GOLD Rush: I'm SKYing a 144% Jump in Profits

In Issue #011, I examine Sky Gold Limited - a designer & manufacturer of gold jewellery. Aided by capacity expansion & acquisitions, Sky Gold is targeting a 260% rise in revenue & profits over 2 years

When Priyam mentioned “Sky Gold”, I was genuinely surprised

And who wouldn’t be? Afterall, here’s a company whose stock price has already surged 10x in just 1 year 😳

But Priyam was well-prepared and what followed was a deep, four-hour discussion — the highlights of which are featured in this week’s issue

This is Priyam’s debut research piece, so kindly share your appreciation & feedback in the comments below

Sky Gold Limited

Sky Gold operates a B2B-model, manufacturing gold jewellery to mid-range jewellers like Kalyan, Malabar, Joyalukkas, Senco etc. – who further sell these products through their retail outlets and online platforms

My initial impression was that this outsourcing is done to meet demand spikes during the festive season

However I was surprised to learn major jewellers – including Titan – rely heavily on companies like Sky Gold, Emerald, Kanakratna, P Mangatram etc. with just 10-30% of the manufacturing being done in-house

Sky Gold has been in the jewellery design & manufacturing business since 2005 offering a wide range of necklaces, bracelets, earrings, rings etc. It specializes in casting jewellery (watch) that accounts for 35% of overall retail sales – a substantial addressable market

With 900,000 unique designs & a range between ₹5,000 & ₹1,00,000, Sky Gold’s products are in 2,000 stores across India, plus another 500+ outlets globally

Viability lies in Capacity

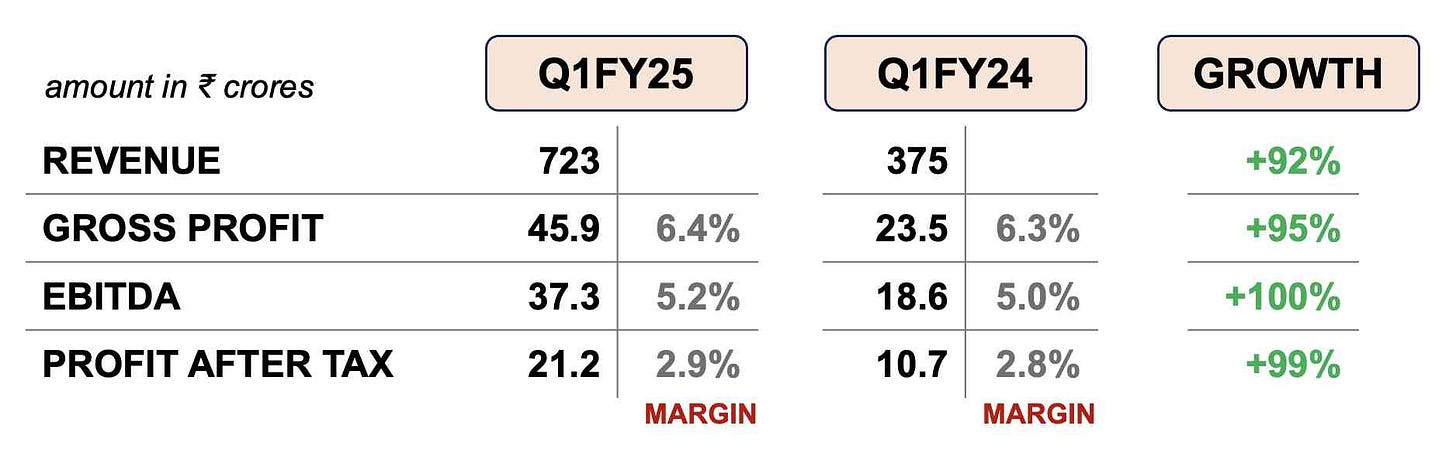

Q1FY25 was a record-breaking quarter for Sky Gold, with the company doubling it’s revenue, gross profit, EBITDA & PAT

The margins – gross profit, EBITDA & PAT – haven’t changed much and that’s how this model works. Sky Gold is a low-margin, high-volume play

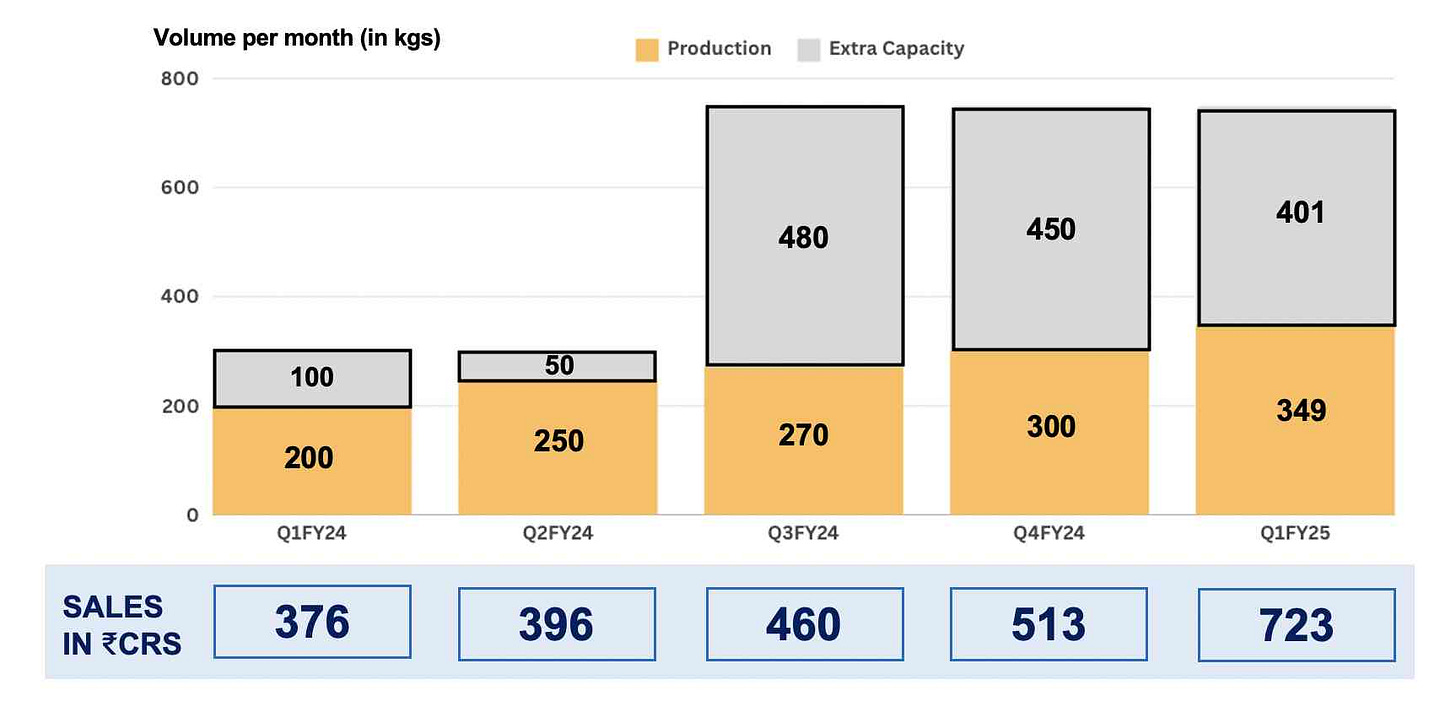

With regards to volumes (capacity), there are two key developments of note

1. In August 2023, the company shifted to an 80,000 sq. ft. facility in Navi Mumbai (earlier 25,000 sq. ft.), boosting capacity to 750 kgs/month

This is helping Sky Gold target more & larger clients domestically and abroad resulting in a sharp increase in sales

2. In June this year, the company acquired Starmangalsutra Pvt. Ltd. and Sparkling Chains Pvt. Ltd. (announcement)

This amounts to an incremental ₹371 crore in combined FY24 sales and raises Sky Gold’s total production capacity by 300 kgs/month – to 1,050 kg/month. Further, these acquisitions expands the company’s market reach from 35% to 65% of retail sales

Short-Term Shine, Long-Term Luster

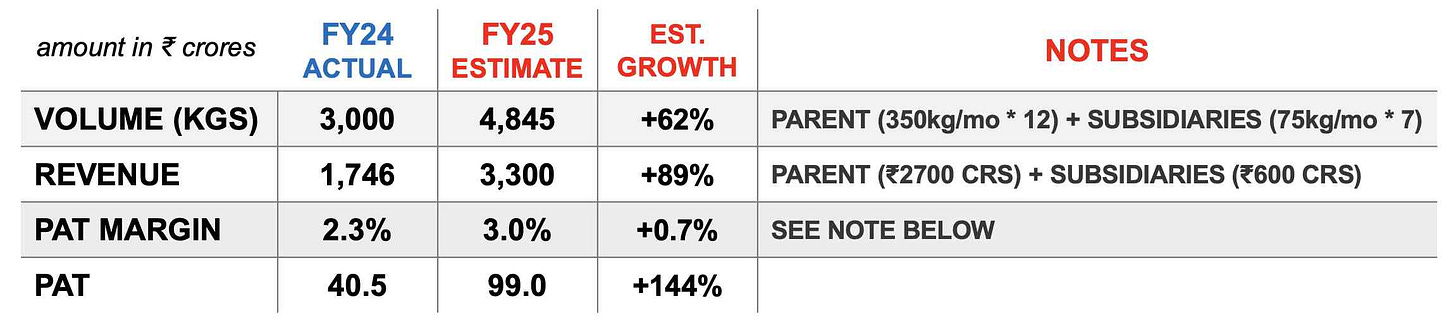

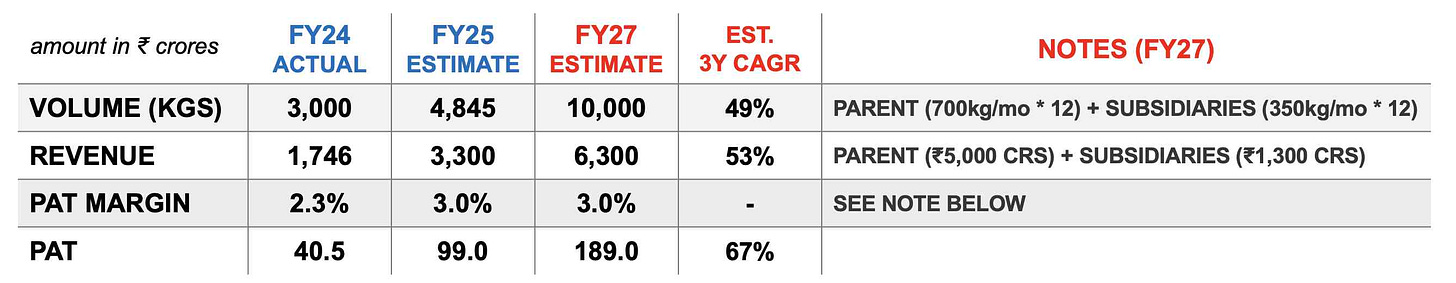

💎 By my estimates, Sky Gold’s FY25 revenue will grow by 89% with the PAT increasing by 144% compared to last year

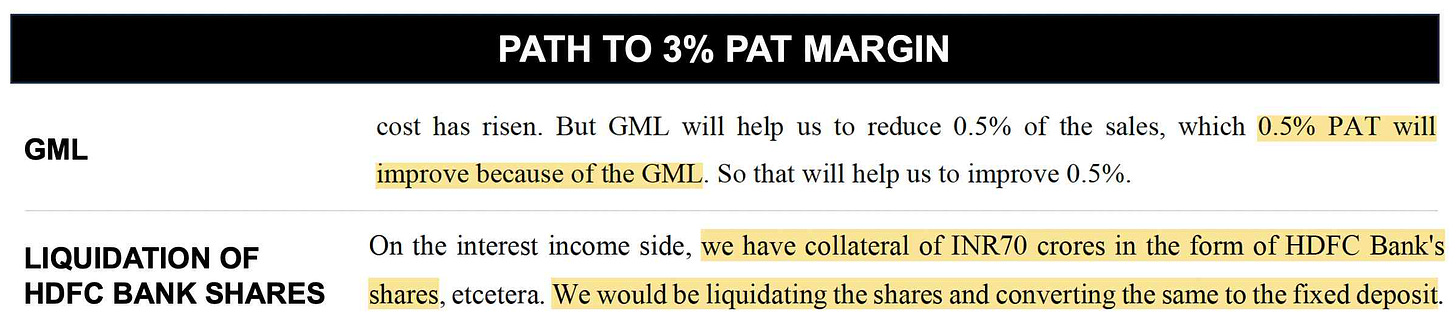

The big assumption here is a 70 bps increase in PAT margin, which the management is confident of achieving on account of:

a) switching from high-interest working capital loans to Gold Metal Loans (this will save 0.5% in PAT)

b) liquidating HDFC Bank shares worth ₹70 crore and reinvesting in fixed deposits to generate ₹5.6 crore in interest income (assuming interest at 8% p.a.)

💎 Further, the management has set a revenue target of ₹6,300 crores for FY27 – assuming 100% utilization of capacity (production of 12 tons; FY24 was 3 tons)

Here again, I haven’t increased the PAT margin beyond 3%, even though the management is aiming higher

My caution stems from comparing Sky Gold to the industry leader – Emerald Jewel Industry India Limited – which operates at a 1.4%-1.7% margin (ICRA rating)

Valuing Sky Gold

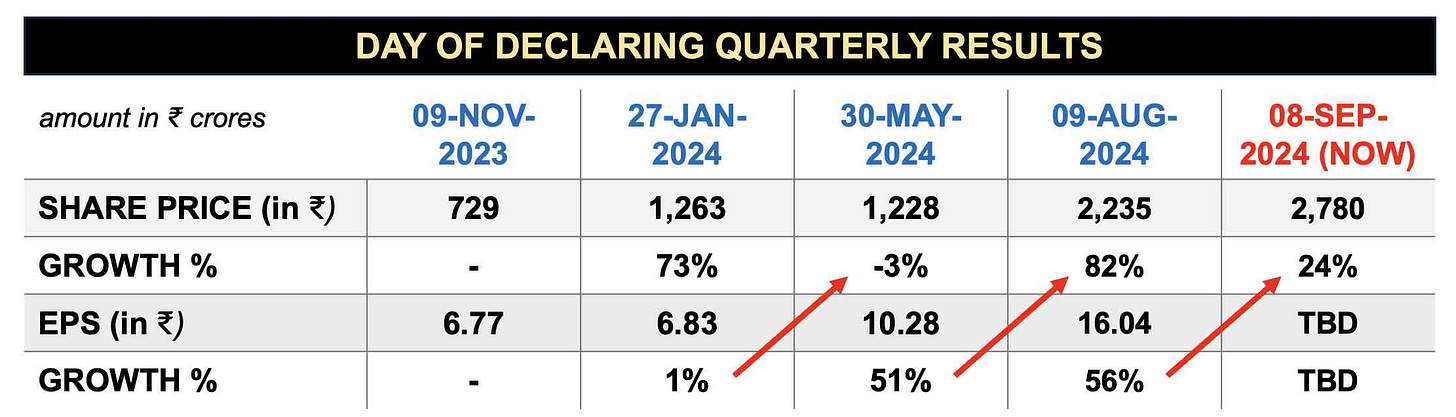

Sky Gold is currently trading at a PE ratio of 70.7 & has seen a 835% jump in share price over the year (wow!)

Luckily, Priyam had an explanation for this

He pointed to two distinct periods of growth:

a) 08-Sep-2023 to 31-Mar-2024 when the price rose from ₹285 to ₹960 due to undervaluation (PE ratio was just 12.8 in Sep 2023)

b) 01-Apr-2024 to 07-Sep-2024 when the price increased from ₹960 to ₹2,780 reflecting EPS growth

The three arrows above clearly explains our hypothesis and another imminent quarter of EPS growth – I’m expecting a YOY increase of 90% in Q2FY25 results – might drive up the stock price

💎 At a current market cap of ₹3,600 crore, the FY25 forward PE ratio comes to 36.4, and for FY27, the PE multiple is estimated at 19.0

This suggests to me that short-term growth may be already priced in but the long-term potential is still substantial, assuming the company meets its execution targets

As a sidenote, Nuvama has a target price of ₹3,600 for Sky Gold, which aligns with my own analysis :) (download PDF)

Investing is a continuous process of learning, analyzing & refining decisions. A lifelong task, skill, passion & an ever-evolving pursuit!

That’s why I’m launching ALPHA — a paid community where like-minded members come together to discuss opportunities, share insights & grow wealth collectively. Unlike a course/workshop, Alpha is a semi-structured space featuring original research, webinars, discussions, expert talk & member-driven participation

It’s my most ambitious project yet — one that I’m deeply passionate about & fully committed to. Tap the link below to learn more, and if it feels like the right fit, I’d love to have you join us! 🤗

Soar High but Keep a Parachute Handy

Sky Gold’s simple business model (capacity expansion = growth, margins = 3%) is reassuring but because we need more comfort before investing – let’s examine the major drivers of it’s strategy

1. Shift towards branded jewellery - The organised market has grown at a 18-19% CAGR, capturing 37% of market share from just 22% in FY19 (full report by Motilal Oswal)

This shift is expected to accelerate with higher disposable incomes, hallmarking and a rising demand for jewellery as fashion & daily wear – a tailwind for Sky Gold

2. Expanding clients, products & geographies – Sky Gold’s current capacity utilisation is only 45% giving them room to onboard new large and mid-sized clients (corporates with atleast 5-10 stores & minimum yearly sales of ₹20+ crores)

The company is expanding to 18-carat & diamond jewellery in addition to exports (already up to 11% of Q1FY25 revenue, 6% in FY24). Plus a potential deal with Titan could be a game-changer

3. Transition to Gold Metal Loans - In Q1FY25, SkyGold covered 10% of its requirement through GML. By December of this year, it plans to be at 100% – saving interest costs, improving cash flow & boosting the company’s PAT margin (+0.5% lift)

Gold Metal Loan is a mechanism under which a jewellery manufacturer a) borrows gold metal, b) uses this gold for production without paying upfront and c) repays the loan in gold or cash from the sale proceeds (RBI’s original notification)

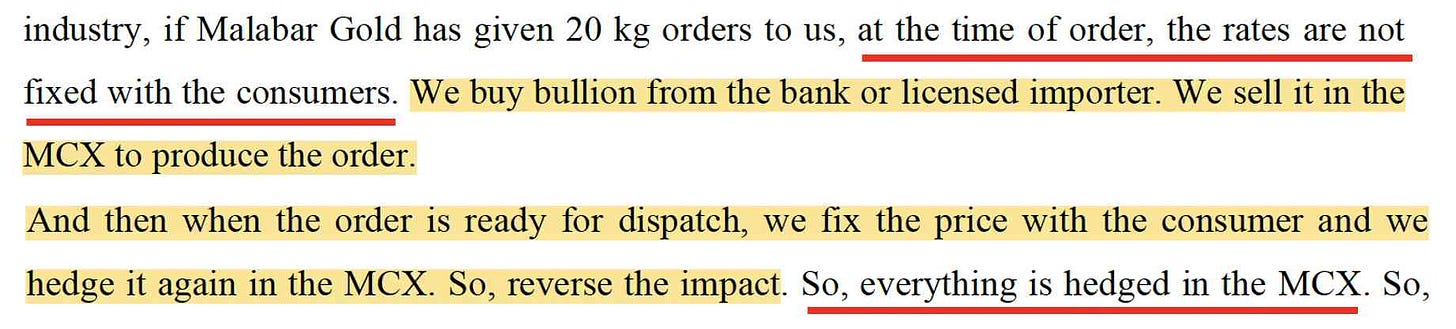

4. 100% Hedging - Sky Gold hedges its entire gold inventory through MCX, protecting it from price volatility (like the recent fall in gold prices due to import duty cuts; watch)

5. Fund Raising - On the 2nd of this month, the Sky Gold’s Board approved the raising of additional capital of upto ₹270 crores via public or private offerings including a QIP (announcement)

Sky Gold plans to use this money – a) to grow it’s subsidiaries, b) expand into 18-carat & diamond jewellery and c) fund R&D for the US market

My Viewpoint

Since "all that glitters is not gold," here are some orange/red flags:

1. The company has negative cash flow. This may stem from a) short payable days (payment for gold is immediate), b) long receivable days (retailers may follow a 30-45 day payment cycle) and c) inventory holding. Per management estimates, one might see a reversal only by end of FY26

2. I found this strange. Between Q4FY24 and Q1FY25, the employee cost and other expenses fell, despite sales rising by 40.8%. The management could not provide an explanation in the earnings call

3. B2B jewellery manufacturing is a low-margin business with cut-throat competition. As organised retail flourishes, I expect more consolidation amongst players

4. Sky Gold’s debt is rising in line with business growth (inventory as of March 2024 was ₹250 crores). However & pleasantly, the interest coverage has risen to 4.7 in Q1FY25 from 3.6 in FY24

In conclusion, Sky Gold’s low-margin, high-volume model and it’s current capacity expansion drive makes it an interesting stock to watch

As long as demand persists (✅️for now), capacity fulfilment grows (✅️), and margins hold steady (3% ✅️) – Sky Gold should stay on our radar

Would love to hear your thoughts in the comments.

Much love,

Shankar

Hi, I like your article and mostly love your content. We are also from jewellery business in madurai can be able to relate the business model. Thanks

Hi Shankar, Thanks for yet another powerful Newsletter. Congratulations to Priyam for your efforts. What running in my mind is that, their competitor working on half of their margins, which means they will be able to sell the jewellery better to the clients of SKY Line, I such a scenario will they not clients towards them ? Any research on USP of SKY Line which makes them distinct from their clients? Please share your views, if my thoughts are right?

Thanks in advance!!!