Garware Hi-Tech Films Eyes Blockbuster 100% EPS Growth 🍿

Issue #014 examines Garware Hi-Tech Films Limited's strategic focus on niche, high-end products & the impact of margin expansion on it's financials. Psst .. I'm projecting a 100% growth in EPS by FY26

There are typically two ways of enhancing shareholder value – by boosting sales growth or, by increasing profit margins

While my recent stories have focused on companies driving significant revenue growth (Sky Gold, BLS, Zaggle, Ceigall), this one here highlights a deliberate strategy aimed at margin expansion

Hope you like it 🤗 — and if you do, kindly share this post with your friends and ask them to subscribe to my newsletter for more such insights

This story has been researched by Priyam Bansal

Garware Hi-Tech Films Limited

Founded in 1933 as a motor trading company, Garware Hi-Tech Films Limited (GHFL) initially gained recognition in the plastic moulding & extrusion industry

In the 1980s and 1990s, it became a household name with GVC — Garware Video Cassettes. Many of you might recall the iconic "GOLD" or "Garware Home Video" logos on VHS tapes

GHFL has since evolved into a leading manufacturer of polyester and specialty films, offering a broad range of products like BOPET films, solar control films (SCF), paint protection films (PPF), thermal lamination & low-oligomer films (read pages 24-37 for details)

The year 2017 marked a turning point when GHFL shifted from low-margin, highly-competitive polyester films (a commodity business) – to high-margin specialty films like SCF, PPF & shrink films

These value-added products – which contributed 48% of sales in FY17 – now make up 88% of Q1FY25 sales (page 13). This strategic shift boosted GHFL’s margins by over 10%, rewarding shareholders with a 52.7% stock price gain since

A Blockbuster Quarter

Our story kicks off with GHFL’s Q1FY25 results (PDF) which revealed substantial improvements in it’s financial performance esp. YOY EBITDA & PAT growth

But what really caught our eye was a 8.2% jump in EBITDA margins, driven by product mix changes such as — a) greater focus on consumer products, b) growing sales of high-end products across segments & c) expansion into new geographies

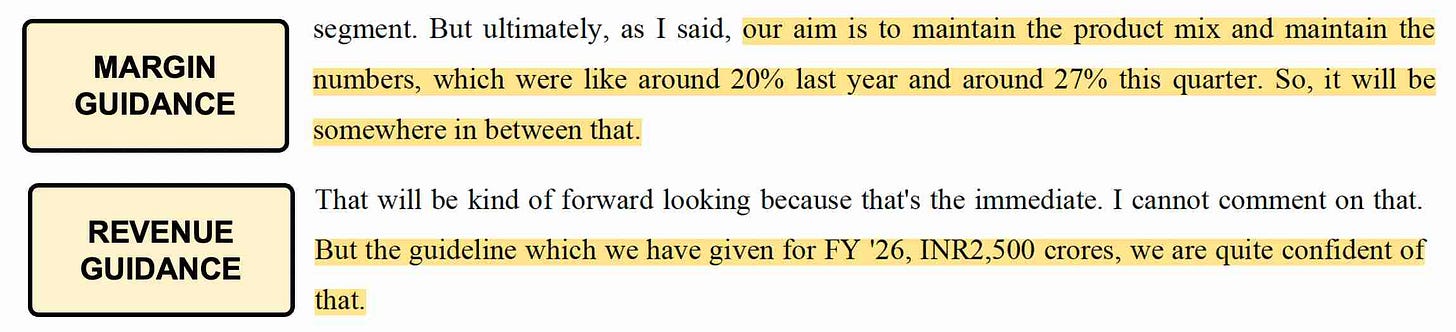

Considering seasonal fluctuations, management has provided:

a) Margin Guidance of 20-25%

b) Revenue Guidance of ₹2,500 crores for FY26

Peeling Back the Layers

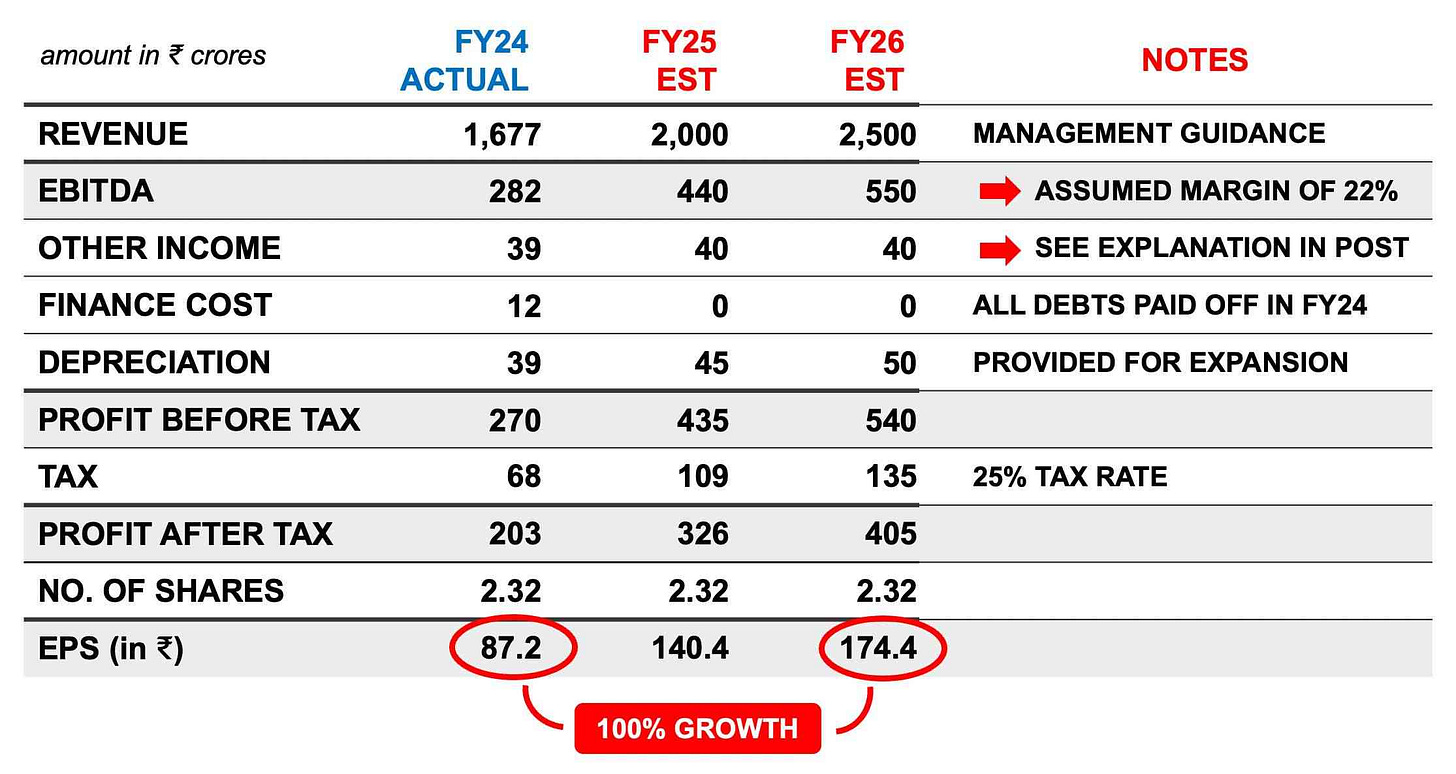

Based on management’s guidance, I estimate a 22.1% revenue CAGR and more importantly, a 41.4% EPS growth over the next two years – from FY24 to FY26

Incredibly, the EPS perfectly doubled in our projections — a growth of exactly 100.0000% 🙂

👉 We found GHFL’s financials a fairly straightforward one, with two key variables of note:

Firstly, there’s EBITDA margin & Priyam chose to go with 22% – in line with management’s 20-25% guidance

Secondly, GHFL holds ₹275 crores in debt and arbitrage mutual funds

With profits of ₹19.4 crs flowing into last year’s P&L as “other income” (page 149) & combined with gains from exchange rate fluctuations (₹16.3 crs) – it’s a bit tricky to estimate “other income”. Hence I’ve conservatively kept it at ₹40 crores for FY25 & FY26

The Thin Valuation Line

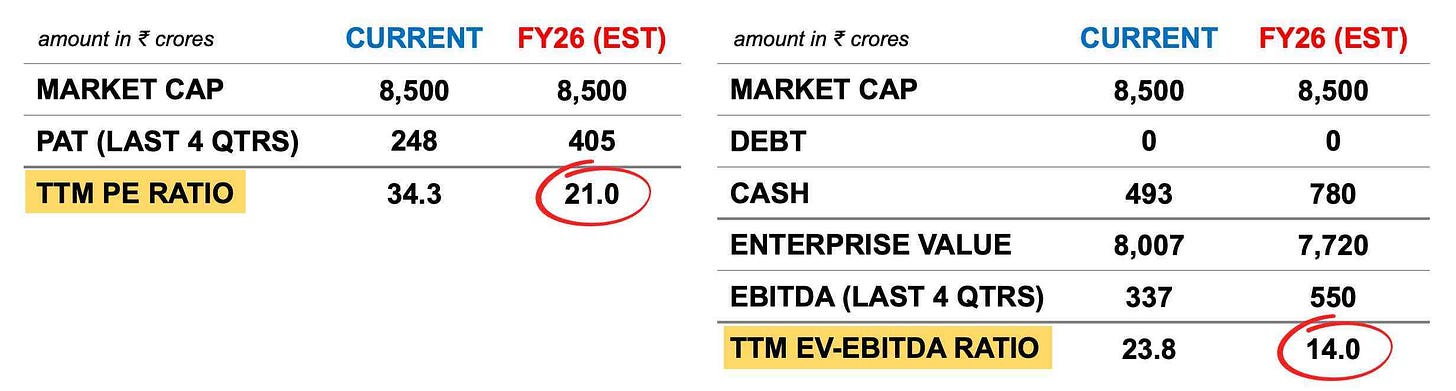

From a valuation standpoint, GHFL currently trades at a TTM PE multiple of 34.3 and an EV-EBITDA ratio of 23.8

Looking forward to FY26, we estimate a fwd PE ratio of 21.0 & fwd EV-EBITDA ratio of 14.0

I find these numbers pretty attractive given the quality of business at hand

👉 Before you check screener (click here) consider this:

a) GHFL is listed under packaging but with SCF, PPF & specialty films driving 80%+ of revenue, it’s far from a traditional packaging company

b) GHFL has few listed peers (3M India comes close) and with 77% of Q1FY25 revenue coming from exports, its key competitors are mostly foreign companies

Investing is a continuous process of learning, analyzing & refining decisions. A lifelong task, skill, passion & an ever-evolving pursuit!

That’s why I’m launching ALPHA — a paid community where like-minded members come together to discuss opportunities, share insights & grow wealth collectively. Unlike a course/workshop, Alpha is a semi-structured space featuring original research, webinars, discussions, expert talk & member-driven participation

It’s my most ambitious project yet — one that I’m deeply passionate about & fully committed to. Tap the link below to learn more, and if it feels like the right fit, I’d love to have you join us! 🤗

Filmy, not Flimsy

GHFL’s business model stands out for its built-in competitive moats. A few:

1️⃣ Focus on high-end, value-added products like SCF, PPF and specialty films helps GHFL carve a niche — keeping Chinese and Korean competitors at bay. Further, its forward and backward integration enhances cost efficiency & quality control, while continuous product innovation strengthens its market position (page 10)

2️⃣ GHFL delivers steady margins – thanks to its differentiated operating model. Meanwhile, commodity players like Uflex and Polyplex (who make PET films, BOPP, CPP etc.) offer low margins, tepid growth & big margin swings — a reason why GHFL commands a higher valuation

3️⃣ GHFL is expanding PPF capacity with a new ₹125 crore manufacturing line that’s set to start production in Q2FY26. This line is expected to generate ₹350-450 crores in revenue within 2-3 years of operationalizing

🧮 Here’s a simple ROI calculation for this upcoming expansion. With capex at ₹125 crs, working capital of ₹25 crs, a 20% margin & ₹350 crores of revenue, the ROI comes to 50% i.e. (20% * 350) ÷ (125 + 25). That’s impressive!

4️⃣ GHFL is a cash-generating machine. As of June 2024, the company held ₹493 crores in cash reserves & is generating an additional ₹220-250 crores annually

After accounting for ₹125 crores in capex, zero debt & a conservative dividend policy (11-12% payout), we estimate GHFL will close FY25 with ₹520 crores and FY26 with ₹780 crores in cash reserves

Understandably, questions are being asked of acquisitions or special dividends – but nothing concrete yet. I’ll update, if & when something comes up

⚠️ That said, GHFL operates in a competitive global environment and is therefore not immune to risks, such as:

Major raw materials like PTA & MEG come from crude oil – whose prices are volatile (GHFL mitigates this with forward contracts & long term agreements)

Logistical delays like supply chain disruptions during Covid (India to US transport time increased to 75 days then; now 35 days)

Industry weakness in automotive sector, especially in the US, could impact revenues as SCF and PPF contribute heavily to sales

My Viewpoint

In my opinion, the positives far outweigh the risks. Afterall, in GHFL we have:

1️⃣ Established global business with presence in 90+ countries & 77% revenue from exports

2️⃣ Manufacturer of high-quality, premium products with strong innovation, R&D capabilities

3️⃣ Strong revenue growth (FY22-24 : 19.4%, est. FY24-26 : 22.0%)

4️⃣ Expansion of capacity (₹125 crs capex to generate incremental sales of upto ₹450 crs by FY29)

5️⃣ Margin upgrade (17% earlier; I estimate a steady 22% for next two years)

6️⃣ EPS growth (estimated to grow by 41.4% annually over next two years)

7️⃣ Solid cash reserves (₹493 crs in Q1FY25) with continued generation (+₹250 crs/year)

8️⃣ No debt

9️⃣ Valuation comfort (FY26 PE ratio of 21.0, FY26 EV-EBITDA of 14.0)

As I said, the positives far outweigh the challenges – and GHFL certainly merits a few hours of your time & research prowess

Would love to know your thoughts 📢

Much love,

Shankar

"There are typically two ways of enhancing shareholder value – by boosting sales growth or, by increasing profit margins" - So simple and elegant. Yet we confuse us with so much jargons and this and that. If we understand this small basic - Then investing becomes easy. Thanks a lot for the knowledge and research.

I really Appreciate your Knowledge and Research Sir.

What a detailed analysis! Many thanks to you.