Ceigall India Ready to Soar Higher: 70% Upside on Strong Order Pipeline 🕊️

Issue #013 dives into the buzz surrounding Ceigall India Limited, examining its business fundamentals, performance, order book and valuations. My analysis indicates a potential 35-70% EPS growth

There’s been a lot of buzz on X (formerly Twitter) about Ceigall India Limited in the past week – and for good reason

Afterall, it’s rare to find a company/stock that:

☑️ trades below it’s IPO price

☑️ projects 30-40% revenue growth

☑️ has a PE ratio in the low 20s

Let’s dive into what’s fueling this optimism 🚀

On The Road More Travelled

Founded in 2002, Ceigall has grown from a small construction firm to a major EPC player specializing in structural projects like elevated roads, flyovers, bridges, tunnels, runways, highways etc.

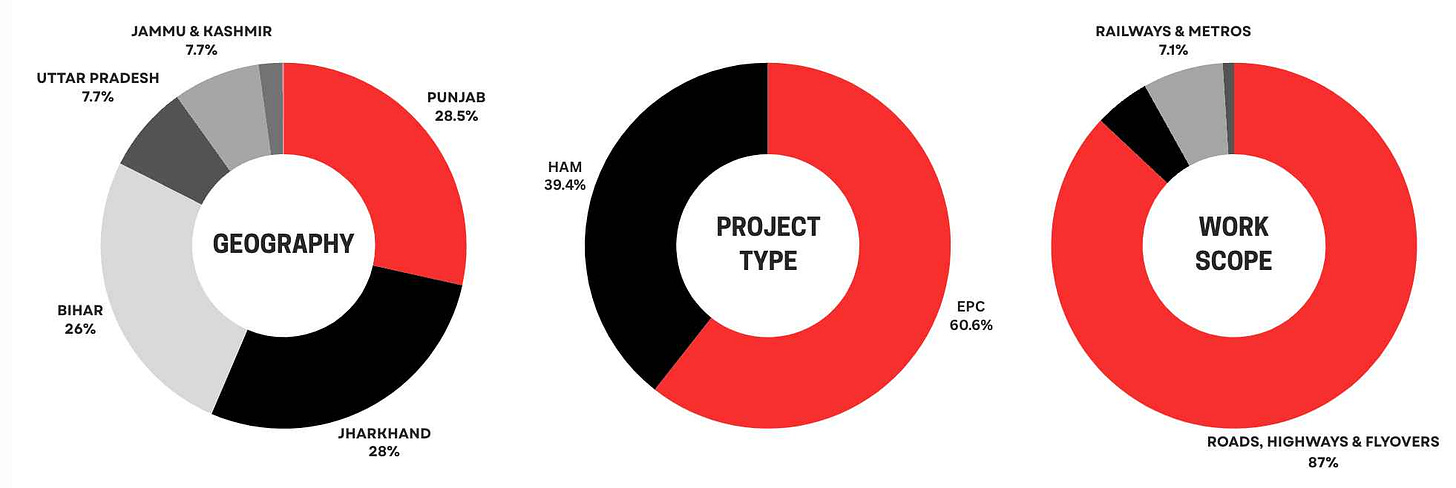

Headed by Ramneek Sehgal – Ceigall is Sehgal’s soaring seagull 🥴 – the company has significantly diversified it’s portfolio across geographies, project types & work scope

Ceigall derives much of its revenue from NHAI contracts and benefits from a supportive policy environment incl. infrastructure spending & initiatives like Gati Shakti, Bharatmala Pariyojana, National Infrastructure Policy, high-speed rail corridors etc.

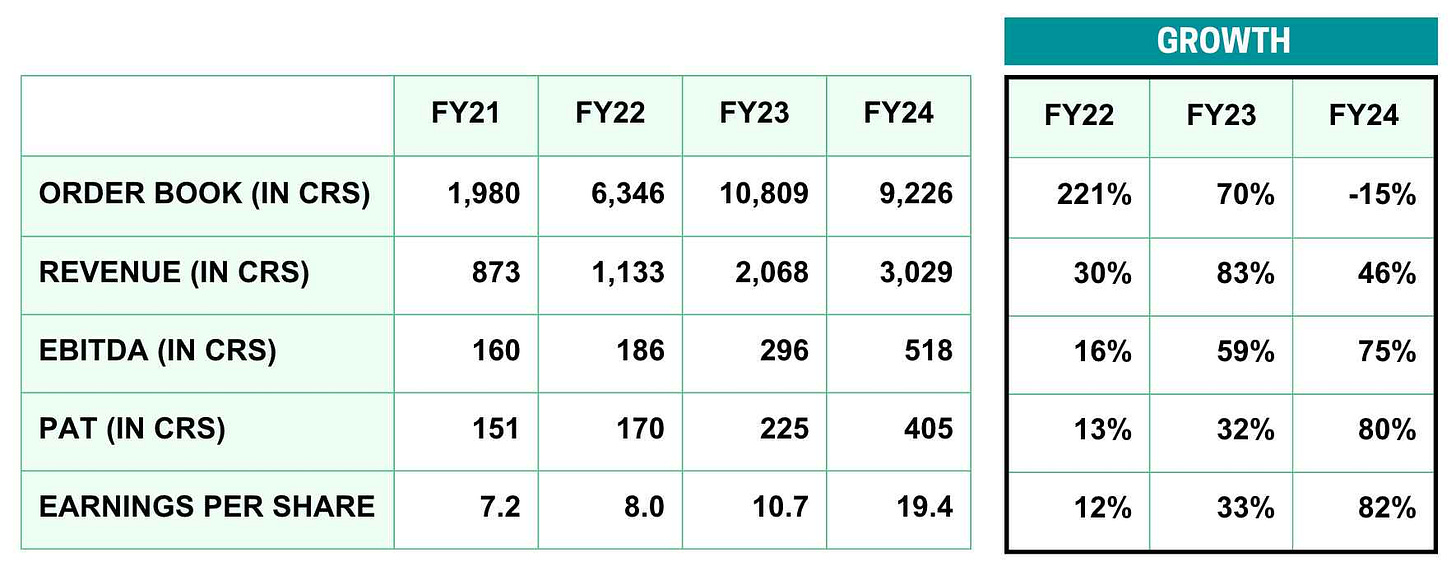

During FY24, the company completed 1,488 lane kms of ongoing projects and generated ₹3,029 crores of revenue – a testament to its consistent growth and execution over the years

Our story starts from August of 2024, when Ceigall launched its IPO with a fresh issue of ₹684 crores – of which, ₹413 crores will go towards repaying debt and the rest will support equipment purchases and corporate needs (news)

By then, the Q1FY25 performance data was already in and expectedly, the company had done well on all counters

Order Book – A Strong Indicator of Future Performance

As of June 30, 2024, Ceigall’s order book stands at ₹9,470 crores (details on page 7 & 8)

Since then, the company’s wins include:

H1 bidder for development of Kanpur Central Bus Terminal (₹143 crs, news)

L1 bidder for Bhubaneswar Metro Project (₹899 crs, announcement),

L1 bidder for 4/6 Lane Northern Ayodhya Bypass (₹1,199 crs, intimation)

L1 bidder for 4/6 Lane Southern Ayodhya Bypass (₹1,299 crs, intimation)

So Ceigall has bid for developing a bus terminus, it’s into metro projects (₹1,600 crs order book), it’s tunnelling (4.9% of order book), building runways, specialized structures, water sewage, solar etc. Ergo, the company now has 11 verticals & bids for projects across 10 states

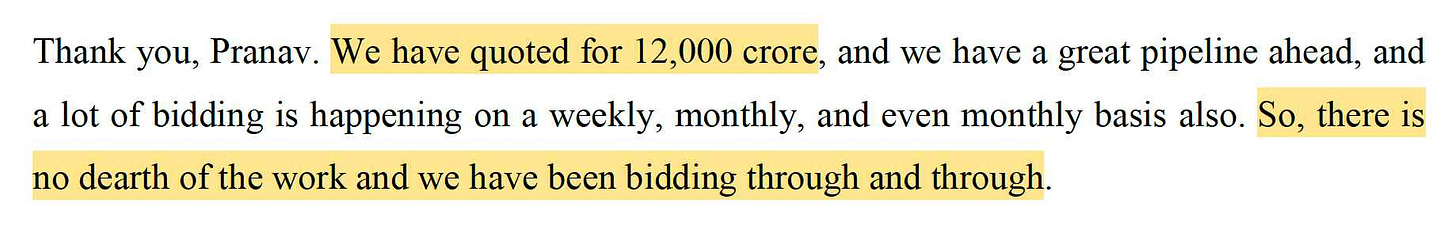

🐥 The company’s outstanding bids are in the range of ₹12,000 crores

🐥 At a bid-to-book conversion ratio of 3.1, we can expect an order inflow of ₹4,000-₹5,000 crores this financial year. Combined with a ₹9,470 crores order book – there is good revenue visibility for the next 2-3 years

A couple of key points worth noting:

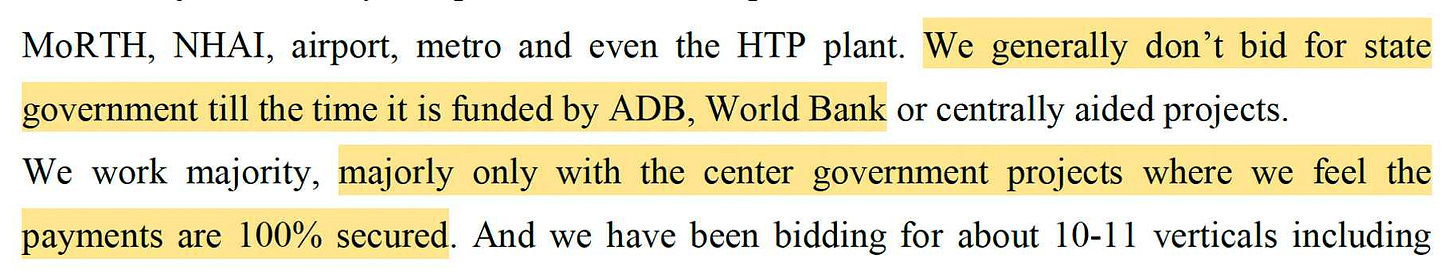

1. Ceigall bids selectively and prefers: 1) central govt. projects or state govt. projects funded by ADB, World Bank etc. – and 2) only where project EBITDA is atleast 14% – giving us some comfort on profitability & receivables

2. Ceigall has expanded into HAM projects (5 ongoing projects; 40% of orderbook) which, unlike EPC contracts, requires upfront investment that is later reimbursed through annuities. Displaying capital prudence, the company targets an IRR of 17% & is open to selling these to InvITs, refinancing, or raising funds through bonds (read pages 12, 13, 18 & 19 for details)

Combining points 1 & 2 together, one observes that Ceigall can bid for more i.e. beyond ₹12,000 crores – but is not keen on compromising margins or capital allocation, avoiding growth for growth’s sake

A Two-Year Play

Revenue wise and inspite of being pushed multiple times, the management isn’t making bold predictions but seems cautiously optimistic about repeating FY24’s 43% growth

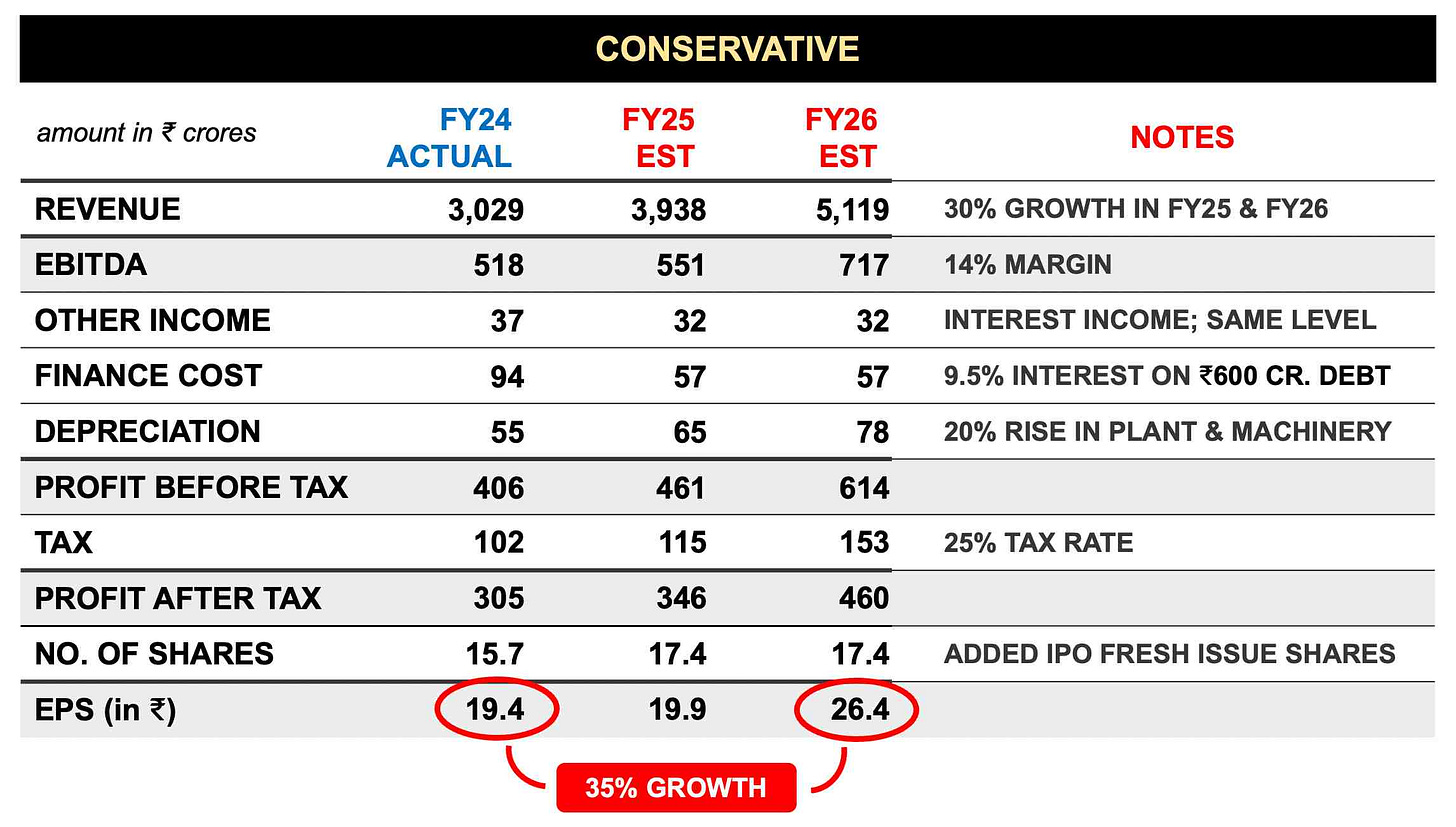

Ergo, I’m modelling a 30% growth for FY25 & FY26 in my back-of-the-envelope calculations

Even on EBITDA and although Ceigall achieved a 17.1% margin in FY24, I feel the management is playing-it-safe and wants us to model a 14% number here

I must say this conservatism is very awkward for a Punjab HQed organization 🙂 and so, I ran two sets of projections – a conservative one (management’s vibe) & a moderate estimate (my read of things)

The key assumption here is the revenue growth & EBITDA margin and the crucial output is the Earnings Per Share

All these vectors are connected and per my calculations, Ceigall can see an EPS growth of 35-70% over the next 2 years – which could bring in a similar rise in the stock price

Investing is a continuous process of learning, analyzing & refining decisions. A lifelong task, skill, passion & an ever-evolving pursuit!

That’s why I’m launching ALPHA — a paid community where like-minded members come together to discuss opportunities, share insights & grow wealth collectively. Unlike a course/workshop, Alpha is a semi-structured space featuring original research, webinars, discussions, expert talk & member-driven participation

It’s my most ambitious project yet — one that I’m deeply passionate about & fully committed to. Tap the link below to learn more, and if it feels like the right fit, I’d love to have you join us! 🤗

Here’s an EPC, There’s an EPC

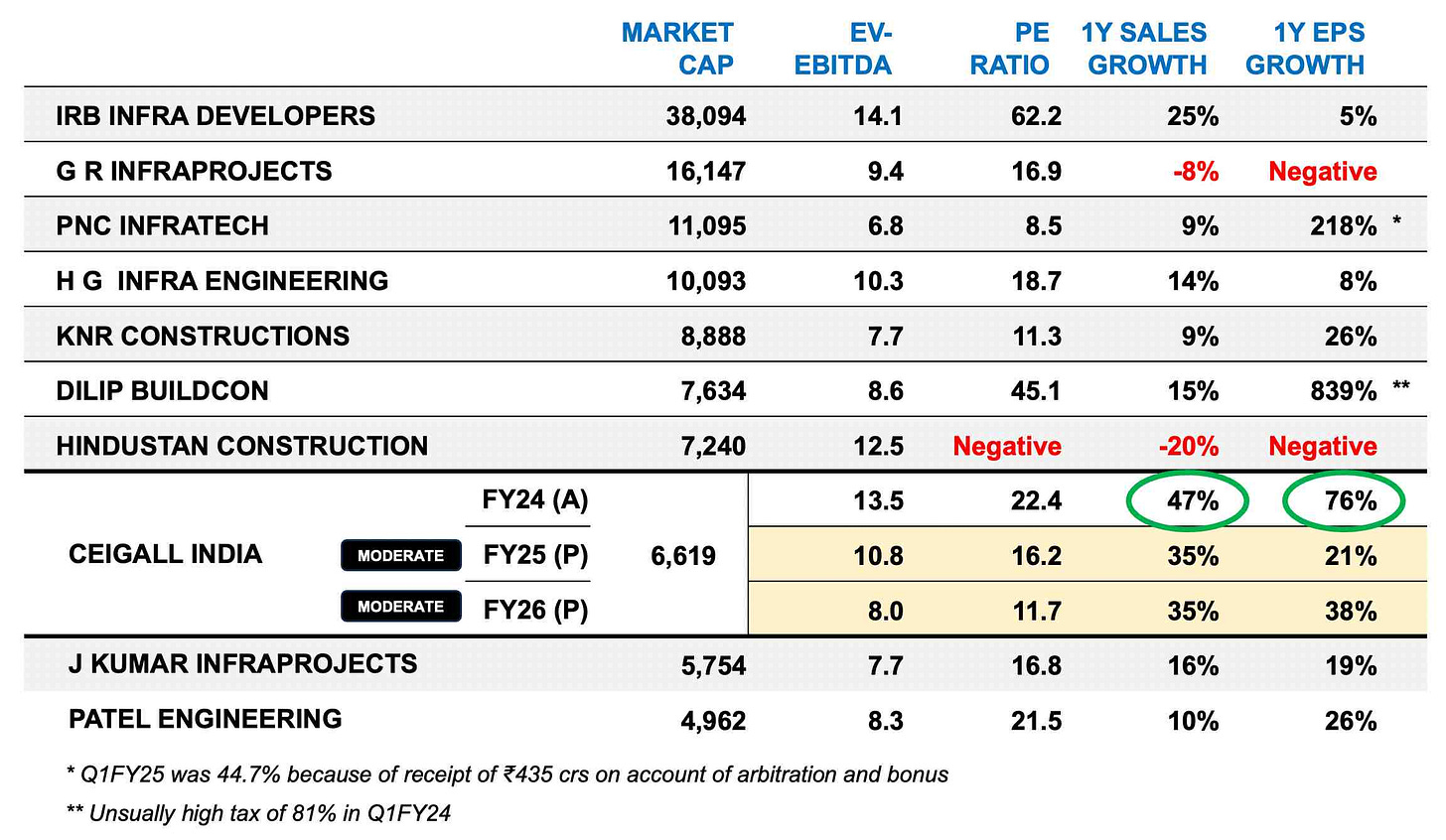

Considering India's vast scale and its growing demand for infrastructure, Ceigall competes in a crowded sector with hundreds of other players. A comparison with its listed peers is, therefore, essential.

At current levels, Ceigall’s EV-EBITDA and PE ratios are slightly above the industry average i.e. the stock appears relatively expensive

However, when considering both sales and EPS growth – 47% & 76% respectively – the company’s current valuation premium seems justified

More importantly when projecting FY25 & FY26 numbers, it becomes evident (atleast to me) that Ceigall India may actually be undervalued at this stage

My Viewpoint

Ceigall is in the spotlight for a reason. And here’s the quick lowdown:

1. One of the fastest-growing EPC firms, expecting 30-35% revenue growth over the next two years, supported by a ₹9,470 crore and expanding order book

2. Diversified business across 11 verticals and 10 states focusing on large contracts, healthy margins and prudent capital allocation

3. Strong pipeline with ₹12,000 crores in outstanding bids and an anticipated order inflow of ₹4,000-₹5,000 crores

4. EPS growth of 35-70% by FY26 (my estimation) with a valuation premium justified by robust forward growth metrics

5. High promoter holding of 82.1% (I’m a fan of owner-operator businesses)

6. Finally, Ceigall operates in a sector with substantial government support — 17.2% growth in road sector investments from FY24 to FY28, massive metro expansions, a ₹25,000 crore airport capex allocation, growth in railway network & infrastructure and a lot more

🐥 In terms of risks, aside from the usual execution and competition concerns:

a) The company relies heavily on government contracts (80% of order book is from NHAI) and any adverse policy changes is likely to impact profitability

b) Ceigall has faced negative cash flows in the past & has high working capital requirements, which could strain finances in tougher times

Having said this – I think the pros outweigh the cons

I’m keen on seeing how far this seagull can fly & the upcoming Q2 results (their first post their IPO) will be one to watch out for

Would love to know your thoughts 📢

Much love,

Shankar

Yet another great discovery and in depth technicals with macro analysis. I immediately added into my watch list and will add into my portfolio if there is a slight dip 👍

Thank you so much for your insights Shankar Sir. Above everything, you are an exceptionally good teacher.