Zen Technologies: Aiming for 50% Growth over Next 3 Years

Issue #020 examines Zen Technologies & its ambitious growth trajectory until FY27. We explore revenue projections, order book, margins & market opportunities to evaluate it's investment potential

Warfare is no longer confined to traditional battlefields

Today, a single drone strike can cripple critical infrastructure (news), a cyber breach can paralyze a nation (news) and even cellphones can be weaponized (news)

Threats are evolving faster-than-ever and the best way to stay ahead is through relentless innovation and preparation

The Q3 performance report on all newsletter-featured companies will hit your inbox on the 22nd of February

Zen Technologies Limited

Founded in 1993, Zen Technologies Limited began with simulation-based training for armed forces. Today, it offers cutting-edge defense solutions with a portfolio of 40+ products, 75 global patents and over 1,000 training systems deployed worldwide

The company operates across three key verticals:

Training Solutions: live ranges, live/virtual simulation & combat training centers

Counter-Drone Solutions: advanced anti-drone detection, tracking & neutralization systems

Equipment/Military Hardware: robotic surveillance systems & remote weapon stations

While the Indian Army, paramilitary & police forces remain its core domestic clients, Zen has expanded its footprint into the Middle East, Africa and CIS countries – with exports now accounting for 39% of its order book (Q2FY25)

Zen Technologies is visibly shifting from traditional simulators to advanced defense equipment including anti-drone systems (watch), ultralight remote-controlled weapon stations (Barbarik, read), robotics (Prahasta, read) and AI-driven technologies (Hawkeye, watch)

And not just national security, I’ll say — AI skills are essential for everyone 👇

Sponsored message

👩🏻💻 The team at Growth School has designed a comprehensive 3-hour training to help you master key AI-driven skills. Although this workshop is usually paid, the first 1,500 people who sign up using my link will get exclusive free access

Zenonomics

👉 Revenues

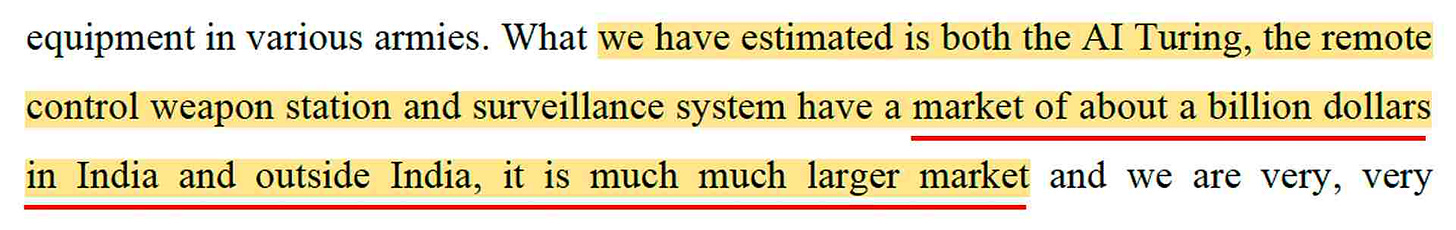

Zen Technologies experienced a revenue tripling in FY23 and a doubling in FY24

In H1FY25, sales reached ₹497 crores – placing the company firmly on track to achieve (or even surpass) its FY25 full-year target of ₹900 crores

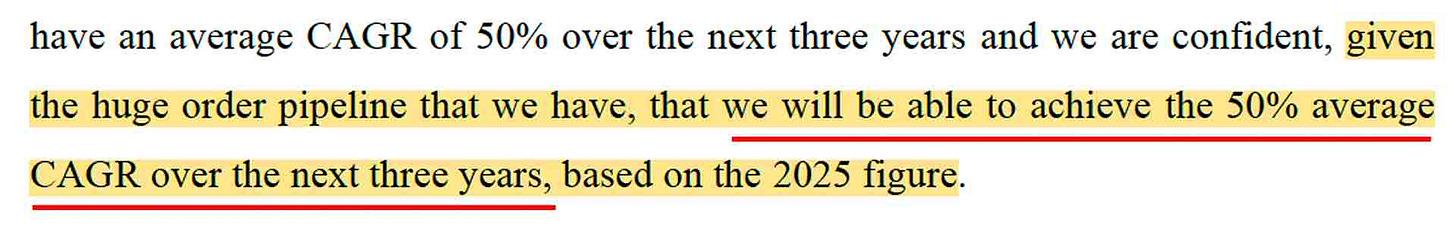

The management projects a 50% sales CAGR for the next three years – driven largely by its robust order pipeline

👉 Order Book

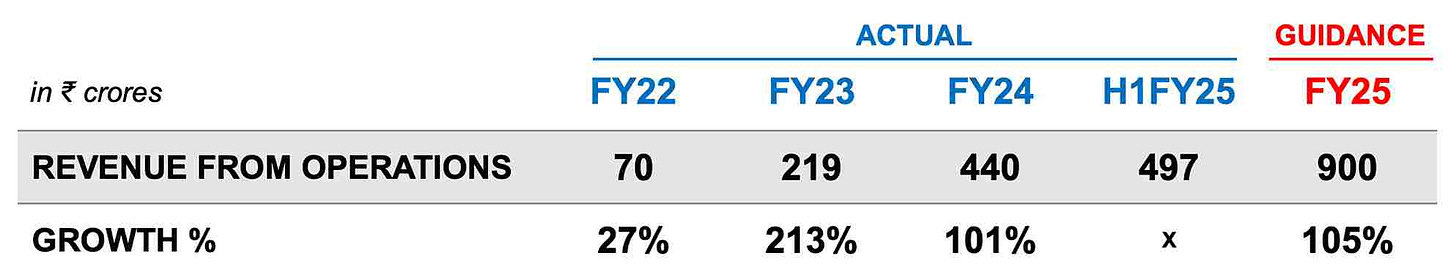

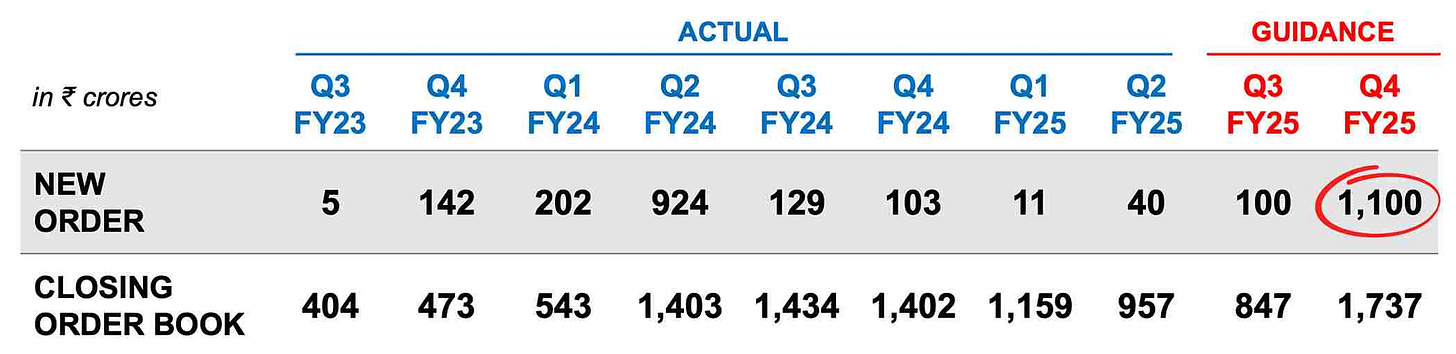

As of Sep 2024, the order book stood at ₹956 crores – offering assurance that Zen Technologies’ FY25 revenue target of ₹900 crores is within reach

However, an examination of new orders across quarters shows us no predictable pattern

Maybe that’s how the defense industry works – in ebbs & flows – so a lot will depend on the management’s expectation of ₹100 crores & ₹1,100 crores of new order inflows in Q3FY25 & Q4FY25 respectively ⚠️

If this happens, it’ll push the opening orderbook (as on April 1, 2025) to about ₹2,000 crores – which I believe is essential for the company to achieve its FY26 revenue target of ₹1,350 crores

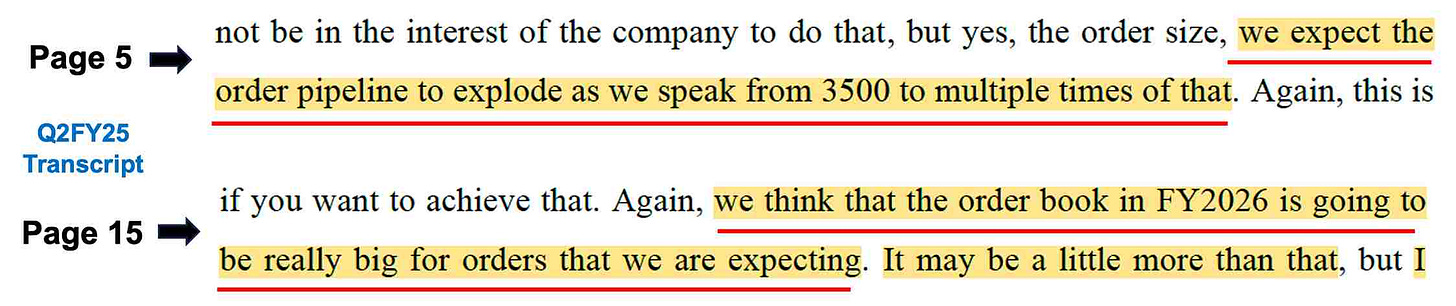

👉 Order Pipeline

A pipeline refers to potential business opportunities

As of Nov 2024, Zen Technologies has identified an order pipeline of ₹3,500 crores

Of these, ₹2,000 crores worth of bids have already been submitted & the company expects an 80% conversion rate

The management is confident of upping the order inflows in FY26 which I reckon has to be in the range of ₹1,800 - ₹2,000 crores for it to achieve its FY27 sales target

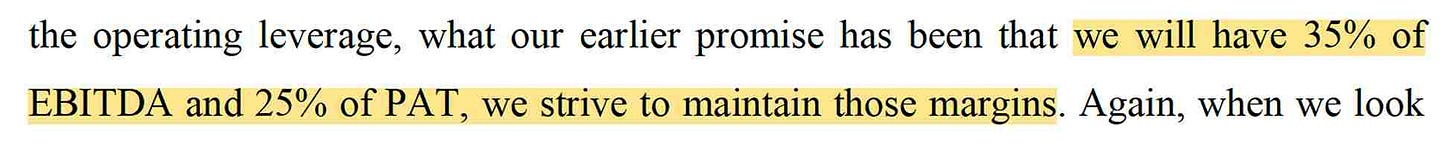

👉 Margins

While quarterly margins may appear volatile, but over two sequential quarters they smooth out to a range of 36% – 41%

In my view, the margins will remain fluid for a few more years on account of a) R&D expenses, b) shifting geographical mix and c) the evolving nature of product introductions

For instance – the EBITDA margin on anti-drone systems is ~30%, while training simulators offer a 40% margin. Likewise, export margins are generally higher than the domestic market

Having said this, the management is confident of achieving & sustaining a 35% EBITDA margin and 25% PAT margin. This is another important variable to watch out for ⚠️

Investing is a continuous process of learning, analyzing & refining decisions. A lifelong task, skill, passion & an ever-evolving pursuit!

That’s why I’m launching ALPHA — a paid community where like-minded members come together to discuss opportunities, share insights & grow wealth collectively. Unlike a course/workshop, Alpha is a semi-structured space featuring original research, webinars, discussions, expert talk & member-driven participation

It’s my most ambitious project yet — one that I’m deeply passionate about & fully committed to. Tap the link below to learn more, and if it feels like the right fit, I’d love to have you join us! 🤗

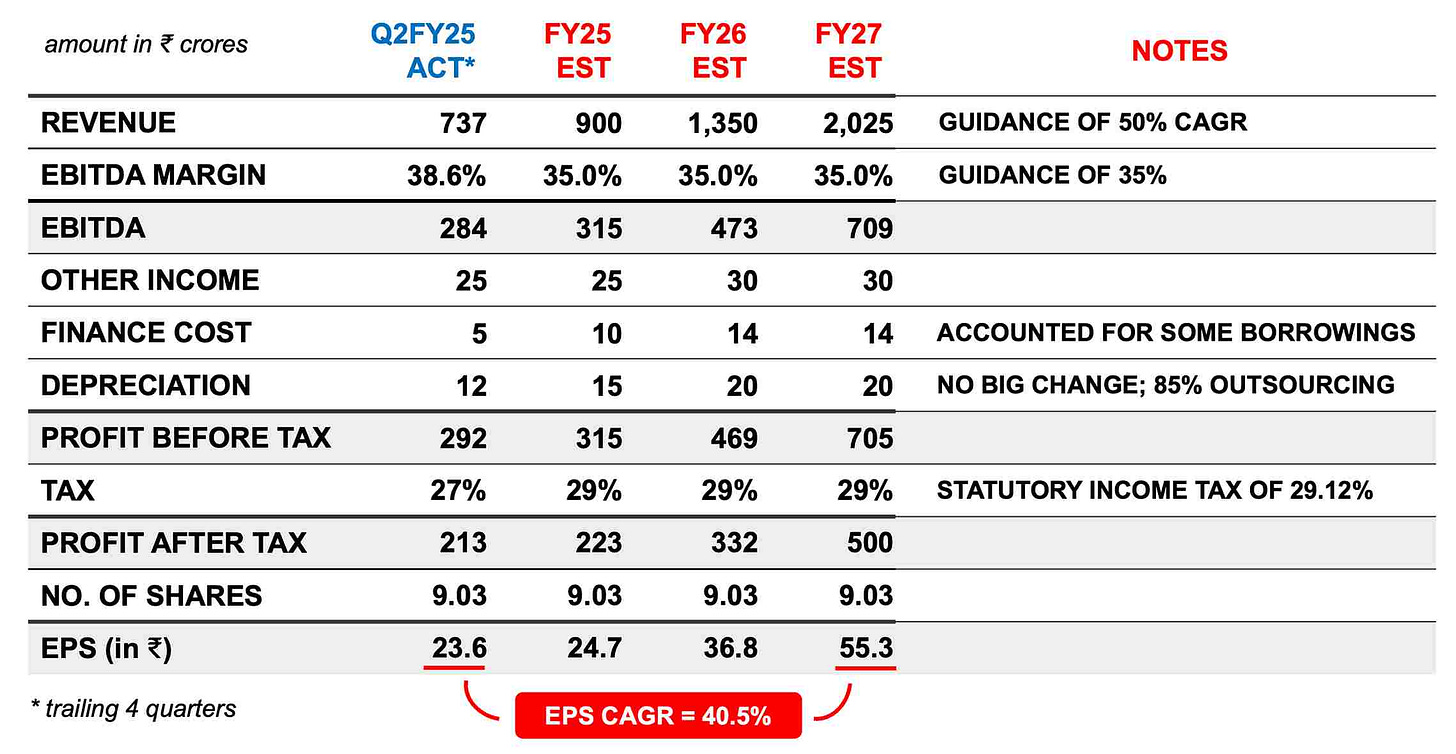

So, What Are We Shooting For?

Here are Priyam’s financial projections, integrating all the insights we’ve gathered so far

Pleasantly, the EPS growth comes to 40.5% (Oct ‘24 to Mar ‘27), but one can’t ignore the many assumptions & guidances we’ve taken in arriving at this number

👉 In terms of valuations, the current price-earning ratio of 63.6 offers some respite from the heady 80-90 multiple, the Zen Technologies stock often finds itself at

It’s difficult to state what is an ideal PE ratio here, but assuming an FY27 PE ratio of 50 – it presents us with a growth upside of 33.2% from the current share price

Zen to Zoom? 🚀

While Zen Technologies has delivered over 50% growth for several quarters, let’s examine some drivers the company is counting on, to continue its growth trajectory

1️⃣ Expanding Market Opportunities

▸ Zen Technologies sees strong demand for high-quality simulators with the ongoing Russia-Ukraine war reinforcing the need for top-notch military training

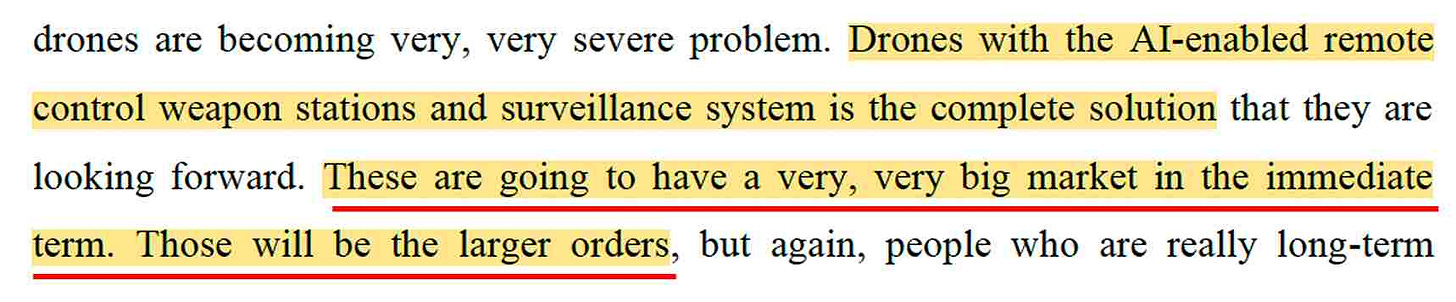

▸ With drone warfare on the rise, the management expects good traction in counter-drone solutions with large-sized orders expected in FY26

▸ The company’s 51% acquisition of AI Turing (exchange filing) opens up a huge market in India and aboard with enhanced anti-drone capabilities and AI-driven solutions like remote weapons station & surveillance systems

▸ Having been a preferred partner for the Armed forces, Zen Technologies seeks to make in-roads into Navy & Air Forces’ training and simulation requirements

2️⃣ Entering the United States market

The US spends over $4 billion annually on military training & simulation. Zen’s entry here can be transformational, unlocking a multi-billion dollar export market across the Americas & NATO countries

In line with the “Make in America” mandate (51% local manufacturing), the company is actively scouting for US-based production facilities

This will take time though. It’s only by FY27 that we might see some progress on this

My Viewpoint

Zen Technologies truly embodies a “growth stock” with:

▸ High growth ambitions with a yearly revenue guidance of 50% for the next 3 years

▸ High PE ratio of 64 — although it’s a lot reasonable now as compared to last year

▸ High revenue upside with current projections not factoring acquisitions & entry into the US

▸ High volatility in revenue & profitability – typical to the defense industry, the order book & margin profile is likely to meander for a few more years

Going forward, I’ll be closely monitoring changes in – a) order book, b) order pipeline and c) product mix – every quarter. These are key drivers that will shape Zen Technologies’ future revenue & margin performance

Would love to hear your views on this 📢

Much love,

Shankar

Zen Technologies is presenting it's Q3FY25 results on the 14th of February (Friday)

More than the results, I'm keen on knowing the order book

Pls note -- Zen Tech needs around ₹1,200 crores of new orders by Q4 to make good on it's 50% growth guidance for FY26

Let's watch out for that metric

Pranam Shankar ji, As always making your posts / YT videos a priority for a reason. Kudos for your hard work in finding Quality stocks for us. Thanks.