Hidden Profit of ₹236 Crores Triggers SAMHI Hotels Turnaround

Issue #008 delves into a remarkable turnaround in the hotel industry. I analyze the recently-IPOed SAMHI Hotels & uncover a hidden ₹236 crore profit that can be a game-changing catalyst for the stock

Indian Hotels (the Taj Group), Oberoi, Lemon Tree, Leela, OYO, Radisson – these are amongst India’s biggest hotel chains. But one name is missing from this list

🔑 SAMHI Hotels checks in

Started in 2010, SAMHI Hotels is India’s third largest owner of hotel rooms operating in 13 cities with 4,801 rooms across 31 hotels

The company has 2 more hotels under development with capacity additions, renovation & rebranding planned in many others (Q1FY25 presentation; pages 17-20)

Interestingly, SAMHI neither builds most of its hotels nor does it operate them 😳

So firstly, the company acquires under-performing & under-managed hotels on the cheap and turns them around. This strategy drastically reduces development time (e.g. their 150-room Fairfield by Marriott opened in just 21 months as against a build-out of upto 5 years for similar grounds-up properties)

Then, SAMHI’s hotels operate under established & well-recognised hotel operator brands like Marriott, Sheraton, Hyatt and Holiday Inn Express. This opens up access to the operator’s loyalty programs, operational expertise, reservation systems & marketing strategies

This unique acquire-turnaround-outsourceoperations strategy has helped SAMHI quickly build a portfolio of 31 hotels in just 13 years

Understandably, much of SAMHI’s growth was financed by debt & as of March 2023, the company had borrowings of ₹2,834 crores on its books

🔑 IPO checks in

Our story starts from September 2023, when SAMHI launched an IPO with an issue size of ₹1,370 crores (RHP)

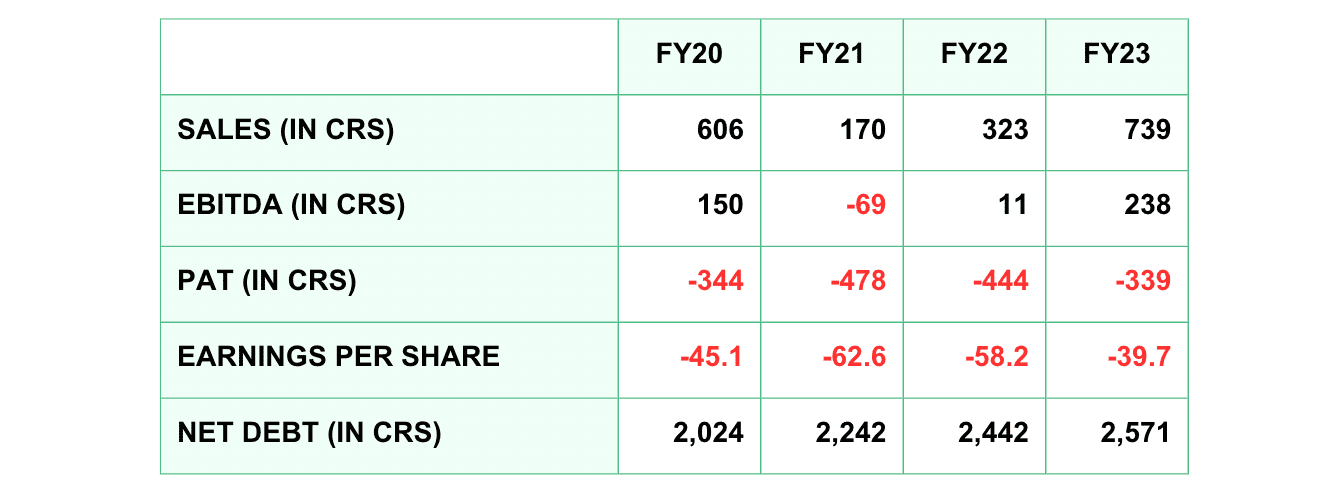

The company’s financials didn’t paint a pretty picture then & expectedly, the listing gains were a miserly 6.7% (news)

However, the management had a plan in place and a major chunk of the IPO proceeds was used to pare down the company’s net debt which stand at ₹1,824 crores as of June 2024

Consequently, the company’s finance (interest) cost came down ₹107 crores in Q1FY24 to ₹55 crores – a saving of ₹52 crores in this quarter which goes straight to the bottomline

Further, the ESOP costs have come down from ₹11.5 crores in Q1FY24 to ₹4.4 crores – a further saving of ₹7.1 crores. This is in line with ESOP costs disclosed in prospectus i.e. ₹45.9 crs in FY24 & ₹17.7 crs in FY25

Incredibly, just these two elements are giving us an annual increment of ₹236 crores to our FY25 bottom line (wow!)

In addition to these savings, SAMHI Hotels registered a 31% jump in Asset EBITDA (I’ll discuss this later) which pleasantly, pushed the most recent quarter’s PAT into positive zone (₹4.1 crores) as against a loss of ₹83.5 crores in Q1FY24

I won’t call it a turnaround yet but let’s see what else we can decipher from the available information

Investing is a continuous process of learning, analyzing & refining decisions. A lifelong task, skill, passion & an ever-evolving pursuit!

That’s why I’m launching ALPHA — a paid community where like-minded members come together to discuss opportunities, share insights & grow wealth collectively. Unlike a course/workshop, Alpha is a semi-structured space featuring original research, webinars, discussions, expert talk & member-driven participation

It’s my most ambitious project yet — one that I’m deeply passionate about & fully committed to. Tap the link below to learn more, and if it feels like the right fit, I’d love to have you join us! 🤗

🔑 The Future checks in

My primary objective here is to build visibility of where SAMHI’s revenues and profitability might be in an year or two from now, so let’s break it down

📌 Let’s start with revenues – which for the hotel industry is a simple formula

1. SAMHI is targeting an inventory growth of 10-15% over last year (not CAGR). How? It’s adding 327 rooms & renovating 468 rooms over the next 6 to 24 months that’ll help boost portfolio revenues

2. In addition to inventory growth, SAMHI expects a strong showing on RevPAR performance targeting an 8-12% growth. This comes on the backdrop of a 13% RevPAR growth in Q1FY25

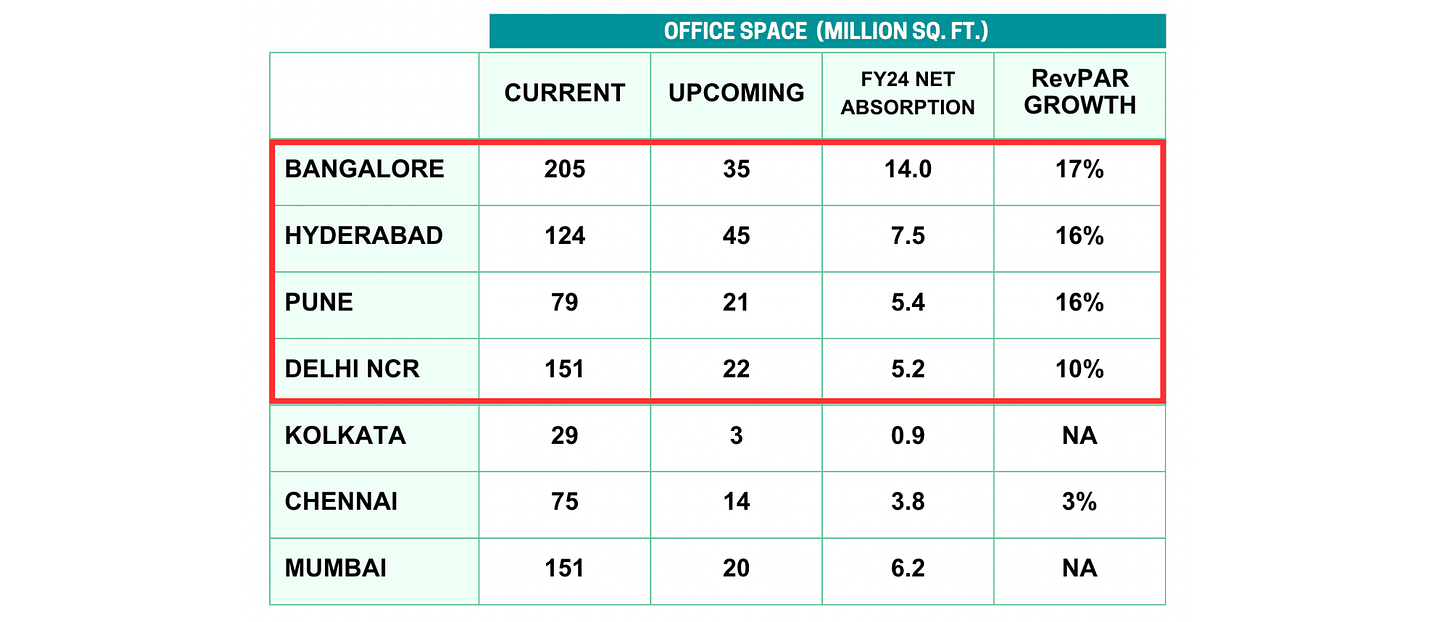

Pleasantly, 76% of SAMHI’s portfolio is in Bangalore, Hyderabad, Pune and Delhi NCR. These offer the highest RevPAR growth amongst major Indian cities

My point is – a combination of inventory growth and RevPAR growth can really boost asset income (consequently asset EBITDA) – and SAMHI Hotels seems to have a 20-25% growth visibility on it’s income over the next 7-8 quarters

If terms like RevPAR, occupancy rate etc. are new to you, then please watch my Youtube video on How to Evaluate a Hotel Stock. It’s one of my favourite videos of the channel and btw, RevPAR stands for Revenue Per Available Room

📌 Now let’s move to the profitability variables

1. SAMHI delivered an asset EBITDA of ₹95 crores in Q1FY25 – a 32% growth over last year

The company expects a 25% bump in it’s EBITDA from it’s visible pipeline of: a) more rooms (+327), b) ongoing & planning renovation and rebranding (+468) and c) improvement in margins (37.7% now to 40%)

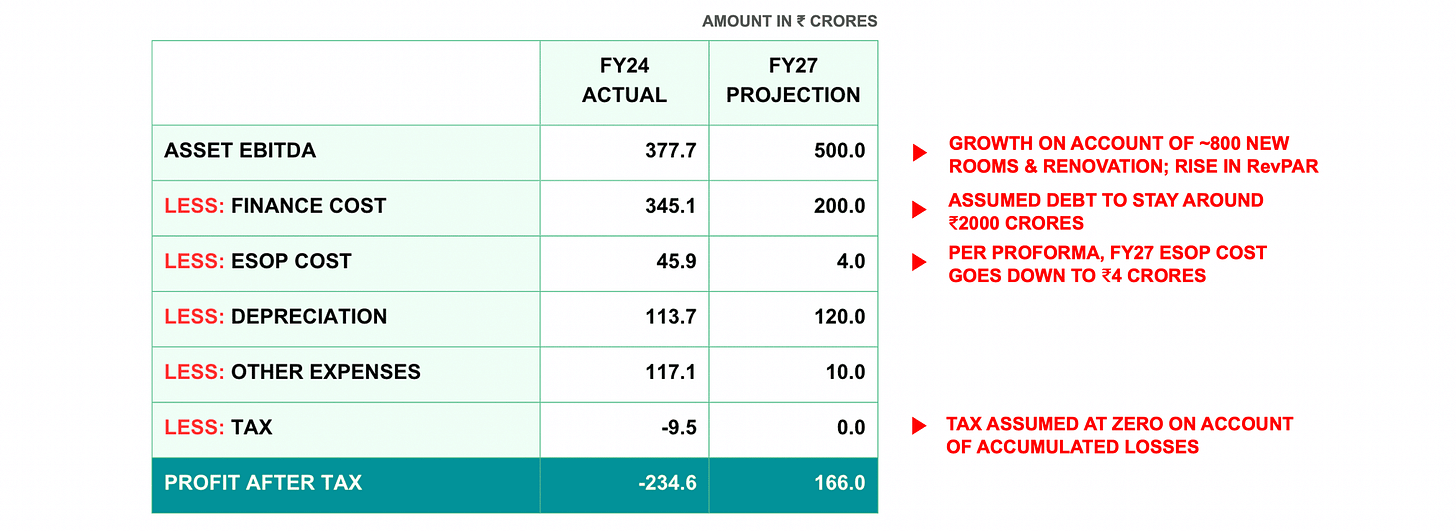

The management has a 25% guidance over it’s FY24 proforma asset EBITDA of ₹399 crores – meaning, they’re looking at ₹500 crores of EBITDA for FY27

2. As discussed earlier, the finance cost was the biggest hole-in-the-pocket but that’s come down now and is estimated at ₹200 crores for the year (down from ₹345 crores in FY24)

3. The ESOP cost is expected to go down every year with ₹17.7 crores allocated in FY25, ₹9.5 crores in FY26 & just ₹4 crores in FY27

Thus, my own back-of-the envelope calculation puts the FY27 PAT at ₹166 crores

This number is a lot conservative than the FY26 PAT of ₹209 crores, a Feb 2024 report by JM Financial had estimated (you can read an earlier report here).

Infact, the research firm has given a buy call for SAMHI Hotels with a target price of ₹295/share (news)

🔑 Competitors checks in

Assuming this math of FY27 PAT of ₹166 crores is acceptable, the current market cap of ₹4,200 crores puts SAMHI’s FY27 PE ratio at 25.3

Comparatively most of its peers are currently priced at a multiple of 60-65

Figure this – if the hotel industry retains a price-multiple of 60 until FY27 (which I think it will, given the demand-supply gap), 60 times of ₹166 crores comes to ₹10,000 crores of market cap – a rise of 138%!

Further, a quick calculation puts my FY27 EV-EBITDA projection at 12 i.e. an EV of ₹6,000 crores (mcap of ₹4,200 crs + net debt of ₹1,800 crs) divided by an EBITDA of ₹500 crores

Again, comparing it with peers reveals a median industry EV-EBITDA ratio of 24 – so, ₹500 crores multiplied by 24 times gives us ₹12,000 crores of EV – a rise of 100% over the next 7-8 quarters!

Nice one, right? If you know anyone who would love to receive similar stories, please encourage them to subscribe to my newsletter. Thanks for your support!

🔑 My Viewpoint – will it check out?

So the math seems straightforward, but my confidence stems from a number of other sources

1. Earnings are now visible. This was missing until last year (probably why valuations were stifled) but SAMHI has been in the black for two quarters now. A 10% growth in inventory & 8-10% RevPAR growth gives me the assurance that this trend would continue

2. After a tough decade, the hospitality industry is finally receiving the benefits of a fast expanding aviation industry (8-9% annual growth) & business environment (~7% GDP growth)

Relatably, the demand for branded hotels in cities like Hyderabad, Pune & Delhi is rising by 10-12% per year while the supply is growing by just 2-5% — a big demand-supply gap that augurs well from branded hotel chains like SAMHI (read here, here & here)

3. With no major expansion planned for the next 2 years, SAMHI is likely to use it’s free cash flow to further bring down the debt

I don’t expect too much here so I haven’t factored that in my calculation but there’s scope for deleveraging which builds more confidence in the thesis. Currently, the company generates ~₹300 crores in FCF and expects this number to increase by a good clip in FY25 & FY26

And that’s my study on SAMHI Hotels

I’ll encourage you to read this twice, examine the materials (presentation, earnings transcript etc.), scan the news & do your own research before making up your mind

If you have a different point of view or useful information on SAMHI, please share it in the comments area below and if you have stock ideas of your own, please email your detailed analysis of the opportunity at hello@beginnersbuck.com

Much love,

Shankar

Thank you shankar

Thank you Shankar. I do hold shares of Samhi Hotels and my thesis is very similar to yours. I do have a bit of optimistic view on how quick they can get to 500cr but then, I gave a lower multiple than 60. Overall an excellent analysis and another well written issue!