Newsletter Performance Review : Q2FY25

Issue #016 reviews the performance of featured stocks post their Q2FY25 results. This includes -- SAMHI Hotels, BLS International, Zaggle, Sky Gold, Raymond, Ceigall & Garware Hi-Tech Films

The Q2FY25 results season is over .. making this the perfect time to review & reflect!

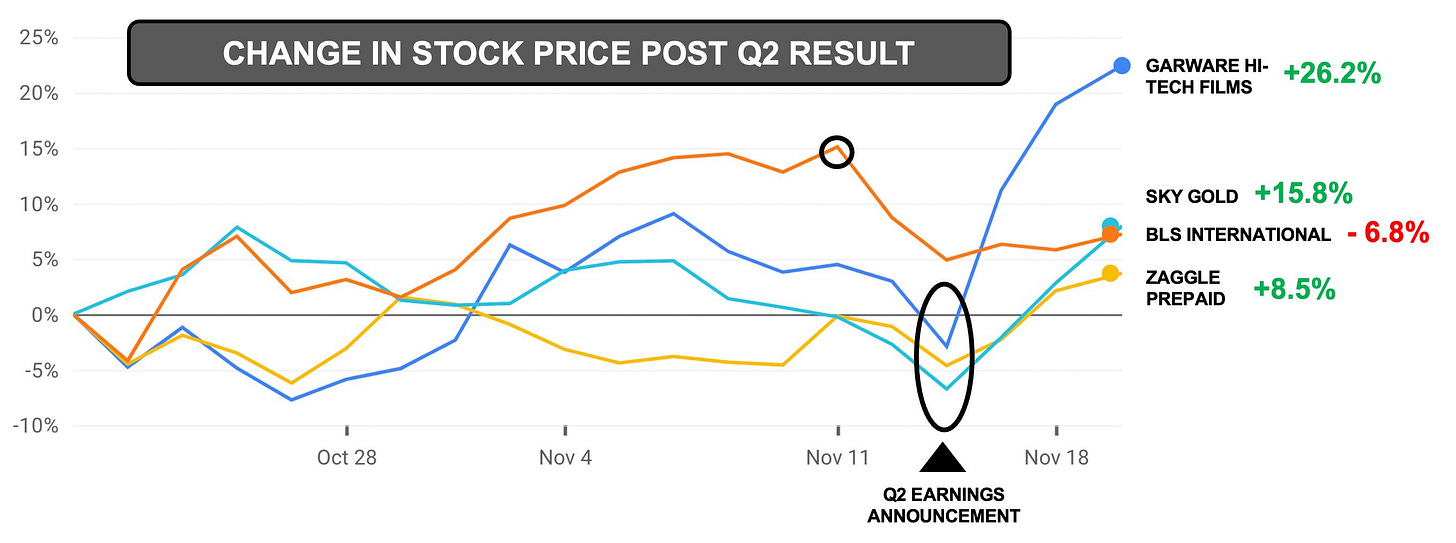

Since August this year, I’ve featured 8 companies and I’m happy to report that many of my picks have performed exceptionally well 👏 at a time when the market continues to experience a correction

Since all featured companies are small caps, I benchmarked their performance against the Nifty Small Cap 250 TRI Index

As a portfolio, our featured companies delivered an annualised return of 34.7% during a period where the smallcap index offered negative returns 🚀

With the stage now set, let’s quickly review the performance of our featured companies – except UGRO Capital, which we covered just last week – compared to our original investing thesis

1. SAMHI Hotels

📝 Research

Just as we predicted, SAMHI saved a chunk of money in Q2 on interest payable (₹56 crs vs ₹115 crs last year) and also ESOP expenses (₹4.4 crs vs ₹19.8 last year)

The result? A profit of ₹12.6 crores in Q2FY25 as compared to a loss of ₹88 crores last year (page 13 of PDF). Additionally SAMHI’s RevPAR numbers are up (+16.5% YOY) and so is the total income (+21.2% YOY)

However, as SAMHI continues to acquire more properties, its net debt is bound to rise. This isn’t a red flag as long as the borrowed capital is used to acquire profitable, value-accretive properties – something SAMHI has consistently aimed for

In my view, our original thesis remains intact – achieving an asset EBITDA of ₹500 crores and PAT of ₹166 crores by FY27 looks achievable

2. BLS International

📝 Research

For its visa business, I had projected Q2 revenues of ₹469 crores and EBITDA of ₹152 crores

While BLS delivered on the EBITDA front (₹152 crs, spot on!), the revenues came in slightly lower at ₹417.6 crs — a shortfall I’ll be digging into further & probably what has depressed the stock price!

I also analyzed this in light of Temasek acquiring a 18% stake in VFS Global for $5.5 billion (news). Based on this deal, VFS commands an EV/EBITDA multiple of ~43 – which is a lot higher than BLS’s current multiple of 29.2

BLS continues to have a healthy balance sheet with ₹902 crores in cash equivalent and strong return ratios (ROE of 32% & ROCE of 27%)

3. Zaggle Prepaid

📝 Research

Zaggle did better than what I anticipated. Q2FY25 revenues were up 64% (₹303 crs vs ₹184 crs last year) while the EPS grew by 143% (₹1.51 vs ₹0.62 last year)

This topline increase is driven by — a) increase in the volume of prepaid & credit cards, b) growth in number of clients (now 3,213 vs 2,732 last year) and c) change in product mix with more focus on Zoyer (pages 20-25 of PDF)

Zaggle has also revised its revenue growth guidance upward (from 45-50% to 50-55%) as it continues to expand it’s product line, explore cross-selling opportunities and international markets.

Zaggle’s momentum is visible and undeniable

4. Sky Gold

📝 Research

Since announcing its Q2 results on November 13th, Sky Gold’s stock has been on fire, hitting its upper circuit of 5% every single trading session

The reason? A spectacular 94% YoY jump in revenue (₹769 crores vs ₹396 crores) and a whooping 297% increase in EPS (₹26.88 vs ₹6.77)

Our projections for FY25 revenue (₹3,300 crores) and PAT (₹99 crores) seem well within reach

In fact, H1FY25 figures already cover 45% of the revenue target and 59% of the PAT target, suggesting Sky Gold may exceed my expectations this year

Key Learning

Zaggle Prepaid, Garware Hi-Tech & Sky Gold were the top performers this quarter

Interestingly, their rallies only took off after their Q2 results were announced

The key takeaway here is the importance of revenue visibility when evaluating companies

Remember, when I first discussed Zaggle and Sky Gold in my newsletter, their PE multiples were in the 70s and we’re still in a correction phase. And yet, their robust near-term revenue and profit growth not only provided a buffer against market volatility — but also propelled impressive stock price gains, defying the broader market sentiment

Investing is a continuous process of learning, analyzing & refining decisions. A lifelong task, skill, passion & an ever-evolving pursuit!

That’s why I’m launching ALPHA — a paid community where like-minded members come together to discuss opportunities, share insights & grow wealth collectively. Unlike a course/workshop, Alpha is a semi-structured space featuring original research, webinars, discussions, expert talk & member-driven participation

It’s my most ambitious project yet — one that I’m deeply passionate about & fully committed to. Tap the link below to learn more, and if it feels like the right fit, I’d love to have you join us! 🤗

5. Raymond Lifestyle

📝 Research

Raymond Lifestyle reported lower-than-expected numbers this quarter – a 6% YoY decline in income 👎, a 21% drop in EBITDA 👎 and a 45% reduction in PBT 👎

Margins also took a hit, with EBITDA margins falling from 16.6% in Q2FY24 to 13.9% in Q2FY25 (page 10-11 of PDF)

The company offered reasons ranging from a) subdued consumer demand, b) impact of high inflation and c) lower offtake due to ‘Shraadh’ in September – which didn’t appeal to consumer sentiments and the stock has lost 7% in value since earnings announcement

For me, Q3 and Q4 will be critical in assessing the company’s ability to execute on its growth plans. Store expansions and product launches are promising, but these need to reflect in financial performance i.e. higher revenues, better margins and growing profits

6. Ceigall India

📝 Research

Ceigall India’s share price has been sliding since mid-October, well before its Q2 results were announced

The stock now trades around ₹317, but the decline appears to be in line with the broader EPC sector, which has seen an average drop of 20% since October

Q3 & Q4 are generally better quarters for all EPC companies so if Ceigall can diligently execute their orderbook (₹12,153 crs now vs ₹9,470 crs in Jun 2024), earn bonuses/royalties, win more orders – then most of the lost ground can be made up

While one quarter isn’t enough to form a firm view, I’ll be closely monitoring this company

7. Garware Hi-Tech Films

📝 Research

Garware Hi-Tech knocked it out of the park in Q2FY25, with revenues up 56% YoY (₹621 crs vs ₹397 crs) and PAT soaring 126% (₹104 crs vs ₹46 crs)

This stellar growth was driven by strong sales in the SCF and PPF segments, product expansion, and entry into new markets. As projected, EBITDA margins remained robust at 22%.

If this pace continues, I wouldn’t be surprised if the company hits its ₹2,500 crores topline target well ahead of FY26

End Notes:

1. I’ve come to realise these quarterly updates are incredibly important. As the number of featured companies grows, managing this solely through email will become increasingly cumbersome. And so, by the time the next quarterly review rolls around (mid-February), I’ll try to have a dedicated paid community platform in place to help streamline tracking & make updates more manageable for everyone

2. Please refrain from asking in the comments whether you should invest at current price levels — I really don’t have a definitive answer for it just as I didn’t offer a buy/sell/hold call in the original analysis. That said, feel free to dive into my research, review the data, ask questions, work your own angle and then decide a course of action for yourself

Happy investing to you!

Much love,

Shankar

Hey Shankar, please start a paid community and please also update the trending value sheet on a quarterly basis.

Very detailed analysis Shankar ji, what stands out is the fact you have compared the performance vs Nifty small cap index. Your knowledge, efforts and transperancy is deeply appreciated.