garware, Kilburn, Deep, UGRO, Zen Tech & Hariom Pipes

The past few weeks have been tough for stock market investors

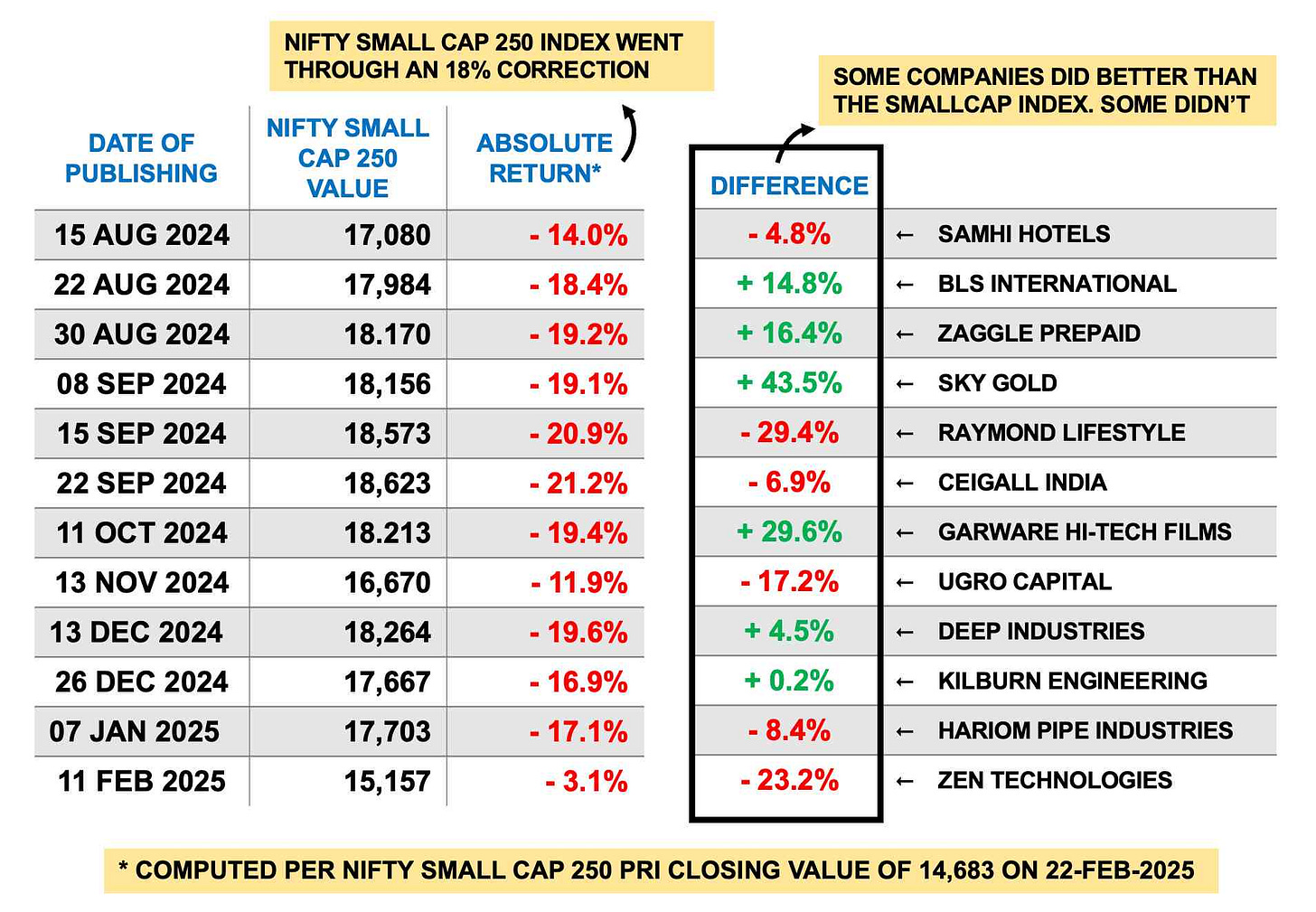

Since the 2nd week of December:

▸ The Nifty 50 is down 7.5% 🔻

▸ The Nifty Midcap 150 has dropped 13.8% 🔻

▸ And the Nifty Smallcap 250 has plunged 20.2% 🔻

Given the focus on small & microcap stocks, this quarter has been particularly challenging for me

Except for Sky Gold & Garware Hi Tech Films, all other featured companies have declined in stock price (not business performance) from the date of publishing

As all companies are small/microcaps, I benchmarked their performance against the Nifty Smallcap 250 Index

And I must confess – seeing the smallcap index in an even worse shape did give me a misplaced sense of relief

Despite the slump, our focus remains clear – 1. analyzing the reasons behind price drops, 2. spotting undervaluation opportunities & 3. learning from these situations

📝 I wasn’t able to prepare a detailed report for every company like I did for Deep Industries last week as the research, analysis & writing was taking longer than expected. My apologies — will do better next time

1. BLS International

Original post | Q3 Transcript | Q3 Presentation

BLS International delivered its highest-ever quarterly revenue of ₹513 crores (+17% YoY) while EBITDA and PAT surged 79% and 50% respectively

The EBITDA margin expanded by 10.6% (not a typo!) driven by the integration of new businesses (iDATA, Citizenship Invest, Aadifidelis) and a shift from partnership to a self-managed model

In its Visa business, overall revenue appears to have declined, but net revenue (post-commission) increased by 60% YoY, making it a key metric to track

Despite the strong performance, the company has not provided any forward guidance

Given our evolving understanding of BLS’s business model, a follow-up note will be published in the coming weeks

2. Ceigall India

Original post | Q3 Transcript | Q3 Presentation

Ceigall India’s 9MFY25 revenue growth slowed to 16.3%, a steep drop from its 82% growth in FY23 and 46% in FY24

The company maintains a healthy orderbook of ₹5,700+ crores in EPC & BOT and another ₹5,500 crores in HAM projects

For FY26, management has guided for 15-20% revenue growth at 12.5-13% margins – a notable shift from earlier expectations

This new guidance marks a significant deviation from our original investment thesis, requiring a reassessment of projections

3. Deep Industries

Original post | Q3 Transcript | Q3 Presentation

Deep Industries delivered an exceptional Q3 with revenue, EBITDA, PAT and EPS growing 48%, 53%, 70%, and 56% YoY respectively

Key developments & material changes in Q3 include – a) delay in barge deployment, b) 7-8 month delay in PEC revenues and c) equity dilution from a ₹350 crore QIP

Our estimation puts DIL’s FY27 revenue at ₹950 crores with an EPS of ₹37.0. At a PE multiple of 20, this translates to an annualized stock return of 23.2% by FY27

A detailed Q3FY25 update was published on 16th February (read)

4. Garware Hi-Tech Films

Original post | Q3 Transcript | Q3 Presentation

As expected, Q3 seasonality impacted the sales of high-margin Infrared Radiation products — leading to a 25% QoQ revenue decline & 5% drop in margin

Despite this, Garware remains on track to achieve its FY25 topline target of ₹2,000 crores, with margins of 24% ±3%. This is in-line with our estimates

This quarter’s key development was the approval of a ₹118 crore TPU extrusion line, expected to be operational by Oct 2026, enabling cost savings for the PPF segment

Management reaffirmed its FY26 topline guidance of ₹2,500 crores (very likely to achieve ) and have set a FY27 target of ₹3,000 crores

After reviewing the earnings call, we see no change in our investment thesis. We’ll reassess post Q4 results

Investing is a continuous process of learning, analyzing & refining decisions. A lifelong task, skill, passion & an ever-evolving pursuit!

That’s why I’m launching ALPHA — a paid community where like-minded members come together to discuss opportunities, share insights & grow wealth collectively. Unlike a course/workshop, Alpha is a semi-structured space featuring original research, webinars, discussions, expert talk & member-driven participation

It’s my most ambitious project yet — one that I’m deeply passionate about & fully committed to. Tap the link below to learn more, and if it feels like the right fit, I’d love to have you join us! 🤗

5. Hariom Pipe Industries

Original post | Q3 Transcript | Q3 Presentation

Hariom Pipe posted a weak Q3 due to falling steel prices. However, the company managed to increase volumes by 17% YoY while EBITDA margins improved to 13.2% (+1.6% YoY)

With steel prices at multi-year lows, Hariom will miss its FY26 revenue target of ₹2,500 crores

Assuming a modest price recovery and 20% volume growth, revised estimates suggest an FY26 topline of ₹1,700 crores

Since guidance has been significantly reduced, the investment thesis will require a reassessment

A potential catalyst is the Indian government's proposed 15% safeguard duty on steel imports which, per Morgan Stanley estimates, could increase domestic hot rolled coil prices by 10%. Hariom Pipe benefits from such a move

6. Kilburn Engineering

Original post | Q3 Transcript | Q3 Presentation

KEL made key strides this quarter, including: a) completion of the Monga Strayfield acquisition, b) acquisition of a unit at MIDC Ambernath and c) completion of phase 1 of M E Energy expansion

The company has lowered its FY25 topline guidance from ₹500 crores to ₹450-500 crores citing delays in a major order (now expected only in Q2FY26)

Similarly, the FY26 guidance has been revised downwards from ₹700-750 crores to ₹650-700 crores

While management reaffirmed its ₹2,000 crore order pipeline, the current order book (₹409 crores), along with revenue estimates from Monga Strayfield (₹90 crs) and M E Energy (₹100 crs), raises doubts about it hitting the ₹650 crore target for FY26

Kilburn Engineering has effectively lowered guidance without explicitly stating it. This will require a redrawing of the numbers

7. Raymond Lifestyle

Original post | Q3 Transcript | Q3 Presentation

Raymond Lifestyle posted weak Q3 numbers – revenue growth of just 2% YoY, EBITDA down 30% while PAT declined sharply by 60% — on account of weak festive demand, scale deleverage, store expansion costs, advertising spends & an unfavorable sales mix

RLL opened 61 new stores, expanded into sleepwear (Oct 2024) and launched innerwear (Jan 2025). These investments will continue over the next 2-3 years, with a focus on premiumization, casualization & brand building

RLL had previously targeted ₹2,200 crores of EBITDA in FY28 which might get pushed back by 12-18 months. They’re targeting a blended EBITDA margin of 15%

The ongoing weakness has impacted RLL’s plans pushing our investment timeline from moderate to long-term. While our initial thesis was based on valuation comparison amongst peers, a detailed financial proforma is now necessary to assess whether RLL is investable at current levels

8. SAMHI Hotels

Original post | Q3 Transcript | Q3 Presentation

SAMHI’s turnaround remains on track, reporting a ₹23 crore PAT this quarter – a sharp improvement from their ₹74 crore loss in Q3FY24

Q3 revenues grew 10% YoY driven by a strong 15% increase in RevPAR, EBITDA margins were at 41.2% while the aggregate occupancy was at 72%

The company plans to double its inventory in the upscale segment, increasing premium room count from 1,000 to 2,000+, which should enhance ARR & RevPAR

While no formal guidance was provided, SAMHI’s expansion strategy suggests a 3-year revenue CAGR of 13% – slightly lower than industry peers

9. Sky Gold

Original post | Q3 Transcript | Q3 Presentation

Sky Gold is on track to achieve its annual revenue target of ₹3,300 crores delivering a stellar Q3 with YoY revenues, EBITDA and PAT surging by 116%, 217% and 309% respectively

In Q3, the company expanded partnerships with Indriya (Aditya Birla), CaratLane, and P.N. Gadgil, while also entering the 18-carat & lab-grown diamond jewellery segments

With major retailers like Kalyan, Senco, Malabar Gold etc. aggressively opening stores, Sky Gold has upped its FY27 revenue guidance from ₹6,300 crores to ₹7,200 crores, with projected EBITDA & PAT margins of 5.5% & 3.5%

Given the revised guidance on revenue and margins, we will be updating our investment thesis accordingly

10. UGRO Capital

Original post | Q3 Transcript | Q3 Presentation

Despite regulatory headwinds in the NBFC and microfinance sectors, UGRO Capital’s Q3 AUM surged 32% YoY with record net disbursements. The company aims to maintain 30% AUM growth

Branch network has now expanded to 224 locations, with a target of 400 branches by FY26. Breakeven now occurs in just 8 months, highlighting operational efficiency

Asset quality remains stable with GNPA at 2.1% and NNPA at 1.5%. 70% of loans are secured and importantly, 75% of unsecured portfolio is covered under CGTMSE guarantee, effectively reducing risk

The current ROA stands at 1.9% (target: 3.5 - 4%) and ROE at 8.4% (target: 16-18%). UGRO initially aimed to achieve an 18% ROE by March 2027, but slowdown in liquidity has pushed this timeline back by 2-3 quarters

I’m currently conducting a deeper analysis of UGRO Capital and will publish a follow-up note soon

11. Zaggle Prepaid

Original post | Q3 Transcript | Q3 Presentation

Zaggle posted strong YoY growth in revenues (68%), adjusted EBITDA (37%) & PAT (33%) in this quarter

This expansion has come at a cost. Q3 EBITDA margins declined from 11.5% to 9.4% as the company aggressively invests in incentives, cashback & rewards to drive user engagement

Zaggle is actively exploring acquisitions in related fields like merchant card software & payment infrastructure. This is in addition to investments in Mobileware Technologies and Taxspanner (Q2FY25)

The company has raised its topline growth target to 58-63% and targets EBITDA margins of 15-16% over the next four years

Zaggle’s business model is complex, and I’m currently studying it in greater depth. A follow-up note will be published soon

12. Zen Technologies

Original post | Q3 Transcript | Q3 Presentation

As explained in the original post, the key metric for Zen Technologies is its order book, which saw a marginal ₹1.69 crore increase in Q3

This quarter is critical for the company as the stock performance now hinges on it securing a high value of new orders (atleast ₹500 crores). I must add - Mr. Atluri in his Q3 earning call confirmed some orders will most likely spill into Q1FY26 & probably a little into Q2

Apologies for the long read, but I hope these highlights have provided some valuable insights into each company’s current state of affairs. For more clarity, please do read the Q3 transcript & presentation, as I have done for each company

Personally, this exercise has reinforced my appreciation for the discovery process and helped identify areas where our research can improve. Priyam and I will continue refining our analysis by incorporating stronger evidence, avoiding overly complex operating models and thoroughly assessing key headwinds & tailwinds

I truly believe this iterative approach will ultimately improve our ability to identify long-term winners making us better investors (I’m sure you’ve already spotted some promising names from this list!)

Much love,

Shankar

Dear Shankar/Priyam,

Firstly thanks a lot to both of you as you indeed do a great job to provide the genuine updates in your call.Also by doing so you encourage all those individuals who are interested to upskill their finance management and stock market learning process.Once again thank you.From your recommendations I keep analyzing bls international, ugrow,zeggle prepaid,kilburn,deep industries,and samhi hotel few of them also make me exited to invest in.Please do let me know if I can contribute to you in your research in any way.

Jay

Thank you so much Shankar Ji,This helps me to understand better on the companies.Wish will sail through on these tough market conditions..Thanks again and salute to your commitment towards our community..