Nifty 500 Momentum 50 Index Fund - A Must Have in Every Portfolio

I’ve made several videos on momentum (here, here, & here) and so far, our participation in momentum funds has been around three offerings:

1. Nifty 200 Momentum 30 – focusses on large caps with some mid caps

2. Nifty Midcap 150 Momentum 50 - exclusively midcaps

3. Nifty Smallcap 250 Momentum Quality 100 - a multi-factor approach targeting smallcaps

But pleasantly, we now have the Nifty 500 Momentum 50 Index – a more comprehensive option aiming to track the performance of the top 50 companies within the Nifty 500, selected on basis their Normalised Momentum Score

In this short writeup, I’ll quickly walk you through a few key points that should be on your consideration set

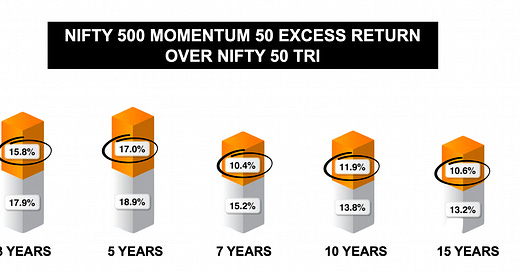

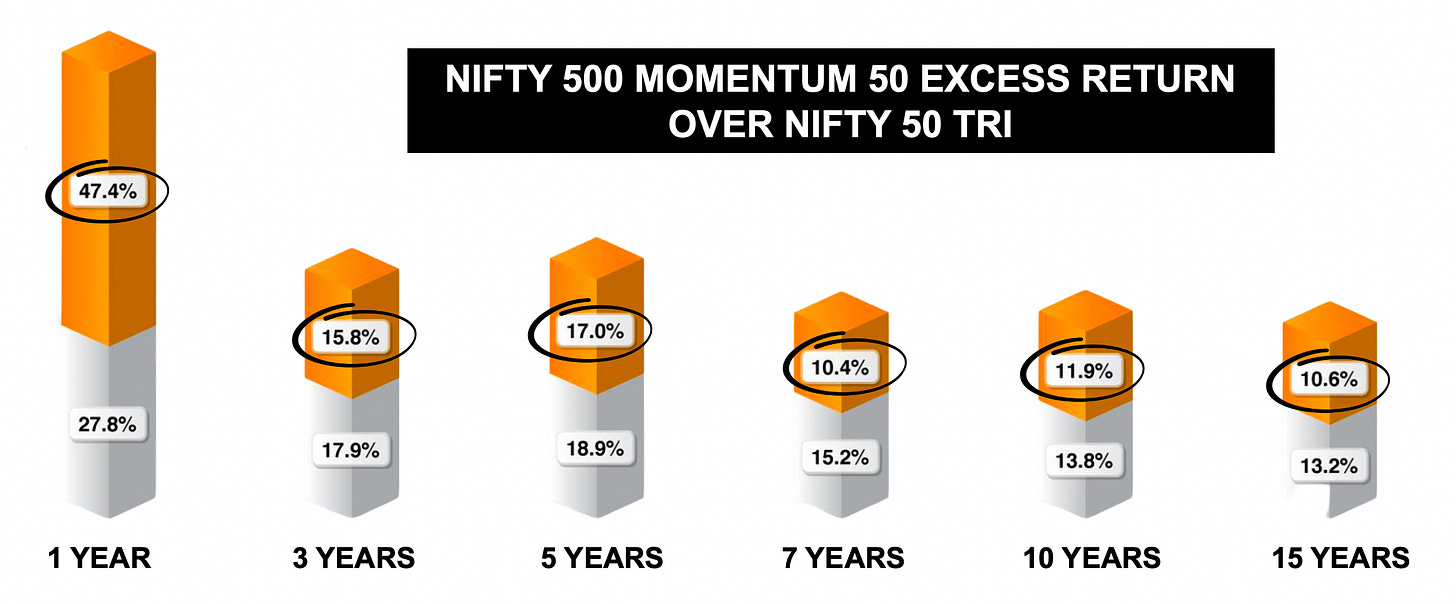

SUPERIOR RETURNS

The Nifty 500 Momentum 50 TRI has delivered a stellar CAGR of 25.2% since April 2005 — an impressive 10% excess return when compared to the Nifty 50 TRI over the same 19-year period

Infact, this overperformance can be seen across time periods

Even for those investing via SIPs, the N500M50 has maintained its edge, offering 27.4% returns over the past decade

Invest in Motilal Oswal’s Nifty 500 Momentum 50 Index Fund

AN APT ADDITION TO YOUR WEALTH CREATION PORTFOLIO

Unlike flexicap and multicap funds, momentum funds are designed to ride short-term market trends, constantly adjusting sectors to capture gains

The N500M50 does this particularly well, with its current allocation emphasizing industrials (35.7%), consumer discretionary (23.9%) and financial services (17.2%)

Another strong point is its broad market cap coverage

In this context, I examined the 3-year average holding and while other momentum indices like the N200M30 are heavily skewed toward large caps (77%), the N500M50 is more balanced with 47% in large caps, 32% in midcaps, and 21% in smallcaps.

This means the N500M50 captures a broader range of market opportunities

This agnosticism (is that a word?) across sectors & market cap makes the N500M50 a versatile inclusion for any portfolio

A SHORT SUMMARY BUT LONG-TERM BENEFITS

I’ve kept this note brief, but the long-term benefits of investing in the Motilal Oswal Nifty 500 Momentum 50 Index Fund are worth emphasizing (more information about the fund)

Here’s a quick wrap-up:

Exposure across market caps (large, mid & small) to high-momentum stocks

Potential for high returns, especially during bull markets

Rules-based, transparent methodology (specifics here)

Low cost due to its index fund structure — expense ratio will be announced post-NFO

Minimum investment starts at just ₹500, whether in lumpsum or SIP mode

Classified as “Very High” risk as per the Risk-o-meter (standard for equity funds)

Invest in Motilal Oswal’s Nifty 500 Momentum 50 Index Fund

Thanks for reading!

All data/tables/images used in this writeup has been sourced from the research done by Motilal Oswal AMC. The information / data herein alone is not sufficient and should not be used for implementation of an investment strategy & should not be construed as investment advice to any party. Past performance may or may not be sustained in future and is not a guarantee of any future return. You can find more information & details here