₹123 Cr to ₹720 Cr: Kilburn Engineering is on Fire 🔥

Issue #018 explores Kilburn Engineering’s revenue surge from ₹123 Cr in FY22 to a projected ₹720 Cr in FY26. We analyze revenue forecasts, margins, profits, valuation gaps - and is it investible?

Kill Bill Vol. 1 (trailer) opens with the Bride (Uma Thurman) lying in a hospital bed, trapped in a coma for four long years

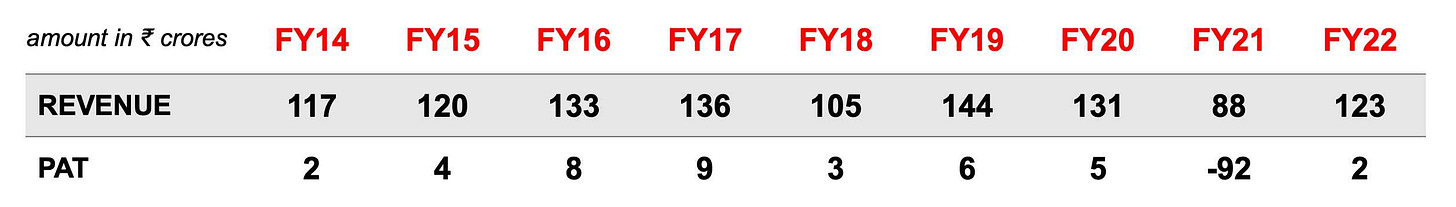

Similarly, Kilburn Engineering Limited (KEL) endured it’s own nine-year slumber from 2014 to 2022 – plagued by stagnant revenues & struggling to surpass ₹10 crores in PAT

Much like Beatrix Kiddo, this is the story of KEL’s awakening – a tale of transformation & resurgence, offering investors a unique opportunity to benefit from its turnaround

This story is researched by Priyam Bansal

Prelude

With over 40 years of expertise, Kilburn Engineering Limited has established itself as a leader in the drying solutions and customized process equipment market

Drying solutions involve specialized equipment & systems designed to remove moisture or liquids from materials like chemicals, food products, industrial components etc. during the manufacturing process

KEL has 3,000+ installations worldwide serving diverse sectors/industries incl. oil & gas, specialty chemicals, nuclear power, carbon black (where it holds a leadership position), pharmaceuticals, soda ash (also leader), fertilizers, tea etc.

The Man from Okinawa

After many years of stagnation, KEL embarked on a transformative journey post-COVID. This revival was led by the current MD, Ranjit Lala

Under his leadership, KEL – a) transitioned from just a dryer manufacturer to a solutions provider, b) expanded the number of product offerings, c) entered new industries, d) invested heavily in R&D, e) raised funds, f) repaid debt and g) acquired companies

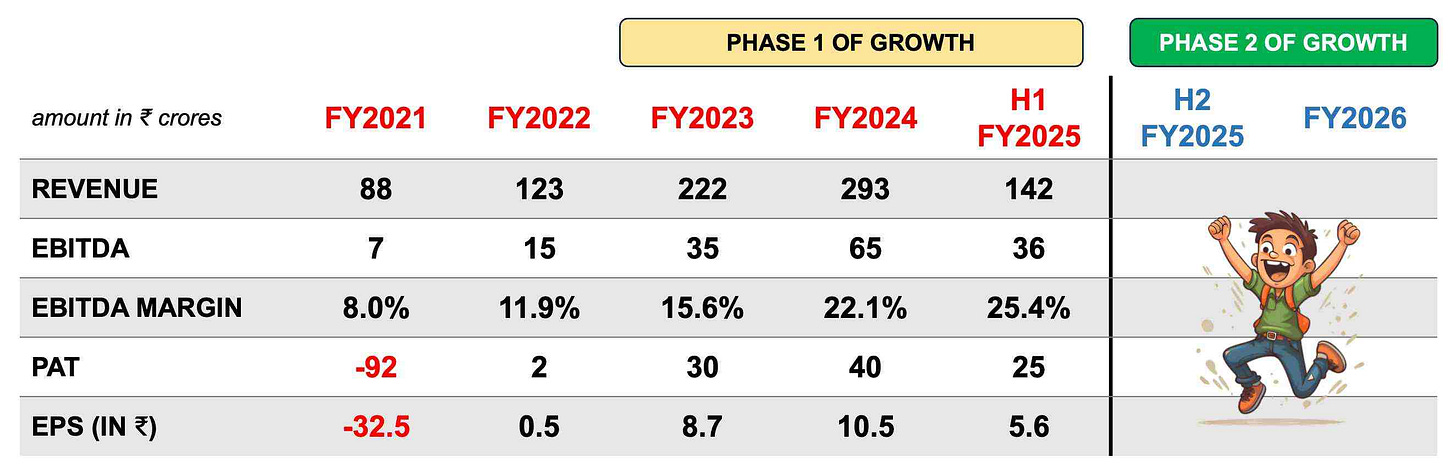

In just two years, these efforts bore fruit and KEL's revenues grew at a CAGR of 54% & its EBITDA skyrocketed by 108% annually

Margins improved, EPS surged and the share price – which was ₹38 on the day of Mr. Lala’s appointment – has risen to an astounding ₹467 today

🙋♂️ While the growth achieved between 2022 and 2024 has been remarkable, I believe this marks just the beginning of KEL’s resurgence and the next 5-6 quarters promises even greater potential

The Origin of O-Ren

Just as Beatrix Kiddo owed her triumphs to Hattori Hanzo’s legendary sword, the next phase of KEL’s resurgence rests on four key pillars:

1️⃣ Expansion of manufacturing facilities

In July 2024, KEL signed a binding term sheet to acquire a factory in MIDC Ambernath for ₹22 crores (announcement)

The facility, spanning 5,000 sq. meters, is expected to start operations by November and gradually ramp up – contributing ₹100 crores in revenue by FY26

2️⃣ Acquisition of M E Energy Pvt. Limited

In February 2024, KEL acquired M E Energy – a leader in waste heat recovery systems for ₹98.7 crores (news)

In one of many use-cases, this acquisition allows KEL to enter the ₹5,000 crore cement waste heat recovery boiler market, that’s presently dominated by 2-3 players

With the first phase of expansion at M E Energy’s Pune facility set to finish this month, the company is targeting a turnover of ₹125–₹130 crores with EBITDA margins exceeding 20%

3️⃣ Proposed acquisition of Monga Strayfield

In August 2024, KEL signed an agreement to acquire Monga Strayfield (exchange filing) – a global leader in radio frequency drying and heating technology, capable of reducing moisture to 1% (since Kilburn dryers manage only upto 5%, R&D based enhancements is a big opportunity)

Through this strategic purchase, KEL aims to unlock new applications & customers across textiles, yarn, food, spices, ceramics, foam, packaging, leather and the wood industry

This deal is expected to be completed by the end of this month with FY26 revenues projected at ₹70 - ₹80 crores at EBITDA margins of 20% or more

4️⃣ Growing Order Book

As of Q2FY25, the group’s order book stands at ₹354 crores, bolstered by a ₹126 crore order win in November (announcement)

Additionally, KEL is aggressively pursuing a strong enquiry pipeline of ₹2,000+ crores, targeting ₹500+ crores of order intake for FY25

👉 Drawing from available information, I project revenues of ₹500 crores in FY25 and in the range of ₹700 - ₹750 crores in FY26

The Money Spattered Bride

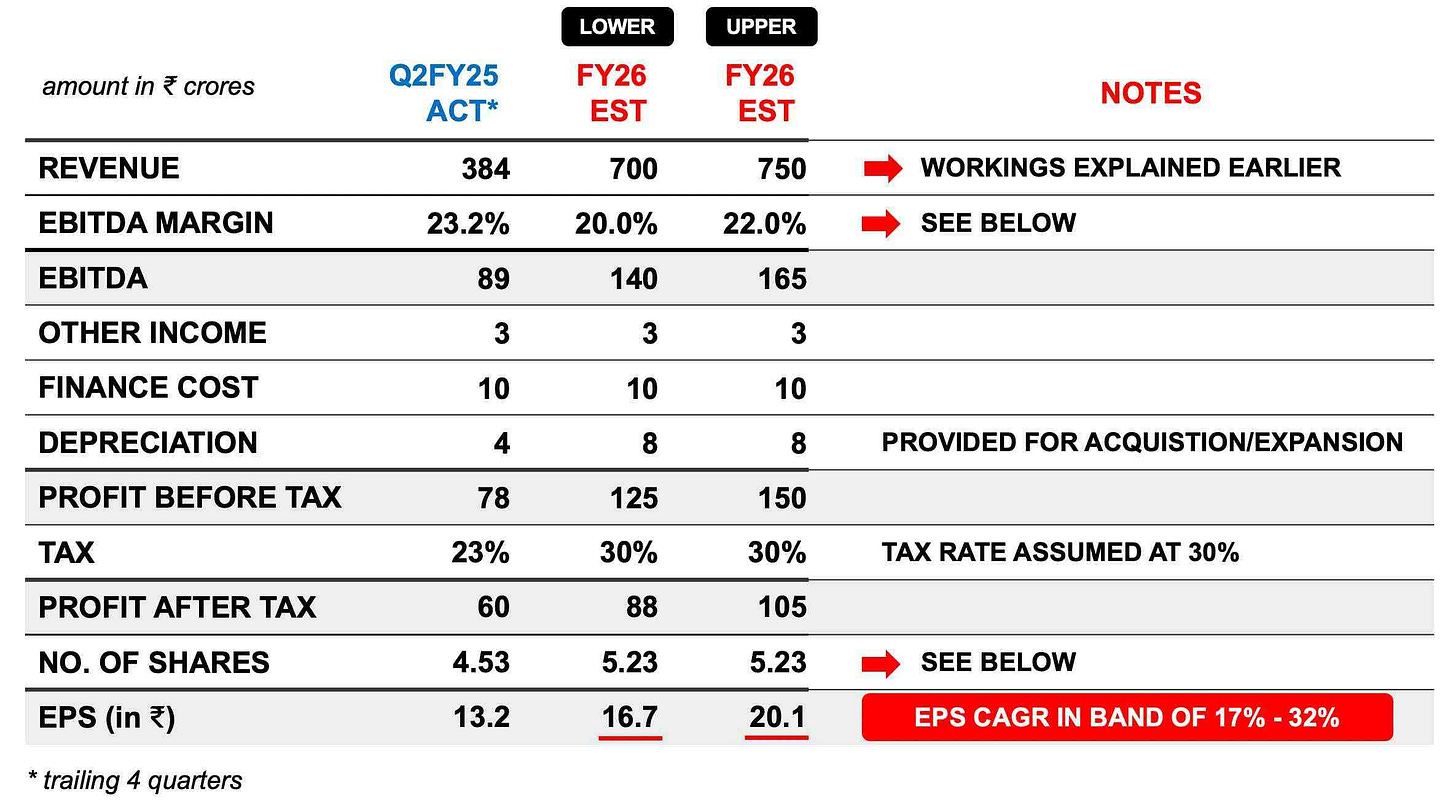

With the top line in sight, let’s delve into KEL’s financial projections and estimate where we might be at in FY26

OK, so there are three points of note here:

1. For revenue, I’ve projected a range of ₹700 to ₹750 crores – this has been explained earlier

2. Regarding margins, the management’s guidance of achieving “20% plus” EBITDA led me to consider a margin band of 20% to 22% in my calculations

Supporting this confidence is KEL's standalone margin performance, which stood at an impressive 25.9% in H1FY25

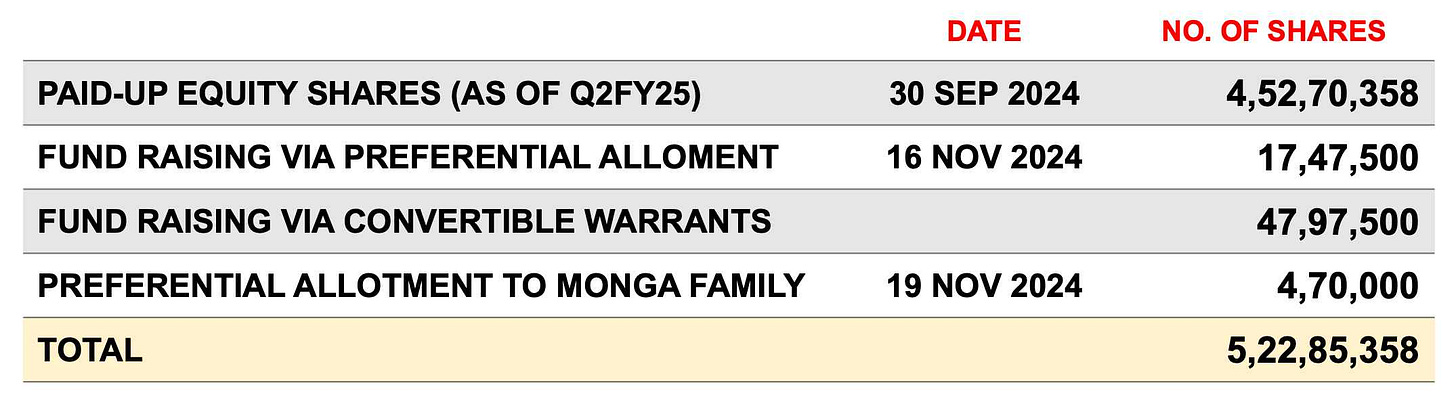

3. The rising equity share capital introduces another important variable

Kilburn’s equity shares have risen from 3.4 crores in Q2FY23 to 4.5 crores in Q2FY25

Based on exchange announcements, much of this increase stems from preferential allotments and convertible warrants (read, read)

Assuming all warrants are converted, we reckon the total outstanding shares would rise to over 5.2 crores, which naturally dilutes EPS and impacts valuations

👉 Everything has a price to it

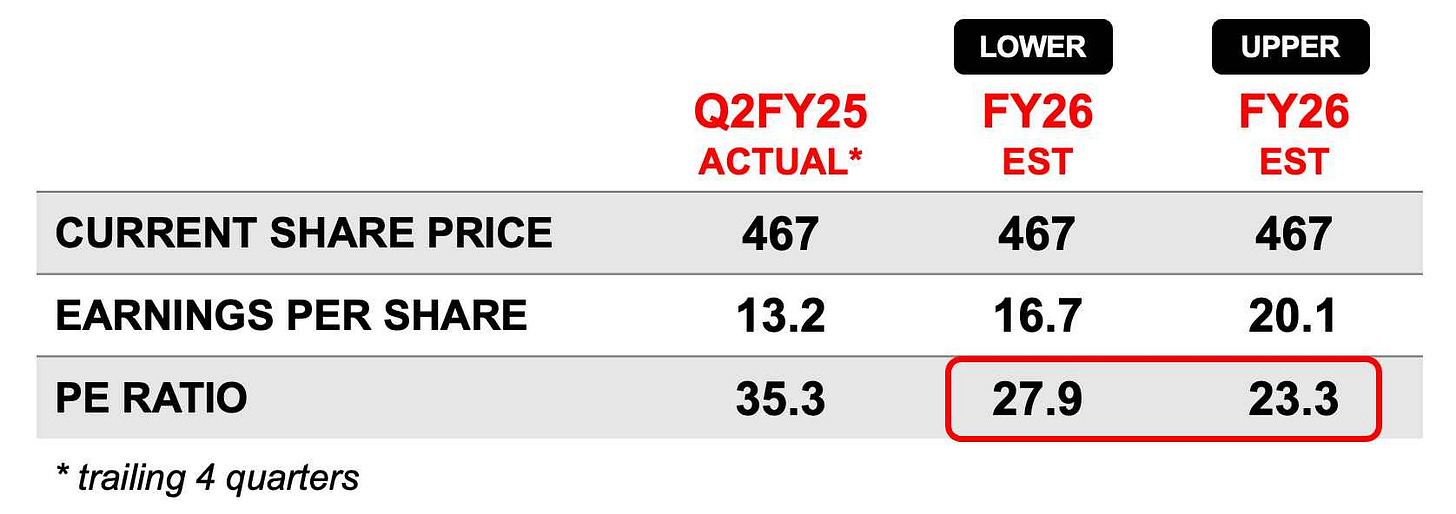

On a price-earning basis, KEL presently trades at 35.3 on a TTM basis

After factoring in the projected revenue, PAT & increased equity, I estimate an EPS band of ₹16.7 to ₹20.1 for FY26 – resulting in a forward PE range of 27.9 to 23.3

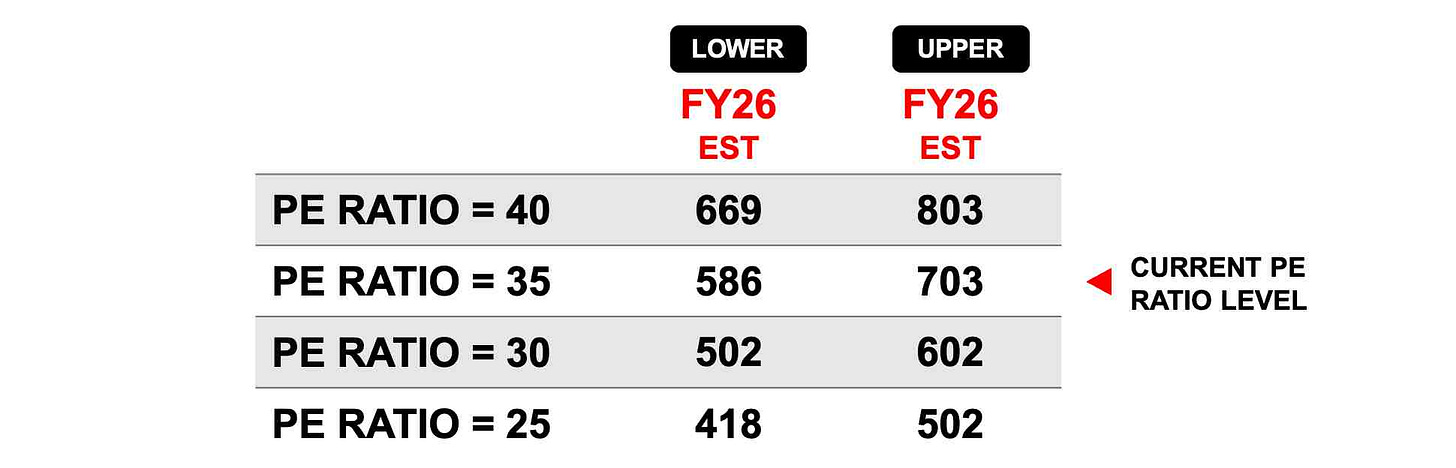

Now, the real question is — what’s the ideal price-earning multiple for a business like Kilburn?

With no real answer, I settled for a back-of-the-envelope calculation and a current PE of 35 gives us a potential future price band between ₹586 and ₹703 (i.e. 35 * ₹16.7 and 35 * ₹20.1)

Understandably, a higher PE ratio (a bit unlikely in my opinion) ups the future price while a lower multiple brings down the projected price

Investing is a continuous process of learning, analyzing & refining decisions. A lifelong task, skill, passion & an ever-evolving pursuit!

That’s why I’m launching ALPHA — a paid community where like-minded members come together to discuss opportunities, share insights & grow wealth collectively. Unlike a course/workshop, Alpha is a semi-structured space featuring original research, webinars, discussions, expert talk & member-driven participation

It’s my most ambitious project yet — one that I’m deeply passionate about & fully committed to. Tap the link below to learn more, and if it feels like the right fit, I’d love to have you join us! 🤗

Showdown at House of Blue Leaves

In my view, KEL’s story is one of transformative growth & warrants our attention. Afterall:

▸ KEL has strong ambitions with revenues surging from a mere ₹123 crs (FY21) to a projected ₹700+ crs in FY26 – driven by organic growth and acquisitions

▸ The company’s diversification across 15+ industries/sectors enhances its resilience

▸ Their acquisitions have brought in advanced technologies enabling KEL to bid for larger & complex orders

▸ Its stable profitability with a target of 20%+ in EBITDA margins, underscores KEL’s operational strength

Having said this, I’m not quite thrilled with their equity dilution strategy and would have instead preferred debt funding, which wouldn’t thin out the EPS

While my assessment focuses on FY26, overall I believe the groundwork being laid by Mr. Lala & his team today, should position the company well for sustained growth

Disclosure: I first invested in KEL at ₹440 in Sep ‘24 but a steep fall in early October helped me add more. I picked a few more shares last month at ₹466 which brings my average acquisition price at ₹410

I’ll request you to set aside my buy price and evaluate this company purely on its merits, conducting your own independent analysis

Would love to hear your views on it 📢

Much love,

Shankar

Hi Shankar,

We love your work - I watch your videos of youtube without fail. You continue to inspire/impress us.

Just one suggestion/critic,

If you could identify the "kilburn" type of a stock.. before it shoots up 6 times in the last 24 months - it would be greatly appreciated.

It doesn't inspire confidence to buy a stock that's already up 6 times in the last 24 months (which has done literally nothing in the last 8 years before that)

This makes us wonder what really happened in the last 2 years that didn't happen in the last 8 years before that.

Best Regards,

Thanks for the another excellent pick and insights shankar ji👌