Deep Industries : Q3FY25 Review

The Deep Industries Limited stock is down 17% despite a strong Q3 performance. In this follow-up note, we examine key quarterly updates & how these changes impact our original thesis

On 13 December 2024, I published my initial research note on Deep Industries (read here)

Since then, DIL’s share price has fallen 17% 🔴 — inspite of the company delivering an excellent Q3 with YOY revenues, EBITDA, PAT & EPS growing by 48%, 53%, 70% and 56% respectively 🟢

Not only have these developments impacted valuations, the company’s recent earnings call (PDF) has revealed key changes in their plans that could materially affect our original thesis

I have outlined these updates in this follow-up review to help us refine our evaluation of the company's future prospects. Please revisit the original note for better context.

Material Changes / New Developments in Q3FY25

1️⃣ Delay in Barge

DIL’s accommodation barge (named Prabha) is yet to be deployed as it awaits critical equipment from the United States

The management asserts they’re 95% there, rate negotiations are at an advanced stage – and they’ll definitely be earning some revenues off it in Q4FY25

2️⃣ Timing of PEC Revenue in FY26

We had originally modelled an entire year of PEC revenue – ₹120 crores in FY26 – from the company’s ₹1,402 crore contract with ONGC (news). However the management now expects execution to be delayed by 7-8 months

3️⃣ QIP of ₹350 crores

In Dec 2024, the Board approved a fund raise via equity shares of upto ₹350 crores (announcement). DIL needs this money for its FY26 capex (₹500 crores) and to finance an acquisition (at advanced stage) – with possible debt to be added later

Now assuming this QIP happens at around ₹450 per share, this is an additional 78 lakh shares one needs to factor into our FY26 & FY27 calculations. Therefore, revised total equity shares = 7.18 crores (6.40 crores presently + 0.78 lakhs QIP)

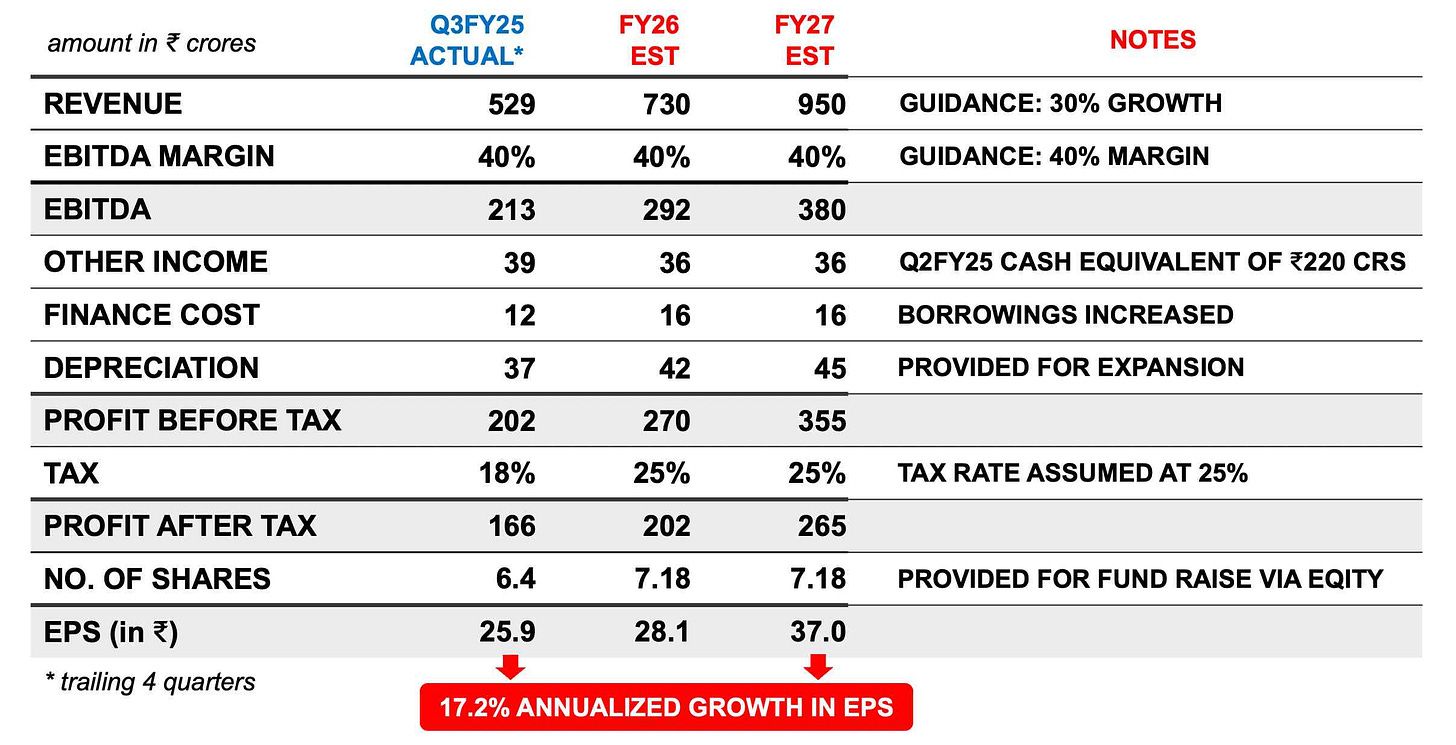

Revised Financials

1️⃣ Revenue

👉 The management remains confident of achieving their earlier FY25 revenue guidance of ₹570 crores

However I’ll be sticking to my original estimate of ₹540 crores – which requires DIL to grow its YOY Q4 sales by 9.2% (easy!)

👉 When it comes to FY26, a few factors need to be accounted for:

a) Growth in organic revenue – This management expects to grow its organic business at 18-19%. This includes their natural gas services, charter of work rigs & integrated project management services

However I’ve taken a more conservative 10% estimate – aligning closer to the 8% orderbook growth over the past year (₹1,200 crs in Dec 2023 & ₹1,299 crs in Dec 2024 ex-PEC)

b) PEC execution timelines - Since execution is delayed, I’ve factored in ₹40 crores of revenue for FY26 and ₹100 crores for FY27. The FY27 revenue could be higher, but that remains uncertain

c) Barge deployment - I’ve maintained my original assumption – an all-inclusive rate of $50,000/day for 330 days at ₹85 per dollar. This gives DIL a top-line contribution of ₹140 crores in FY26.

Revenue for FY25 will be negligible but pleasantly, there would be some

After factoring a), b) and c), our revised FY26 revenue estimate stands at ₹766 crores

However, a read of the earnings transcript gave me mixed signals

On page 6 of the latest transcript (PDF), the management guided for at least 30% growth – which comes to ₹702 crores per my calculations (i.e. 30% growth over ₹540)

But then on page 17 of the transcript, they reiterated their earlier ₹800 crore guidance – which seems a bit aggressive to me

Ergo – when choosing between ₹702 crores, ₹766 crores and ₹800 crores – I opted for a mid-path+conservative number & settled for ₹730 crores in FY26 revenues

In line with management’s 30% growth guidance, our FY27 revenue estimate comes to ₹950 crores

2️⃣ Margin

The management is hopeful of maintaining margins in the range of 45-47%. However this number is inclusive of “other income” and excluding that, the margins will be more around the 42% mark

As in my initial note, I’m continuing with a 40% EBITDA margin in my projections

3️⃣ Projection

With these revised assumptions, FY27 EPS is projected to grow 17.2%

17.2% isn’t a bad number but it could have been higher had the company opted for debt over equity dilution (QIP). Someone even raised this in the earnings call, but management gave a textbook response

Investing is a continuous process of learning, analyzing & refining decisions. A lifelong task, skill, passion & an ever-evolving pursuit!

That’s why I’m launching ALPHA — a paid community where like-minded members come together to discuss opportunities, share insights & grow wealth collectively. Unlike a course/workshop, Alpha is a semi-structured space featuring original research, webinars, discussions, expert talk & member-driven participation

It’s my most ambitious project yet — one that I’m deeply passionate about & fully committed to. Tap the link below to learn more, and if it feels like the right fit, I’d love to have you join us! 🤗

Revised Valuations

At the current share price of ₹474, DIL trades at a trailing PE of 19.6

As always, I’ve mapped future EPS projections across different PE bands to estimate an appropriate price range

At a PE of 20, DIL presents an annualized stock price return of 23.2%. I do encourage you to form your own view on where the PE multiple might settle based on your research

My Viewpoint

Despite delivering strong Q3 results, DIL’s stock price has declined – in line with the broader smallcap and midcap selloff

Beyond the financials, two key developments stand out:

a) DIL won an arbitration case worth ₹108 crores, 75% of which has already been received but is currently parked under “other current liabilities”. This money will eventually be booked as income, providing a one-time earnings boost to the company

b) In December 2024, the Oilfields Regulation and Development Act was amended in the Rajya Sabha (news). The updated law aims to modernize India’s energy framework, boost domestic exploration, and improve the economics of marginal oil fields – all potential tailwinds for DIL

Overall, I’ll say – DIL remains a solid business with strong execution, but market conditions & capital allocation decisions will dictate its stock performance. I encourage you to do a second round of research and form your own view on its long-term prospects

As always, I look forward to hearing from you 📢

Much love,

Shankar

Q3FY25 performance review of all newsletter-featured companies will land in your inbox on February 22.

With management playbook, stock prices & market conditions always shifting, I’ll have in-depth notes of all companies every 3–6 months. These will be made available in my community, details of which will be shared in the next two weeks

Good Evening.

As always thank you for your succinct analysis.

Where can I learn more on what your community offers and how I might become a member of it.

Thank you for your review of the developments