Zaggle All The Way - a 10X in 10Y Opportunity 🎁

Issue #010 features a leading player in the spends management space. Can Zaggle’s unique business model, growth drivers and global aspirations turn it into a 10-bagger over the next decade?

🔲 Profitable

🔲 Undervalued

🔲 Scalable

It's rare to find a fintech that ticks all three boxes

I think I’ve found one that does!

Zaggle Prepaid Ocean Services Limited

Incorporated in 2011, Zaggle is a leading player in the spends management space with over 3,100 corporate customers serving a base of 29 lakh users.

It is also amongst India’s largest issuer of prepaid cards having distributed more than 5 crore cards (read, read, listen)

The business is built around three products

1. Zaggle SAVE - an employee expense management & benefits platform that consolidates benefits like food coupons, fuel, travel vouchers, mobile expenses, periodicals etc. (across 90+ wallets) – into a single pre-paid card

2. Zaggle PROPEL - a rewards and recognition platform designed to enhance employee & channel partner engagement

3. Zaggle ZOYER - an automated accounts payable solution focused on accelerating invoice processing, vendor payments, GST payments, budget management & more

The company’s key differentiator is its seamless integration of all three critical components: a) workflow management for employees, channel partners & vendors, b) payment solutions such as prepaid cards, corporate credit cards, UPI, NEFT etc. and c) third-party integrations with banking & other partners through APIs

This will become clear as we delve deeper into the story

✅ A Profitable Fintech

For a fintech, Zaggle has taken the road less travelled – it’s profitable! 🥳

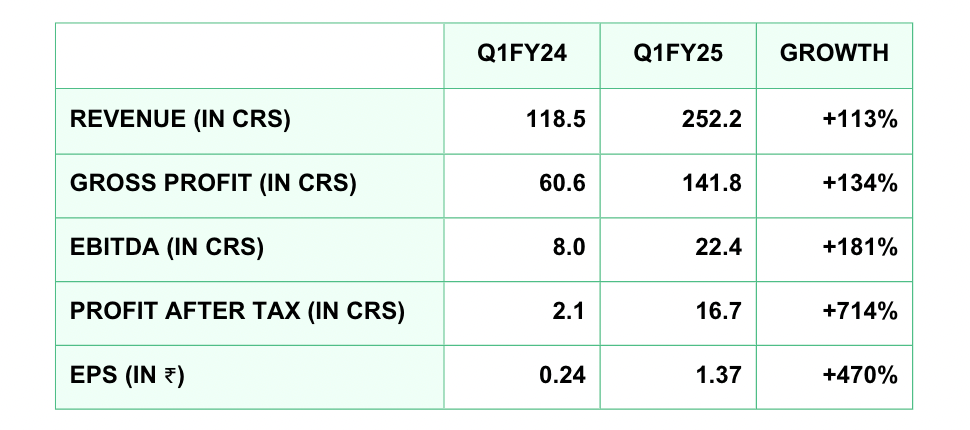

Infact, the company had a fantastic Q1FY25 with every metric doubling over the last year

The recent revenue growth is largely driven by a 165% increase in program fees – thanks to a surge in credit card volumes & the growing adoption of Zoyer

In this context, let’s explore how Zaggle generates its revenue

There are two broad segments to consider:

1. Software fees (also called platform fees) is charged from corporate customers typically on a per user per month basis

2. Transaction fees (also called program fees) is earned when users spend on Zaggle’s prepaid and/or corporate credit cards. These fees represent a percentage of the interchange, typically around 1.7-1.8%. Additionally, the company receives incentives from banks and networks like Visa, Rupay & Mastercard for the volume of spends generated

The table below shows us an almost equal contribution coming from platform & program fees (good!)

Segment-wise, Propel generates it’s revenue from platform fees. On the other hand, Save and Zoyer are primarily driven by program fees

This distinction is important because although Propel currently accounts for 57% of revenues, Zaggle’s management expects Zoyer to become their flagship product by FY27, contributing 40-50% of the company’s revenue

✅ An Undervalued Fintech

From a valuation standpoint, the numbers might not be appealing — a trailing 12-month PE ratio of 72.7

But as we’ve seen with Imagicaaworld, SAMHI Hotels & BLS International, a more practical approach is to focus on expected numbers

Pleasantly, Zaggle’s management is confident of growing it’s FY25 revenues by 45-55% over last year and doubling the topline by FY26 (interview)

In fact, the team at Zaggle is so optimistic that they’re considering raising their financial guidance for the year after the Q2 results 😳

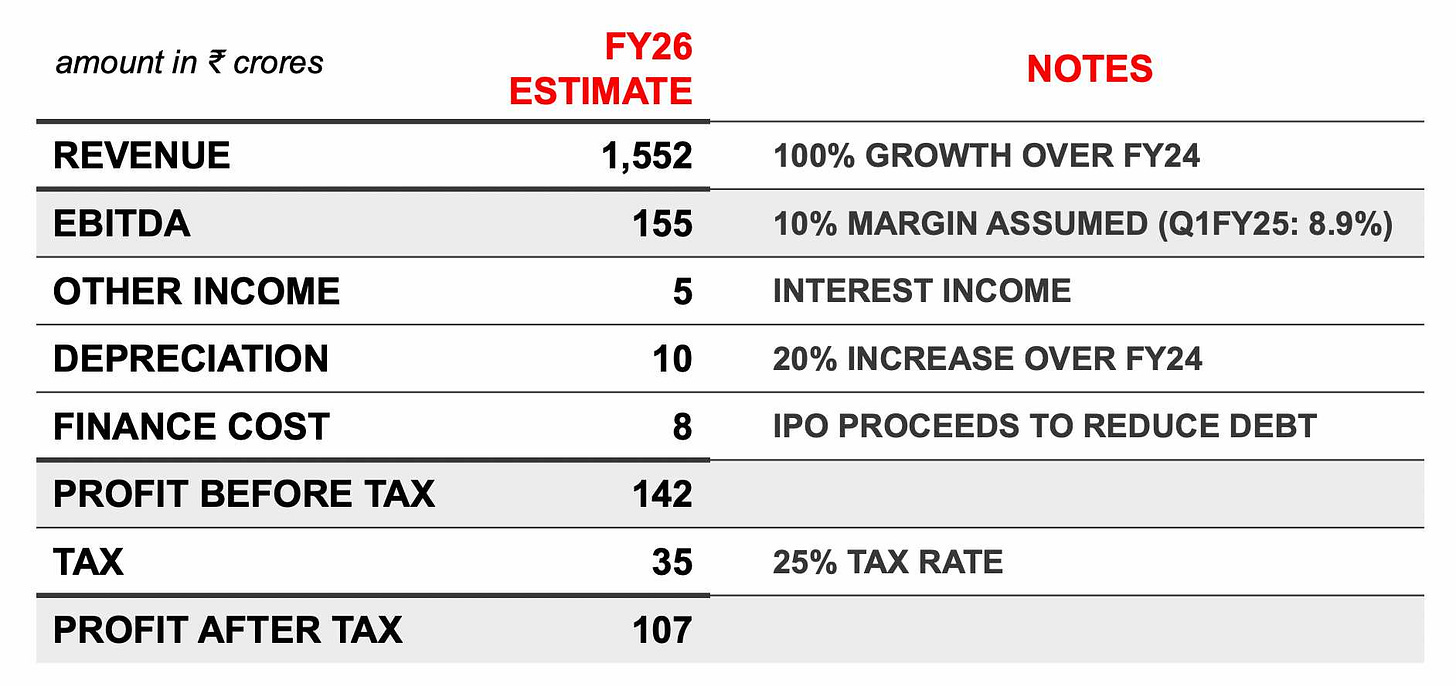

I particularly focused on the “doubling the revenue by FY26” part – and per my calculations FY26 EBITDA is estimated at ₹155 crores while FY26 PAT is projected at ₹107 crores

I used 3 different metrics to assess Zaggle’s valuation. Pick your poison 🙂

1️⃣ At a current market cap of ₹4,300 crores, Zaggle’s FY26 PE ratio comes to 40.3 — which appears to be acceptable for a fintech business. In comparison, PB Fintech has a FY26 forward PE multiple of 107 as noted in this report

2️⃣ Zaggle’s PEG ratio is currently 1.45 i.e. PE ratio of 72.7 divided by the expected 1-year growth rate of 50%. This suggests to me that Zaggle is a fairly valued business

3️⃣ Further, most IT companies with a sub-₹10,000 crore market cap with a sales growth of 40% or more – operate at a price-to-sales ratio of 12 or more (run this query on screener)

In that context, Zaggle currently operates at a PS ratio of 4.7 and a projected FY26 PS ratio of 2.8

Global spend management companies are priced a lot higher. Figure this –

a) Brex is presently valued at $4 billion with annualised revenue of $279 million (article, another article) giving it a PS ratio of 14.3

b) Coupa, acquired in 2022 for $8 billion (news) on revenue of $725 million has a PS ratio of 11.0

In comparison Zaggle, with a market cap of $510 million, has a PS ratio of 4.7

👉 Based on these metrics, I believe Zaggle is is fairly valued – not overvalued or undervalued

However, there are several potential upsides that we’ll explore in the next section

Investing is a continuous process of learning, analyzing & refining decisions. A lifelong task, skill, passion & an ever-evolving pursuit!

That’s why I’m launching ALPHA — a paid community where like-minded members come together to discuss opportunities, share insights & grow wealth collectively. Unlike a course/workshop, Alpha is a semi-structured space featuring original research, webinars, discussions, expert talk & member-driven participation

It’s my most ambitious project yet — one that I’m deeply passionate about & fully committed to. Tap the link below to learn more, and if it feels like the right fit, I’d love to have you join us! 🤗

✅ A Scalable Fintech

Can Zaggle replicate other fintechs to become a 10 bagger — a $5 billion company in the next 10 year?

Let’s gather some insights

1. Growth in Clients

Zaggle has been adding 600-700 corporates every year

However, the company is shifting its strategy by increasing the usage of Zaggle’s prepaid and corporate credit cards amongst their larger clients, the company aims to generate more interchange (program) fees. This comes directly from the playbook of companies like Brex who make 2.7% in interchange fees (Substack on Brex)

As a result, Zaggle signed up fewer but larger clients (~100) in Q1FY25, including notable names like Yokohama India, Hero Motorcorp and PNB Metlife

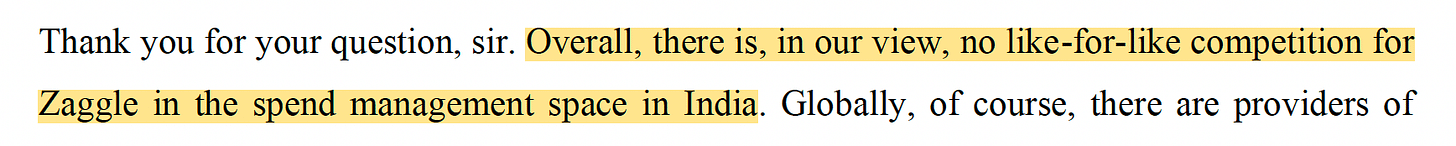

2. Lack of Domestic Competitors

There are very few spend management companies in India that can deliver a comprehensive, all-in-one solution (software + payment + integrations) with the required compliance & cybersecurity features

This competitive edge explains why Zaggle’s CEO, Avinash Godkhindi, confidently asserts that the company faces no direct competitors in the domestic market

With the overall market for spend management (procurement, payroll & expense management) estimated to surpass ₹20,000 crores by FY27 with 60% outsourcing – Zaggle has a lot of juice to extract

3. Growing Number of Use Cases

Zaggle benefits from the Government’s digitization initiatives (APIs, ONDC, UPI, BBPS etc.) and increasing client demand for automation, transparency, control, productivity and cost savings

In this context, the management has identified several use cases that will drive revenue and earnings growth

For example – an improvement in road networks acts as a catalyst for more goods being transported, a rise in fuel stations, more trucks, food stops etc. – all of it pointing to more spends

Zaggle is targeting this sub-market by developing systems to cater to India’s annual fleet expenditure of ₹73,000 crores

4. International Expansion

Zaggle is exploring new geographies and is particularly interested in the US market. The company is currently working on its go-to-market strategy and product-market fit

Breaking into the US market won’t be easy, given the presence of established players like Corpay, Brex, Ramp, Emburse, Coupa & others

However, with the US B2B payments market valued at $25 trillion — of which corporate cards make up 4% ($1 trillion) — success in this market could have a substantial impact on Zaggle’s growth

My Viewpoint

The way I see it, Zaggle has a well-defined vision for its future

1. The company is transitioning from a software provider (Propel) to a SaaS business (Zoyer) with a clear emphasis on boosting program fees as part of this strategic shift

2. The business model is solid – demand for the service is strong, there is minimal cyclicity (although H2 revenues are higher) and it maintains a healthy gross margin of 55%

3. I love the fact that while Zaggle has no direct domestic competitors, the company is ambitiously targeting international markets showing its readiness to compete on a global scale

Ofcourse, standard risks like competition, dependence on banks/third-party payment networks and potential regulatory changes are always present. However, I believe – the growth prospects outweigh these risks

🤔 Zaggle’s entry into the US market is the thought-point here. So if an acquisition is pursued, the current cash position (est. ₹230 crores) and borrowing capacity (est. ₹240 crores; based on interest coverage of 3) may fall short for a significant acquisition. A preferential allotment might be necessary to support this.

Overall, I find Zaggle Prepaid Ocean Services to be a compelling company to watch — a niche player in a large market with the potential to expand significantly over time

Would love to hear your views on it 📢

Much love,

Shankar

Really impressed by this analysis on Zaggle and the earlier newsletters on BLS, SAMHI and others. Frankly I didn't find anyone sharing such insights and detailed analysis on the social media like you Shankar sir ji.

On other note, I got allotment of Zaggle shares in its IPO last year and I still hold them. Even I found their business model and segment unique (with my very limited knowledge) and you too confirmed the same.

I am very much impressed with your analysis and simple but clear way of expression. I missed BLS but may be trying out Zaggle since I like new tech applications. Will you be updating developments on your older suggestions in the future or will we be left on our own to add or exit these companies.