Raymond Lifestyle: The Incomplete Man (Since 2024)

Issue #012 explores the recent demerger & listing of Raymond Lifestyle Limited and the opportunity it presents for quick gains. It's The Complete opportunity, Man

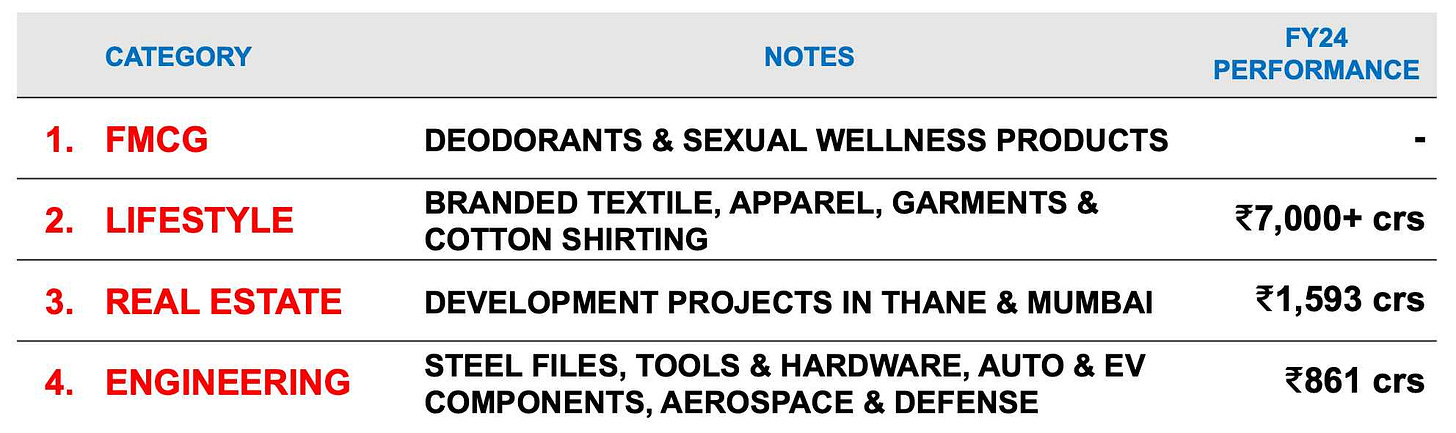

Established in 1925, The Raymond Group evolved over the past century into four distinct business segments

Then in FY24 & continuing into this year, the group launched several growth initiatives & value-unlocking strategies including:

1️⃣ Sale of their FMCG business to Godrej Consumer Products Ltd. for ₹2,825 crores (news)

2️⃣ Vertical demerger of the real estate business into Raymond Realty Limited (announcement); expected to be listed by August 2025 (interview)

3️⃣ Restructuring of the engineering business with two new subsidiaries: a) aerospace & defence and, b) auto component & engineering consumables (acquisition of MPPL)

4️⃣ Demerger of lifestyle business in June 2024 with the resulting entity – Raymond Lifestyle Limited – listed on the stock exchanges last week (news)

Today’s newsletter focuses on point 4 — the recent demerger of Raymond Lifestyle Limited and the opportunities it presents

This newsletter issue is in collaboration with Beat the Street

RLL’s Listing Post-Demerger

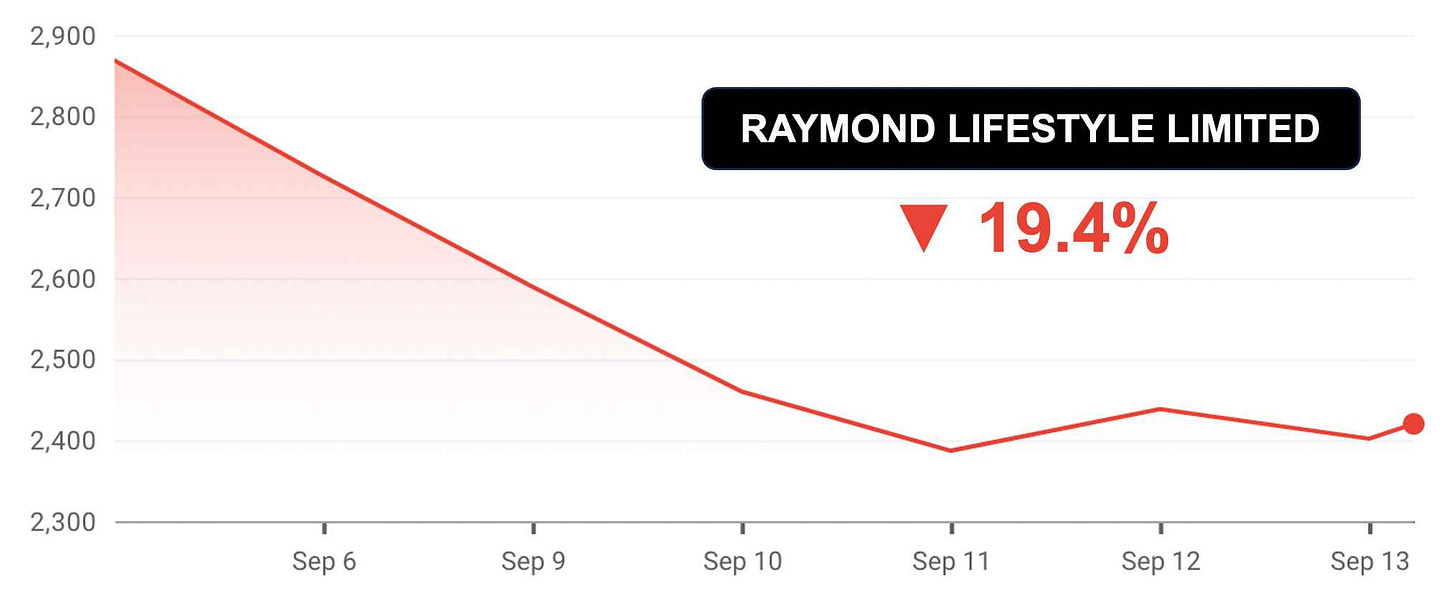

On September 5th, shares of Raymond Lifestyle Limited (RLL) were listed on the NSE & BSE at ₹3,020 & ₹3,000 respectively

The same day, the stock hit the 5% lower circuit limit – and within a week, RLL is down almost 20%

🤔 So, why did the stock price drop?

We believe it’s due to "forced selling" – a common occurrence in special situations like demergers or spin-offs

🤔 And what exactly is forced selling?

It’s when institutional investors like mutual funds, PMS, AMCs & family offices are required to offload their shares because the stock, like RLL, doesn’t fit their mandate

This could be due to a number of reasons. There might be sector-specific limits or maybe “textiles” is not promising for the fund or perhaps RLL’s market cap of ₹14,600 crores is too small for them etc.

While I can’t be certain, this is likely what’s happening here

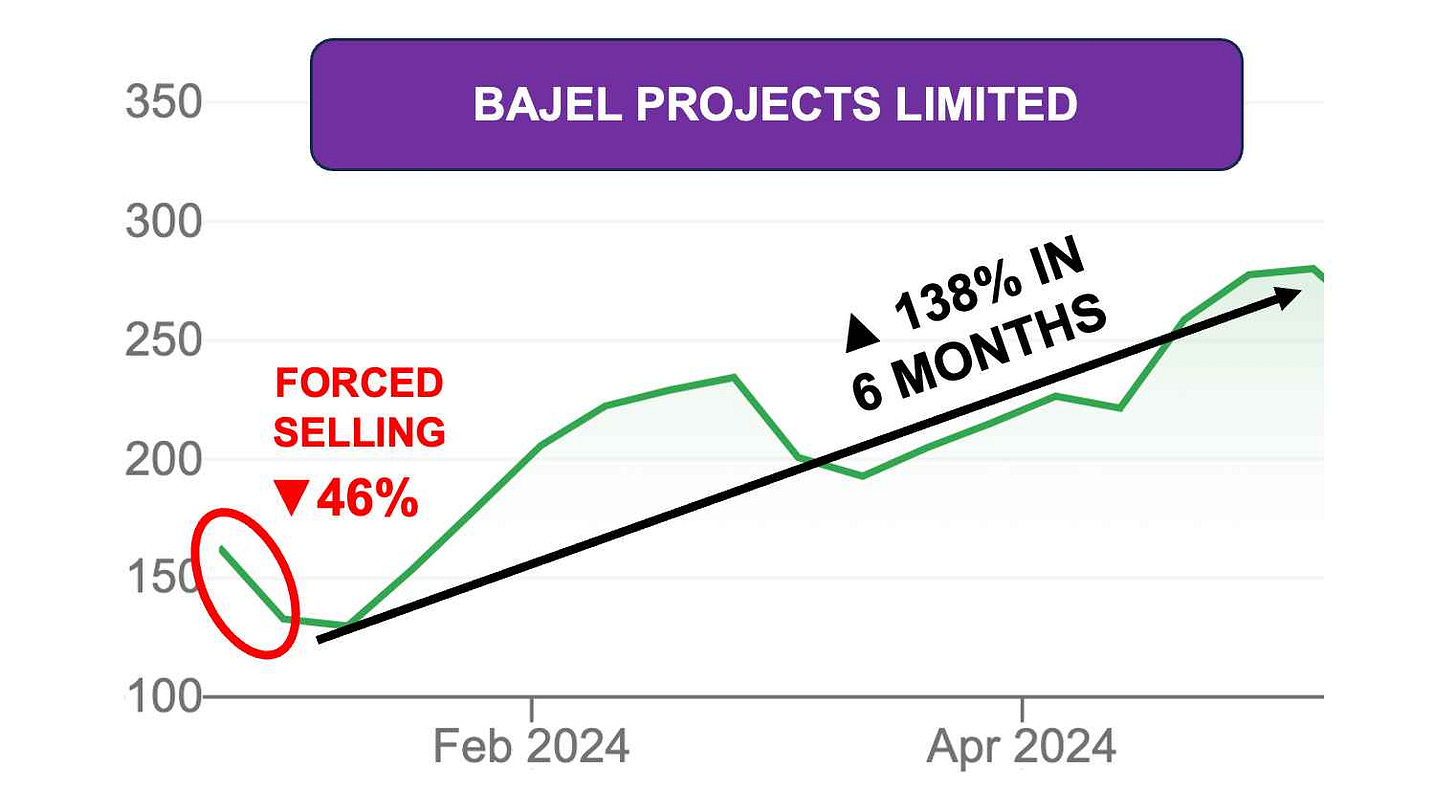

🎯 A similar case study: In a previous issue of my newsletter, I covered Bajel Projects Limited - a demerged entity of Bajaj Electricals - whose stock price fell from ₹200 to ₹109 within two weeks of its listing. Reason: exits by firms like Enam AMC, Norges Bank & ICICI Prudential Mutual Fund

However since such type of selling doesn't reflect on the company’s true fundamentals, markets tend to quickly recognize such anomalies & Bajel’s stock price doubled over the next few months

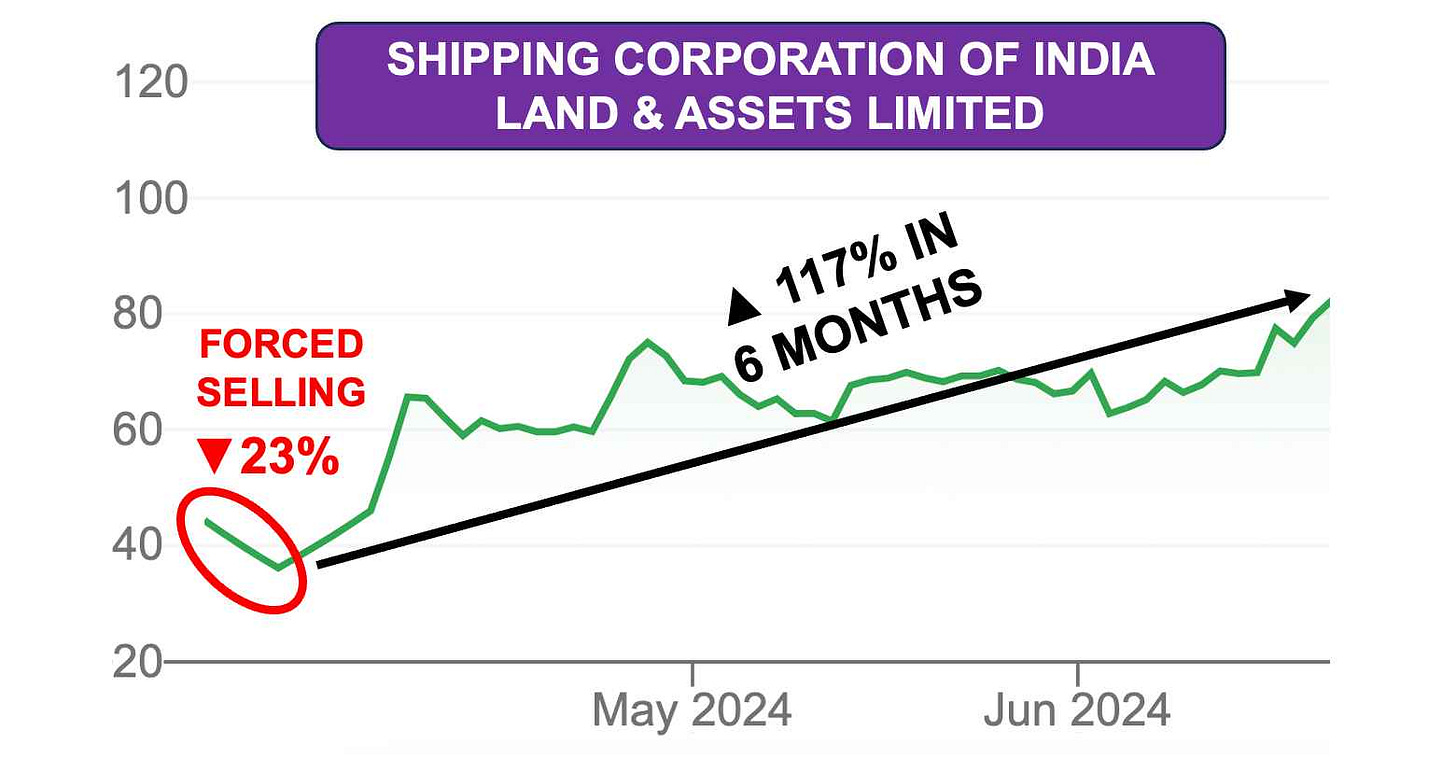

🎯 Another example: Shipping Corporation of India Land & Assets Limited – a demerger from Shipping Corporation of India - saw a 23% drop within a week of listing (₹46.80 to ₹36.20). But as market participants identified the anomaly, the stock price quickly recovered

In all these cases (46% in Bajel, 23% in SCI L&A, and 19% in RLL), the price drop didn’t indicate a decline in the company's value but rather a temporary imbalance in supply and demand

For contrarian investors, this presents a compelling opportunity

But there’s more to consider. So let’s dive into RLL’s post-demerger positioning and financials

Post continues after sponsored content

You’ve followed my momentum insights through many of my videos. Now, I'm happy to present my latest write-up on Motilal Oswal’s Nifty 500 Momentum 50 Index Fund. Hope you like it!

And I’m back :)

Growth Strategy & Ambitions

RLL’s business is divided into four verticals:

1. The core business is branded textiles that includes suiting, shirting, and home furnishings. With over 1,050 stores across 800 locations, this segment thrives during the wedding season (read pages 20-27 for details)

2. Branded apparel with brands like Park Avenue, ColorPlus, Parx, and Ethnix is seeing an aggressive push

Growth strategies include a) expanding the distribution network, b) riding on trends like premiumization & casualization, and c) introducing new categories like ethnic, sleepwear, and innerwear (read pages 28-51 for details)

3 & 4. B2B manufacturing – Garmenting and High-value Cotton Shirting – is benefiting from global companies adopting “China + 1” and now “Bangladesh + 1” strategies. To support this, RLL has invested ₹200 crores to expand its production lines (pages 52-57)

🎯 The company has a stated goal of achieving 12-15% growth in revenue, doubling it’s EBITDA by FY28 & generating ₹600-₹700 crores in free cash annually

Financials & Valuation

The lifestyle business had a tough start to FY25, with Q1 revenues down 8% and EBITDA dropping by 50%

The slowdown in branded textiles, driven by fewer weddings and a heatwave, was a major factor

However the management is confident about a recovery in Q2 and Q3 as wedding-related purchases ramp up. The wedding season resumes next month in October and continues upto February

Then there’s also the political situation to the East of our borders – in Bangladesh – that has led to "massive enquiries" for garment supply, as noted by Chairman Gautam Singhania (news)

👉 These developments do have an impact on RLL’s valuation, so let’s dive into it

Given the current state of flux, let’s assume parity i.e. FY25 EBITDA remains at around ₹1,100 crores – same as FY24

Then per my calculations, the current enterprise value (EV) is ₹14,400 crores (₹14,600 crs market cap minus ₹200 crs of net cash)

This results in an EV-EBITDA ratio of 13.1, positioning RLL as relatively undervalued when compared to its peers

I also reviewed the price-to-sales multiple, and once again RLL stands out as significantly underpriced against competitors like Trent (Westside, Zudio, Utsav) and especially Vedant Fashions (Manyavar, Mohey) that participates in the wedding and celebration wear segment

In short, RLL offers considerable valuation comfort

Investing is a continuous process of learning, analyzing & refining decisions. A lifelong task, skill, passion & an ever-evolving pursuit!

That’s why I’m launching ALPHA — a paid community where like-minded members come together to discuss opportunities, share insights & grow wealth collectively. Unlike a course/workshop, Alpha is a semi-structured space featuring original research, webinars, discussions, expert talk & member-driven participation

It’s my most ambitious project yet — one that I’m deeply passionate about & fully committed to. Tap the link below to learn more, and if it feels like the right fit, I’d love to have you join us! 🤗

My Viewpoint

Special situations often create mispricing and I believe RLL is no exception

In summary, here’s a company with a:

99-year legacy

Strong brand recognition (many of you might have worn a Raymond at your wedding)

Solid balance sheet with minimal debt

High profitability (EBITDA of ₹1,100 crores)

Attractive valuation compared to competitors

12-15% growth guidance

Expansion plans (350+ new stores, new segments)

High free cash generation (₹600-₹700 crores annually)

Promoter (Raymond Limited) holding of 49.11%

In my opinion, it’s reasonable to expect a positive re-rating of the stock in the coming few quarters. I’ll be closely watching its Q2 and Q3 performance

Would love to hear your views on it 📢

Much love,

Shankar

Assuming that the FY2028 EBITDA will be 2150 Cr which double of FY24 EBITDA (Translating to 19% CAGR growth In EBITDA), and the EV/EBITDA Multiple re-rates to 25 times which is again much lower than major peers like Vedant Fashions, ABFRL, Page Industries, etc, the stock price for FY28 comes at Rs. Rs. 8,900. This is 274% absolute returns on CMP of stock.

So, three assumtions are:

1. EBITDA Guidance will be met

2. EV EBITDA Multiple will re-rate to 25 times

3. Furthur dilution of stock doesn't take place.

I think EV EBITDA Multiple of 25 times is very conservative again because of the brand recall that Raymond has and plus it is a debt free company. So, I should trade at better valuations. Only hindrance that that come between RLL achieveing this valuation is the reputation of Mr. Singhania that public has. If people discount that thing more than the business fundamentals, stock might not re-rate beyond some level.

Sunday evening, a cup of coffee and Shankar sir's substack, a perfect combination! As always beautifully written!