Hariom Pipe projects 48%+ Growth in EPS (psst .. it's also cheap!)

Issue #019 explores Hariom Pipe Industries & its ambitious revenue/EPS growth by FY26. We dive into revenue projections, margins, capacity, valuation etc. to assess if the stock is investment worthy

In the last 3-4 months, we’ve seen a notable decline in stock prices across several companies, opening up some promising investment opportunities

In this edition, we’ll explore one such case – a stock whose price has tumbled from ₹870 in August to just under ₹500

The Pied Piper of Hyderabad

Established in 2007, Hariom Pipe Industries Limited (HPIL) manufactures a wide range of premium iron and steel products from it’s facilities in Telangana, Andhra Pradesh and Tamil Nadu

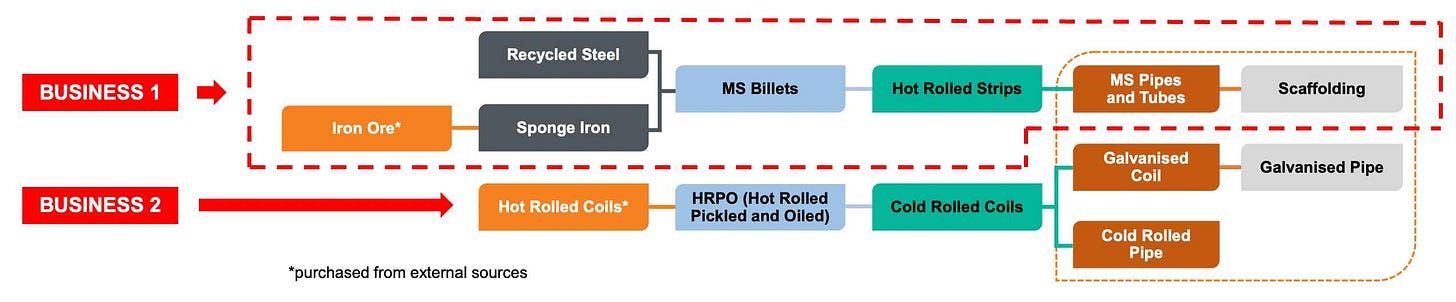

HPIL operates across two business segments:

1️⃣ Fully Integrated Process: The company controls the entire production cycle – from raw material (iron ore) to final products (MS pipes, MS tubes & scaffolding)

2️⃣ Galvanized Products: These include galvanized coils & cold-rolled pipes, made using hot-rolled coils sourced from external suppliers

For specifics on each product, check out pages 8-9

The company distributes its products through a network of 800+ dealers, with a majority of its current sales coming from Karnataka, Telangana, Tamil Nadu & Kerala

HPIL has been consistently ramping up its production capacity and output. With a utilization rate of 28% as of H2FY25, the company has ample capacity to comfortably meet its targets for this year and the next

What’s particularly interesting is its consistent profitability – blended EBITDA margins have remained in the 12–13% range for many years

It’s definitely a metric to watch out for as margins on galvanized products (65% of sales) are lower than those offered by MS pipes. However I do draw some comfort from the recent acquisition of Ultra Pipes (announcement) that is likely to up MS pipes' contribution to 42% of sales, potentially stabilizing overall margins

The Melody of Results

Over the last four years, HPIL has delivered impressive growth across key financial indicators

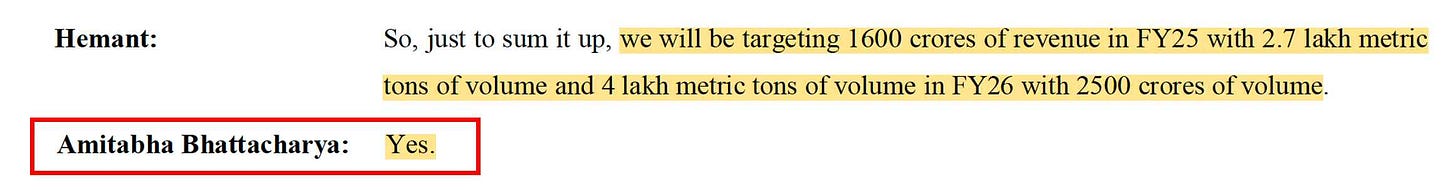

Most particularly, the company’s revenues have risen by atleast 50% every year as it targets a revenue of ₹1,600 crores in FY25 and ₹2,500 crores in FY26

This implies a 44% growth in H2FY25 compared to H1 – and a 56% growth in FY26 over FY25

These are steep ambitious targets & much of management’s confidence comes from:

1️⃣ Revival in steel demand in H2FY25 after a challenging Q2 that saw slowdown in steel demand, a 5% decline in prices and weather-related disruptions across South India. Historically, Q3 & Q4 are peak periods for steel product demand

2️⃣ Geographical expansion into Maharashtra & Gujarat plus, focus on specialized steel products

3️⃣ Past track record of consistently achieving 40%+ revenue growth in FY21, FY22, FY23 and FY24

While I appreciate the management's optimism, it’s always wise to err on the side of caution. To that end, Priyam has prepared two revenue projections for FY26 – one conservative and the other aligned with management's guidance

Remarkably, these projections translate to an impressive annualized EPS growth range 48% to 84% 😳

It’s worth noting these calculations factor a total equity base of 3.22 crore shares – which includes 12,53,462 outstanding warrants. We have assumed full conversion by March 2026 (for a detailed flow of warrants, kindly read, read, read & read)

Investing is a continuous process of learning, analyzing & refining decisions. A lifelong task, skill, passion & an ever-evolving pursuit!

That’s why I’m launching ALPHA — a paid community where like-minded members come together to discuss opportunities, share insights & grow wealth collectively. Unlike a course/workshop, Alpha is a semi-structured space featuring original research, webinars, discussions, expert talk & member-driven participation

It’s my most ambitious project yet — one that I’m deeply passionate about & fully committed to. Tap the link below to learn more, and if it feels like the right fit, I’d love to have you join us! 🤗

What’s It Worth To You, Mr. Piper?

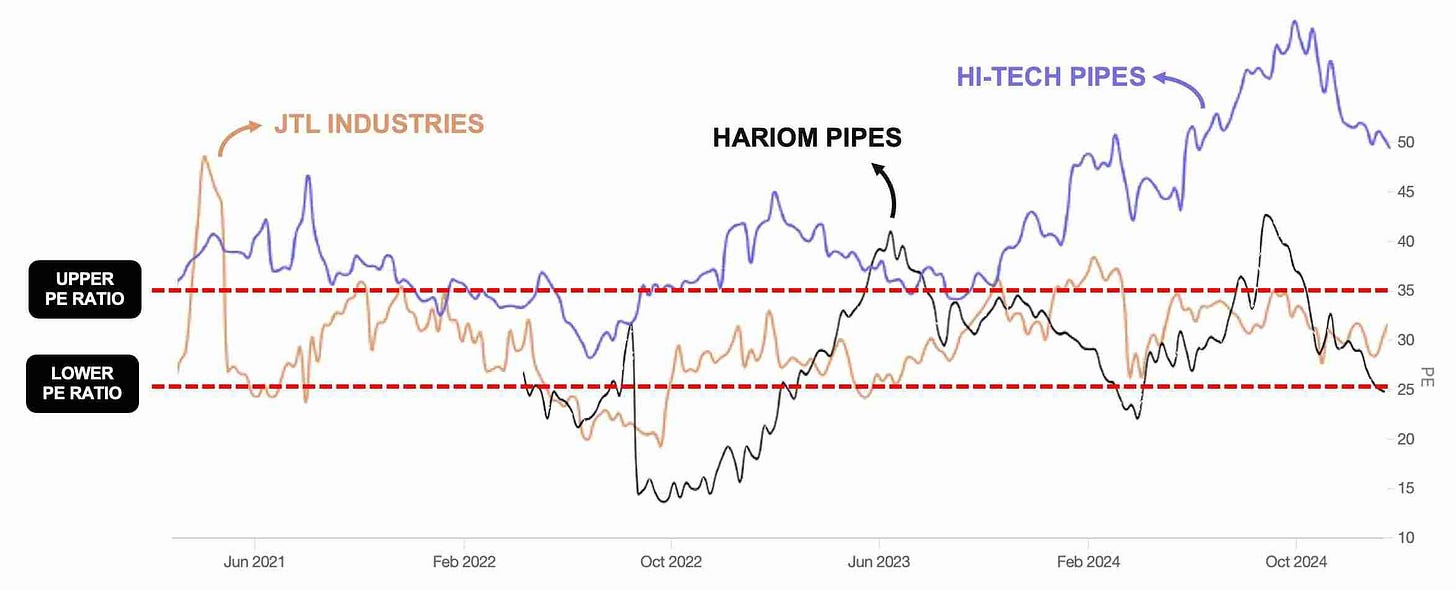

At its current price of ₹496/share (as on 06.01.2025), HPIL trades at a PE multiple of 25

Our projected FY26 earnings gives us a forward PE band of 10.0 to 13.9 indicating a significant margin of safety

Further, I reviewed the PE multiples across steel pipe companies & a range of 25 to 35 appears to be most apt. Encouragingly, HPIL currently sits at the lower end of this PE ratio band

As we did with Kilburn Engineering, I opted for a straight-forward back-of-the-envelope calculation. Using the current PE of 25, we arrive at a potential future price range of ₹895 to ₹1,243 (i.e. 25 * ₹35.8 and 25 * ₹49.7)

These numbers are undeniably compelling and if the PE ratio goes higher (more likely) then it further ups the future stock price

Beyond the Music

While Hariom Pipe presents some steely numbers but there are a few considerations to keep in mind:

1️⃣ Impact of steel prices – At first glance, one might assume the margins of a steel pipe company to closely track the price of its primary raw material – steel

However, HPIL’s EBITDA margins (consistently in the 12–14% range over many years) show no clear correlation to steel price fluctuations. Further, the management remains confident in its ability to maintain profitability by passing on raw material cost changes to its customers

2️⃣ Capital raise? – In September 2024, HPIL’s board approved an enabling resolution to raise up to ₹700 crores via QIP (exchange filing). This is just an approval & the management has not yet finalized on its purpose or quantum – which I think will be a mix of debt reduction (currently ₹107 crs) or to fund the acquisition of a business or plant

Notably, HPIL doesn’t need any capex funding as the existing capacity is sufficient to meet its FY25 and FY26 production targets of 2.7 lakh MT and 4 lakh MT, respectively

3️⃣ Drop in promoters shareholding – HPIL’s issuance of shares through convertible warrants and preferential allotments has led to a decline in the promoters’ percentage shareholding. However, as the table below shows, there has been no significant dilution in the absolute number of shares held by promoters

4️⃣ Not co-operating with rating agency – Over the past year, HPIL has been rated by one agency (Crisil, here, here) while another (CareEdge, here, here) has classified the company as “non-cooperating.” It’s unclear why this discrepancy exists, so you may want to assess your own comfort level with this situation

I’ll continue to monitor critical factors like margins, QIP, shareholding patterns, ratings, earnings growth etc. in my community – not just for Hariom Pipe but for all the stocks I’ve covered and will cover in the future. The paid community is yet to be launched, more on this soon

Despite these four considerations, the potential upside in HPIL’s stock price is hard to ignore, which is why it deserves a closer look and your independent analysis

As always, I look forward to hearing your views on it 📢

Much love,

Shankar

Great issue as always, Shankar! Thank you for sharing this.

I am curious to know - how do you identify the stocks to deep dive on? And which tools do you use for the same?

Hi Shanker ji, Really appreciate your effort behind wirting such a details analysis, have been reading your article since a zaggle one, what a amazing explanation methodology you have plain and simple. Thank you very much.