840% Upside: UGRO Capital’s Ambitious Roadmap to Five-Star Status ⭐⭐⭐⭐⭐

Issue #015 dives into UGRO Capital's bold ambition & blueprint to replicate Five-Star Business Finance's successful playbook in the MSME lending space

Some companies drift aimlessly, uncertain of where growth will come from. Needless to say, investors should steer clear of such businesses

This week, I’m diving into a company with a bold vision, a clear roadmap for the next 6-8 quarters – one that could offer much to investors like you & me

The real question is: can it execute?

Here’s a list of all previous editions of my newsletter

UGRO Capital Limited

UGRO Capital Limited is an MSME-focused NBFC that has seen rapid growth since starting its lending operations in 2019

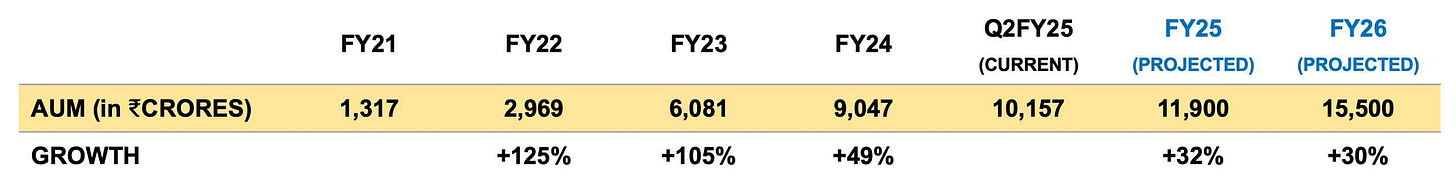

Having recently crossed the ₹10,000 crore AUM mark, the company aims to reach ₹20,000 crores within the next 8-10 quarters (interview with CEO)

Over the past 5 years, UGRO has experimented, expanded product lines & importantly, learnt through experience

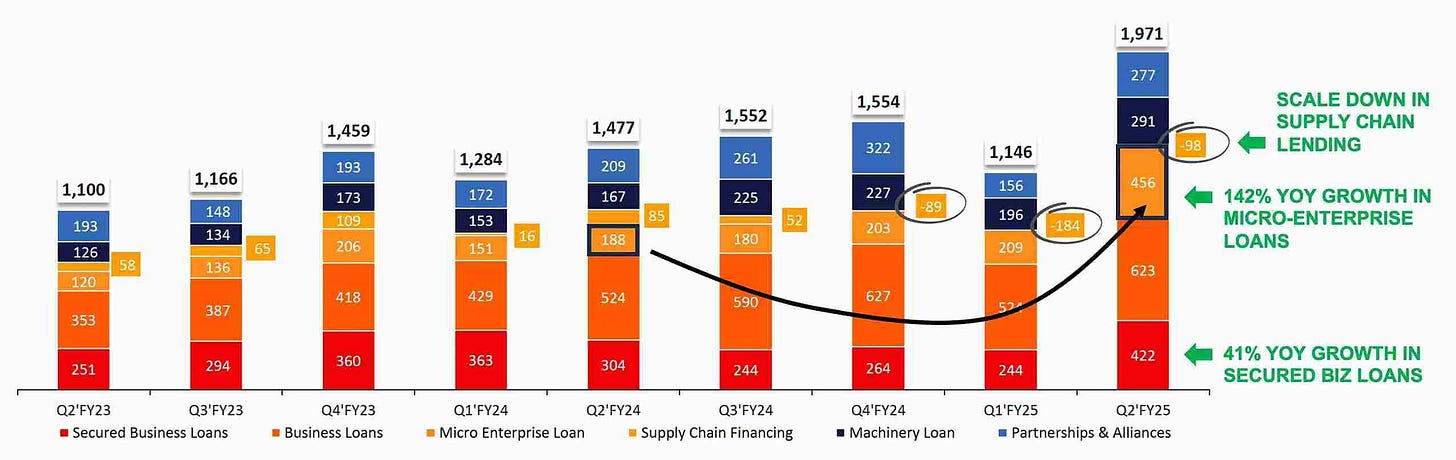

For example, the company has scaled back on supply chain lending due to unfavourable profitability (high GNPA of 10.1% + banks offer loans at 7-8% interest v/s UGRO’s 10.8% cost of borrowing)

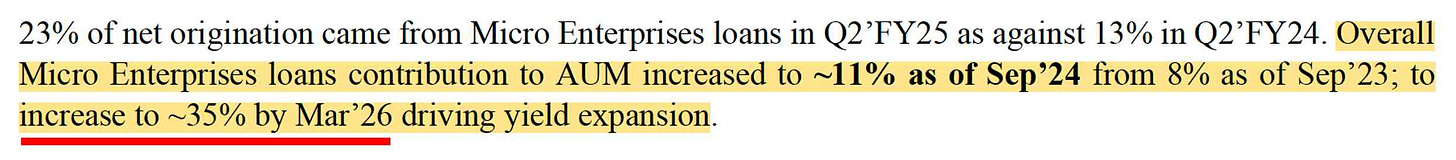

On the other hand, UGRO has doubled down on micro-enterprise loans growing it’s share of the AUM from 8% to 11% over the past year

What really caught my attention was a line in UGRO’s Q2FY25 update (here) where the company is targeting an increase in its micro-enterprise loan share from 11% to 35% over the next six quarters

It’s All About the Yield

“Yield” refers to the annual percentage return (APR) the lender earns through interest and fees paid by the borrower

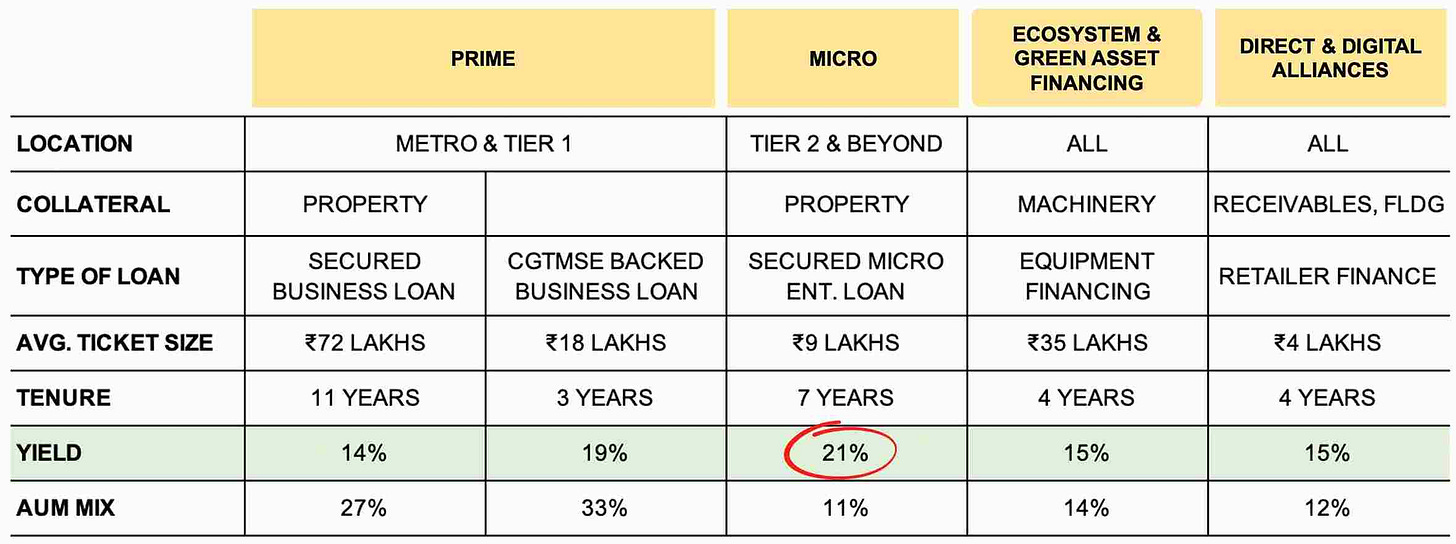

Yields vary across products. For example, loans to micro-enterprises & shop-owners offer yields of 21% & 26% respectively, while supply chain lending – an area UGRO is stepping away from – offers an APR of just 14%

UGRO has shown considerable commitment in improving it’s portfolio yield while keeping 65-70% of it’s book secured

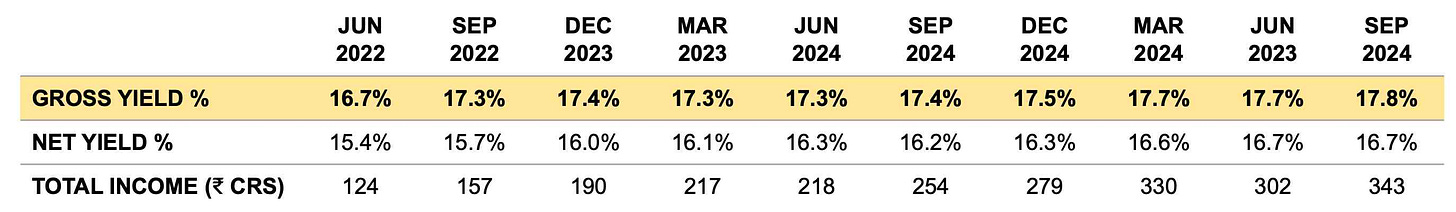

Gross yields have risen steadily over the past 10 quarters – from 16.7% in Q1FY23 to 17.8% in Q2FY25

Measure what Matters

NBFCs have so many moving parts that identifying the critical metrics is essential. Let’s examine a few here:

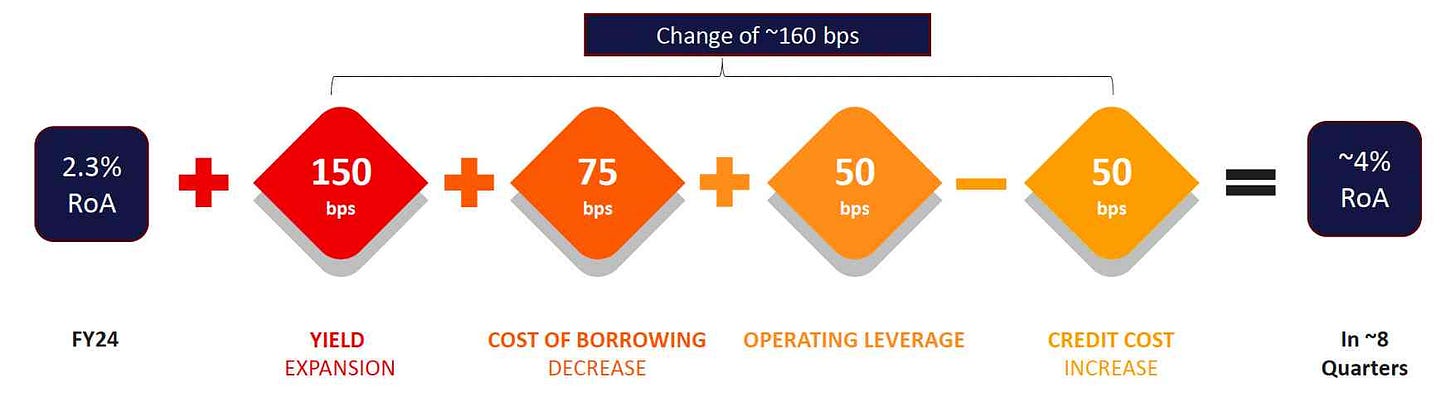

1️⃣ Return on Assets – UGRO aims to achieve a 4% ROA by March 2026 — up from 2.0% currently. This growth hinges on expanding its micro-enterprise loan segment (from 11% to ~35% of AUM), which is expected to increase yield by 150 bps

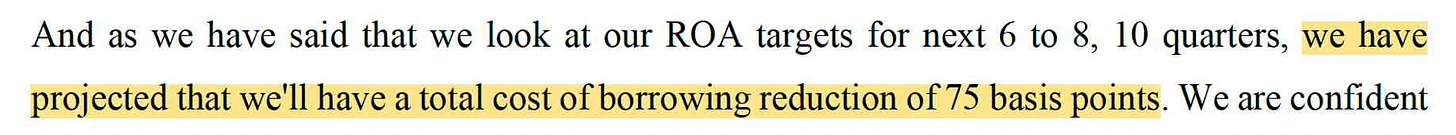

2️⃣ Cost of borrowing – Currently a bit high at 10.75% (Q2FY25), management expects a 75 bps reduction in it’s cost of borrowing over the next 8-10 quarters on account of vintage, capital raise & interest rate cycle

On the liability side, the company’s two credit rating upgrades (Mar ‘24 & Jul ‘24) will help reduce overall funding costs

3️⃣ AUM Growth – UGRO delivered ₹3,000 crores of incremental AUM in FY23 & FY24. The company aims to maintain a 30-35% AUM growth over the next two years

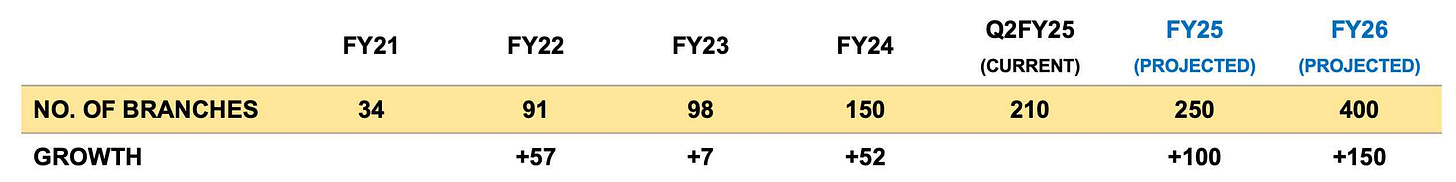

4️⃣ Branch Additions – UGRO has been adding 15-30 branches each quarter and plans to open another 150 by March 2026, bringing its total to 400. This branch growth has directly contributed to a 34% income increase in H1FY25 compared to last year

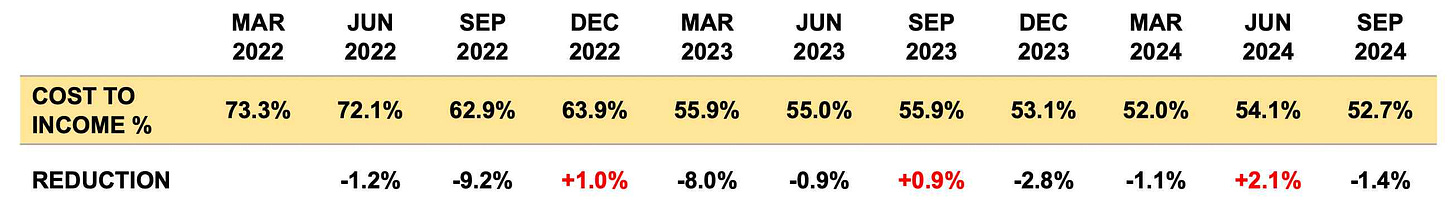

5️⃣ Opex to Income Ratio – Over the past five years, UGRO has heavily invested in data technology, branches, systems and teams – resulting in a high cost-to-income ratio. This figure has been trending down, with the management targeting 40-45% in the coming quarters

6️⃣ Capital Adequacy & NPAs – As of Sep 2024, UGRO’s Capital to Risk-Weighted Assets Ratio (CRAR) stands at a healthy 24.5%. This is well above the RBI-mandated 15%

UGRO’s Gross NPA is 2.1% of total AUM on a blended basis but this might change (I’m projecting 2.5%) as UGRO makes changes to it’s product mix

Is this a Five-Star in the Making?

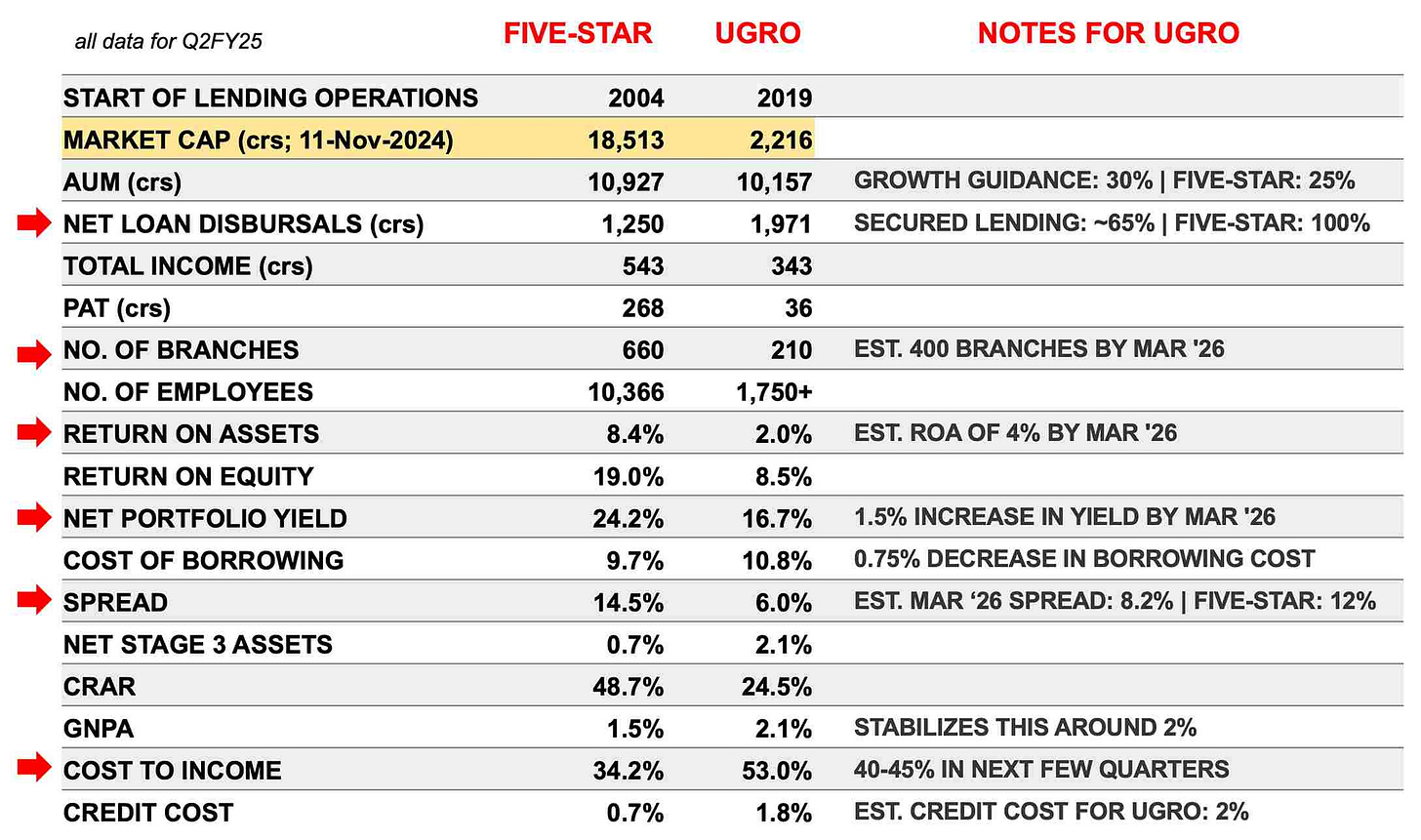

Five-Star Business Finance Limited is the heavyweight amongst MSME lenders, with a market cap of ₹18,500 crores and over two decades of lending experience

In comparison, UGRO Capital is relatively young (started ops in 2019) with a market cap of ₹2,200 crores – and it seems UGRO is following in Five Star’s footsteps, aiming to replicate it’s playbook and success

This becomes evident when we compare the two entities across parameters. psst .. pay extra attention to the ones I have marked with a red arrow – especially the notes

I hope you’ve observed the difference in a seasoned player & a newbie

While both companies are on a similar path in terms of AUM, disbursal velocity and new branch openings, UGRO is playing catchup in areas like ROA, portfolio yield, cost of borrowing and cost-to-income ratio

Understandably, UGRO will might get there in a few years and if its numbers back up that ambition — there’s potential for an 840% increase in market cap as UGRO bridges the gap on Five-Star (₹18,500 crs v/s ₹2,200 crs)

This is the central idea I’m exploring in this edition

Investing is a continuous process of learning, analyzing & refining decisions. A lifelong task, skill, passion & an ever-evolving pursuit!

That’s why I’m launching ALPHA — a paid community where like-minded members come together to discuss opportunities, share insights & grow wealth collectively. Unlike a course/workshop, Alpha is a semi-structured space featuring original research, webinars, discussions, expert talk & member-driven participation

It’s my most ambitious project yet — one that I’m deeply passionate about & fully committed to. Tap the link below to learn more, and if it feels like the right fit, I’d love to have you join us! 🤗

Vision without Execution is Delusion

Let’s go back to the question I started this inquisition with – can UGRO Capital execute their plans efficiently?

Here are some markers for us to consider:

1️⃣ Clear Blueprint: UGRO’s management has committed to: a) 30-35% yearly AUM growth, b) 400 branches, c) ~4% ROA, d) ~18% ROE, e) Opex-to-income < 45%, f) drop of 75 bps in cost of borrowing, g) 20% of assets from micro lending etc. — all to be accomplished in the next 8-10 quarters

2️⃣ Strong Tailwinds: Only 15% of India’s 6.3 crore MSMEs have access to formal credit, representing an untapped opportunity worth ₹78,00,000 crores (report by Care). UGRO targets the ₹15 lakh to ₹15 crore segment – which covers 90% of the MSME financing gap. Ergo, no dearth in demand + strong government support

3️⃣ Proven Resilience: Starting operations in 2019, UGRO weathered the COVID years (FY21 & FY22) and has since reached ₹10,000 crores in AUM. I find this commendable when one notes that seasoned peers like Five-Star, SBFC & MAS Financial Services are at similar AUM – ₹10,927 crs, ₹7,715 crs & ₹11,016 crs respectively

4️⃣ Balanced Book: UGRO offers a wider spread – secured loans of upto ₹3 crores, business loans of upto ₹25 lakhs, machinery financing, retailer financing & ₹8-10 lakh secured loans for micro-enterprises

Additionally, UGRO employs an asset-light “Lending as a Service” model involving multiple co-lending & co-origination arrangements. As of Q2FY25, 44% of UGRO’s AUM is off-books (eventual target is 50%) – which puts less strain on its balance sheet

5️⃣ Funding Support: Over five years, UGRO has raised over ₹10,000 crores in equity & debt

Infact, it’s latest equity raise of ₹1,322 crs was led by existing investors (Samena Capital committed ₹500 crores) and many of India’s marquee family offices. UGRO’s founder (Shachindra Nath), board members & the management team also participated, collectively investing ₹16.25 crores

6️⃣ Beware of Exaggerations: Mr. Shachindra Nath & team has been changing markers which has unsettled some investors. For example, the FY24 AUM target was ₹10,000 crores but UGRO did about ₹9,000 (article)

Similarly, the FY25 target (as of Jan 2023) was ₹20,000 crores which has since become an aspirational one & the company may not reach there in FY26 aswell

Hopefully UGRO is setting more realistic goals now. Investors are advised to track the company’s progress on a quarterly basis

7️⃣ Analyst Thumbs-Up: Many brokerages see a strong upside for UGRO Capital's stock price:

› Emkay Global Financial Services – target price of ₹360 (Oct 2024; PDF)

› Keynote Capitals - target price of ₹279 (Oct 2024; PDF)

› Systematix - target price of ₹348 (Oct 2024; PDF)

› Incred Capital - target price of ₹350 (Sep 2024; news)

› Choice Broking - target price of ₹345 (Oct 2024; PDF)

While I don’t weigh analyst projections heavily, these reports can add valuable insights to one’s investment thesis

My endnotes:

I agree – there’s a touch more uncertainty in UGRO’s future compared to other stories I’ve covered in my newsletter

This one’s more long-term, a bit execution-heavy and requires regular monitoring

But that said, I think the potential returns exceed the question marks – which is why this company & it’s stock finds a place in my consideration set

Is it a punt I’m taking? Yes, maybe

Would love to hear your views on it 📢

Much love,

Shankar

Very Neat and well explained article sir!!

Hi Sankar Bhai, yet an another insightful analysis. It helps us to make informed decision. Looking forward to your mails, always.