Deep Industries: Rigged Up for 55% Growth

Issue #017 delves into Deep Industries Limited’s growing stature in the oil & gas support sector. We explore their strategic moves aimed at driving a stellar 50%+ growth in revenue and profits by FY26

Niche player

➕ Market leader

➕ High margin business

➕ Strong revenue visibility

➕ Reasonably valued

= My kind of business 🤩💰🚀

If you're enjoying my newsletter, please share it in your WhatsApp groups and encourage others to subscribe. Thanks for your support!

Deep Industries Limited

With over 30 years of expertise, Deep Industries Limited has positioned itself as a “one-stop solution provider” in the oil and gas support services industry

Its offerings include natural gas compression, dehydration, processing, workover & drilling rigs and integrated project management services – covering more than 70% of the post-exploration value chain

DIL’s clients are major players in the energy sector – ONGC, OIL, GAIL, Reliance Industries, Gujarat Gas, Cairns, Adani, GSPL and more

The industry’s high capital requirement, deep expertise & specialized technology (high barriers to entry) limits competition benefiting established players like DIL

Expansion & Recent Growth Initiatives

DIL has been actively pursuing growth aimed at diversifying revenue streams and enhancing its core capabilities.

Here’s a snapshot of their recent efforts:

1️⃣ In Sep 2024, DIL was awarded a 15-year Production Enhancement Contract (PEC) worth ₹1,402 crores by ONGC (news)

A PEC is where a specialized service provider (DIL) collaborates with an oil & gas company (ONGC) to improve production levels of existing gas fields (Rajahmundry basin)

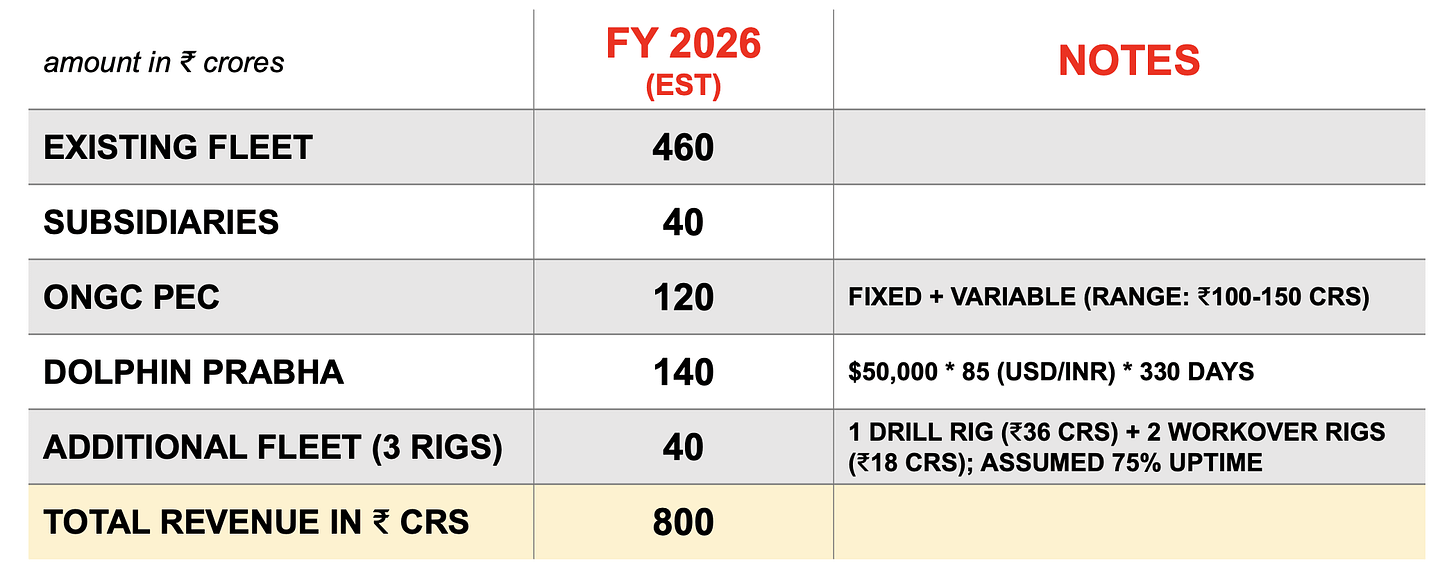

This is ONGC’s first PEC, and it opens doors for similar contracts in the future. This contract is expected to contribute ₹100 to ₹150 crores annually for the next 10 years at a 40% margin – starting FY26

2️⃣ In 2022, a subsidiary of DIL acquired Dolphin Offshore Enterprises through insolvency – diversifying into offshore exploration and production services. After refurbishment & some unexpected delays, the barge (named Prabha) is expected to begin operations by Q4

At a revenue potential of $50,000/day, Prabha is expected to generate ₹38 crores every quarter – with strong margins in the range of 60%. FY26 will be a full year of operations for this barge

3️⃣ Pleasantly, DIL has expanded it’s fleet with operations like to commence by Q4 or early FY26.

The additions include 1 drilling rig (expected revenue of ₹3 crores/mo) and 2 workover rigs (exp. revenue is ₹1-1.5 crores/mo)

4️⃣ DIL provides gas processing services to countries like Egypt & Oman through its two subsidiaries there. Combined, they contribute revenues of ₹40-50 crores annually & is expected to grow at 10-15%

5️⃣ The Government of India’s Open Acreage Licensing Policy (OALP) is expected to drive oil & gas exploration and production in India. The 10th round of bidding under OALP is expected to take place in early 2025 (news)

OALP is aimed at reducing India’s heavy reliance on imports & under this policy, over 1 million sq. km. of previously restricted areas (referred to as No-Go zones) have been opened up for exploration and production

This push towards energy independence is expected to create further opportunities for DIL

Financials

A great deal of my stock-picking confidence largely hinges on revenue and margin visibility, so let’s break that down for DIL

👉 Revenue

Our base scenario starts from the ₹460 crores, DIL’s management expects to achieve this year i.e. FY25. An additional ₹40-50 crores from its subsidiaries brings the total to ₹500 crores – a notable 17% increase over FY24 revenues

Per the management, there’s potential upside of ₹70 crores that hinges on the Dolphin (Prabha) getting operational in mid-Q3 – very unlikely in my opinion

Realistically, I estimate DIL closing FY25 at consolidated revenues of ₹540 crores

But it’s the FY26 numbers I’m really kicked about, which I reckon will be around ₹800 crores – a 48% jump from my FY25 estimate

👉 Margin

DIL has consistently maintained an average EBITDA margin of 40%

There were only two exceptions to this. Both exceptional events – in Q2FY23 (29% margin) due to contract transition and in Q4FY24 (32%) on account of a one-time loss from sale of Dolphin office

When analysed on a segment-wise basis, it was pleasant to see most projects deliver a 40%-plus margin

👉 OK, so let’s put all this together and build a financial projection for FY26

By my estimate, Deep Industries’ EPS can grow from ₹22.7 to ₹35.0 over the next 6 quarters – a 55% jump in EPS

👉 From a valuation standpoint, the current market price of ₹573/share gives us a TTM current PE ratio of 25.3

On a forward basis, the FY26 PE ratio drops to 16.4 – which I think is a great price for a services company

And for any fans of Peter Lynch out there, Deep Industries is available at a PEG ratio of 0.75 – current PE of 25.3 divided by expected EPS growth of 34% – indicating the stock to be undervalued

Investing is a continuous process of learning, analyzing & refining decisions. A lifelong task, skill, passion & an ever-evolving pursuit!

That’s why I’m launching ALPHA — a paid community where like-minded members come together to discuss opportunities, share insights & grow wealth collectively. Unlike a course/workshop, Alpha is a semi-structured space featuring original research, webinars, discussions, expert talk & member-driven participation

It’s my most ambitious project yet — one that I’m deeply passionate about & fully committed to. Tap the link below to learn more, and if it feels like the right fit, I’d love to have you join us! 🤗

My Viewpoint

In DIL, I see the following positives:

30-year old established company with a dominant market position in its field

Business with high barriers to entry (specialized technology & high capex)

A strong clientele offering regular order inflow

Favourable industry dynamic with OALP & the govt’s push towards energy security

Diversified revenue streams with excellent margins (40%+)

Growing order book (₹2,622 crs as of Q2FY25; bidding pipeline of ₹800 crs)

Multiple strategic expansion initiatives incl. recent PEC with ONGC, foray into offshore services, charter-hire business, fleet expansion & international operations

Use of fixed pricing contracts that remain unaffected by crude oil price fluctuations

Strong balance sheet with negligible borrowing & good cash reserves

High revenue (41% CAGR) and EPS visibility (34% CAGR) over the next 6 quarters

Favourable valuations with the stock trading at a FY26 forward PE ratio of 16.4

⚠️ That said, there are some concerns (other than standards risks) that need to be addressed:

DIL typically realizes its debtors within 90-100 days. While the average debtor days have improved from 171 days in March 2022 to 126 days in March 2024 for the standalone business – it’s still pretty high

The company has extended loans/advances of ₹58.65 crore to Prabha Energy Private Limited – a subsidiary of Deep Energy Resources Limited. These entities are owned and operated by a common promoter group so there’s some exposure there

The oil & gas sector has few players which leads to concentration risk for DIL. For instance, ONGC contributed 49% of FY24 revenues but pleasantly this association remains strong, evidenced by new contracts & re-awards

In my view, the benefits here seriously outweigh the concerns which is the reason Deep Industries Limited finds a space in my consideration set

Would love to hear your views on it 📢

Much love,

Shankar

Thank you for your exceptional analysis of Deep Industries Limited in your recent newsletter. Your detailed breakdown of the company's numbers and insightful coverage of its future plans were truly impressive.

The clarity and depth of your research have provided immense value to readers like me, offering a comprehensive understanding of the company's position in the oil and gas sector and its potential growth trajectory. Such well-crafted content not only informs but also inspires confidence in making informed decisions.

Thank you for your hard work and dedication. I look forward to reading more of your insightful pieces in the future!

Thank you for the in-depth analysis, Shankar ji! I truly appreciate it and look forward to more detailed analyses in the future. As an avid reader of your newsletter, I am particularly interested in your exit framework for the companies you have analyzed. Understanding when to exit a position is crucial, and I believe your insights on this would be invaluable. Will you be sharing exit analyses for these companies in the future?

Additionally, I know you have plans to enhance this newsletter into a freemium model soon. I am eagerly anticipating this transition and would love to hear any updates regarding it. Thank you once again for your thorough analysis, and I look forward to your continued insights.