Sky Gold : Q3FY25 Review

Sky Gold delivered a strong Q3 & has upped it's FY27 revenue guidance by 14%. In this follow-up note, we examine the key achievements, growth drivers and revised financial projections

On 8 September 2024, I published my initial research note on Sky Gold Limited (read here)

At the time, the stock was trading at ₹276. Since then, it has risen by 21% – an impressive feat considering most small & microcap companies have lost about a-fifth in value

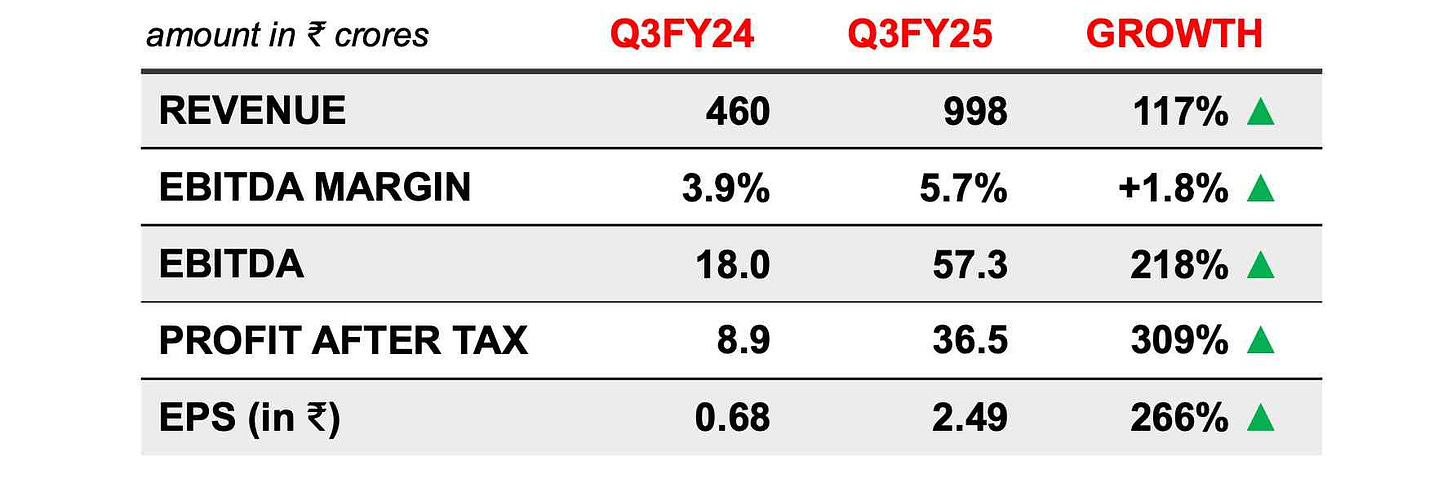

For Q3, the company delivered excellent results with YOY revenues, EBITDA, PAT & EPS surging by 117%, 218%, 309% and 266% respectively

In this follow-up note, we break-down the latest earnings call (transcript) covering the company’s key achievements, growth drivers, potential hiccups and updated financial projections. Let’s dive in!

Material Changes / New Developments

1️⃣ Big Jump in Production Volumes

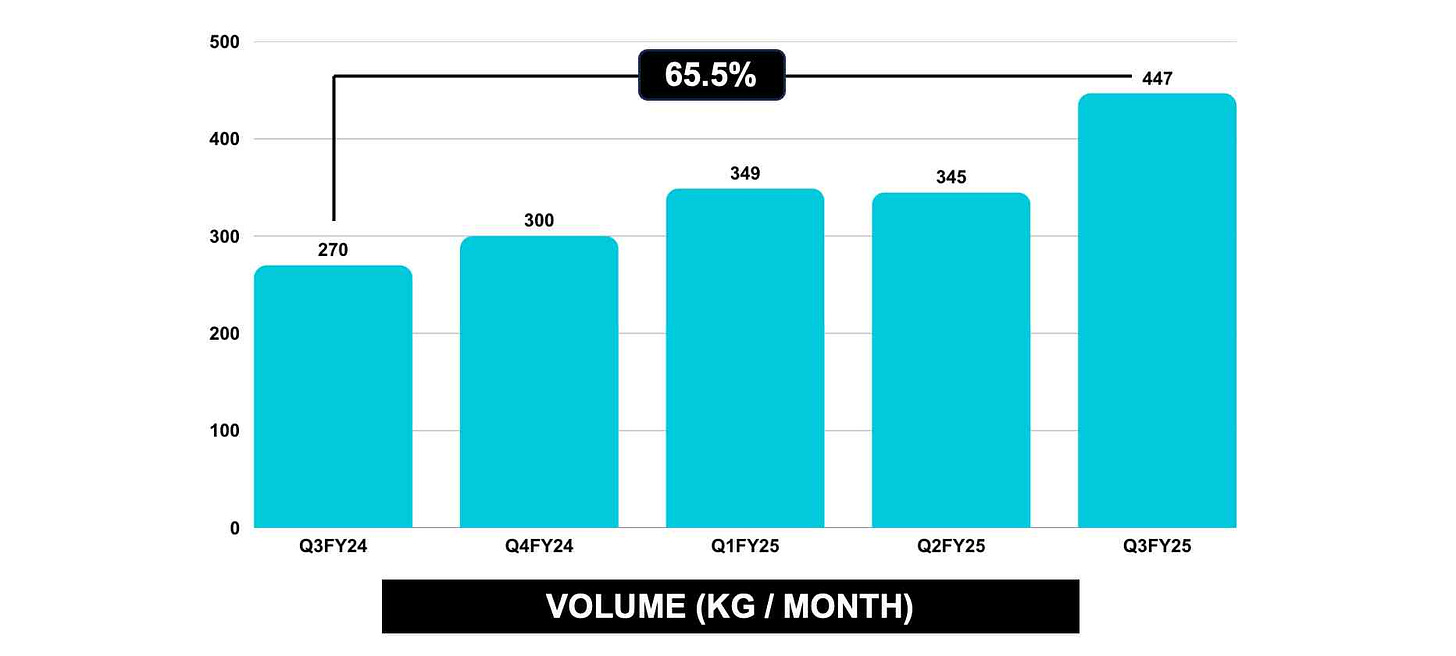

Sky Gold’s monthly production volume hit an all-time high of 447 kgs in Q3 – a significant jump over last year (270 kgs/month). Pleasantly, the company has ample capacity (1,050 kgs/month) to accommodate further growth in demand

2️⃣ New Clients & Stronger Partnerships

Sky Gold onboarded Aditya Birla Novel Jewels’ Indriya brand (news) with an initial trial order of 20 kilograms. By Q1FY26, deliveries are expected to scale to 50 kgs/month

The company has also deepened its ties with CaratLane and P.N. Gadgil (acquired in Q2, press release). Currently supplying 20 kgs/month to CaratLane, Sky Gold plans to increase this to 50 kgs/month by Q1 of the coming financial year

3️⃣ Diversification into New Jewellery Segments

Beyond 22-carat gold jewellery, the company’s revenue contribution from 18-carat gold went up from 3% last quarter to 5% in Q3

Sale of natural diamonds too have increased (400 carats in Q2 to 883 carats in Q3) and in a first, Sky Gold has also started lab-grown diamonds and has shipped some to Limelight Jewellery which has 25 stores

4️⃣ Modifications in Operating Model

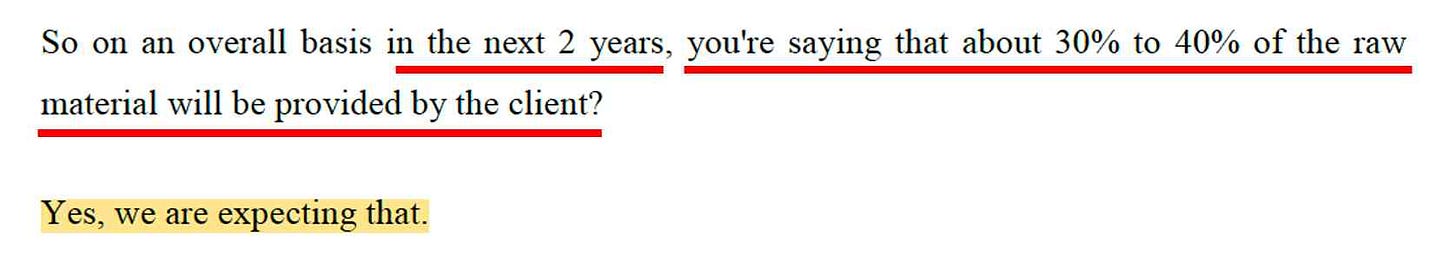

Historically, clients supplied the raw material (bullion) while Sky Gold handled design & manufacturing – charging the client a making fee

An alternative model is where the client provides only 50% from the bullion, with Sky Gold sourcing the rest of it. Over the next two years, major clients (like CaratLane, Aditya Birla etc.) are expected to transition to this model

This shift has implications on working capital, debt levels, inventory cost etc. which will become clearer in the coming quarters. I’ll keep you posted on this

5️⃣ Delays in Adoption of Gold Metal Loans

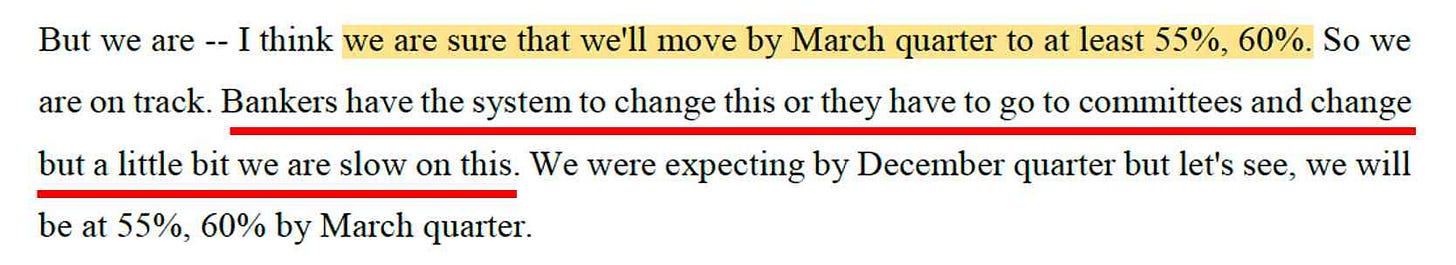

In Q1, Sky Gold had covered 10% of its requirement through GML. By Q2, this number had gone up to 20-25%.

However this stalled in Q3 due to bank delays and Karur Vysya Bank exiting the model. That said – ICICI Bank has sanctioned ₹100 crores of GML while SBI is still processing Sky Gold’s application

Sky Gold expects their GML coverage to be at 55-60% by March 2025. As noted in my original post, a 100% movement towards GML can boost PAT margins by 0.5%

6️⃣ QIP of ₹270 crores

In October 2024, Sky Gold raised ₹270 crores via QIP. This brought in institutional investors like Motilal Oswal MF, Kotak Mahindra Life Insurance and Bank of India (news)

This money has/is being towards working capital needs and for expanding 18-carat gold, natural diamonds, and lab-grown diamond segments

Revised Financials

1️⃣ Revenue

With 9MFY25 revenues at ₹2,490 crores, Sky Gold is well on track to achieve its FY25 target of ₹3,300 crores. They’re likely to exceed it, with Q4 doing even better than Q3 per the management

👉 Notably, the company has upped it’s FY27 guidance from ₹6,300 crores to ₹7,200 crores

At current prices, this equates to 900 kgs/month in deliveries in FY27 – double of what it achieved in Q3FY25 (447 kgs/month)

The revised target is fueled by aggressive expansion by key clients like Kalyan (news), Malabar (news), Thangamayil (news), Caratlane (interview), Indriya (news) etc.

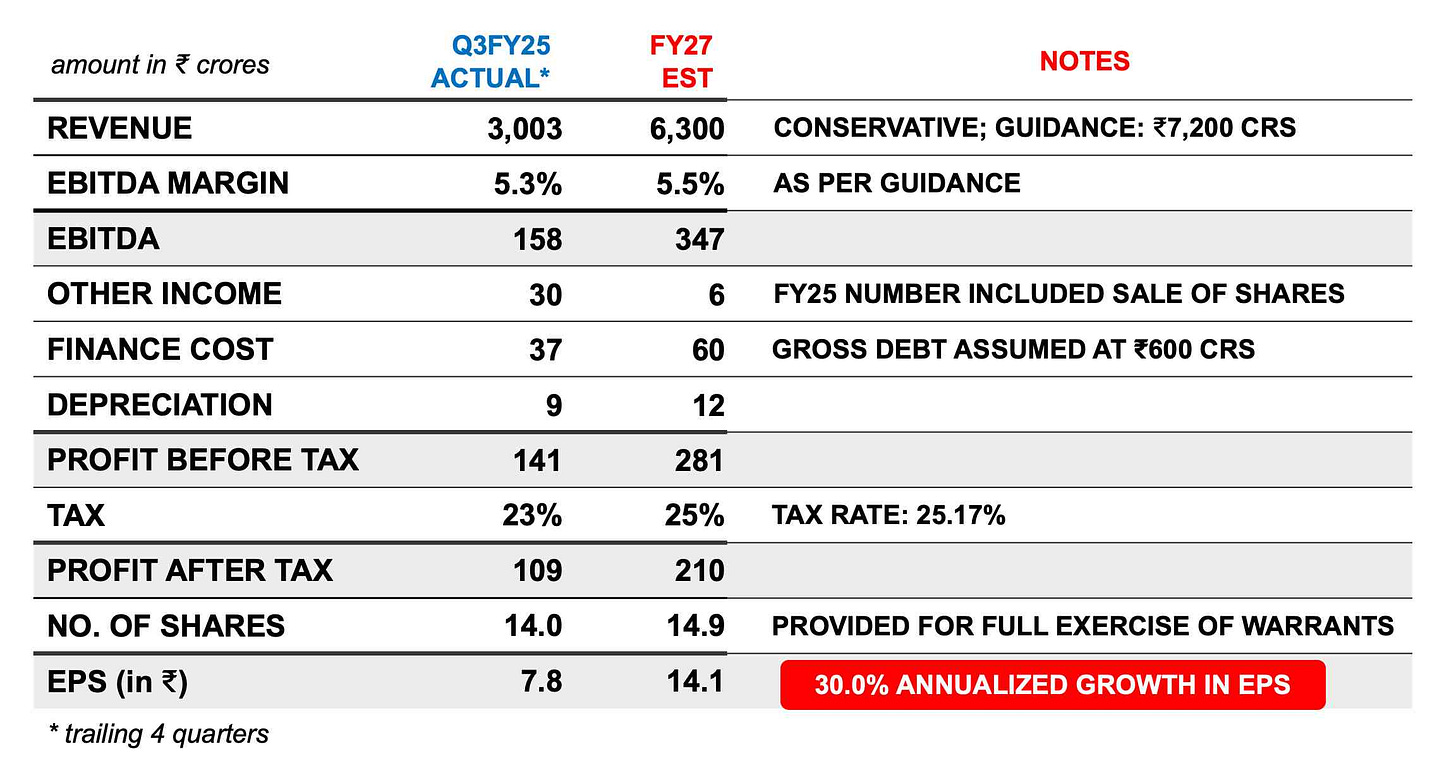

👉 On my part, I’m taking a conservative approach, maintaining my FY27 revenue estimate at ₹6,300 crores – the management’s previous guidance

2️⃣ Margin

For FY27, the management projects a gross margin of 7%, EBITDA margin of 5.5% and PAT margin of 3.5%

9MFY25 margins are already close at 7.3%, 5.4%, and 3.8% respectively

A couple factors that lends support to these estimates:

1. Sky Gold eventually moving to 100% GML is expected to lift PAT margins by 0.5%

2. Increased use of advanced technologies will reduce manpower costs improving EBITDA margin

3️⃣ Projection

👉 Given these assumptions – FY27 EPS is projected to grow 30%

Please note: I’ve applied a 12.5% discount to revenue estimates vs management’s ₹7,200 crore projection

Investing is a continuous process of learning, analyzing & refining decisions. A lifelong task, skill, passion & an ever-evolving pursuit!

That’s why I’m launching ALPHA — a paid community where like-minded members come together to discuss opportunities, share insights & grow wealth collectively. Unlike a course/workshop, Alpha is a semi-structured space featuring original research, webinars, discussions, expert talk & member-driven participation

It’s my most ambitious project yet — one that I’m deeply passionate about & fully committed to. Tap the link below to learn more, and if it feels like the right fit, I’d love to have you join us! 🤗

Revised Valuations

At its current share price of ₹333 (as on 27.02.2025), Sky Gold trades at a trailing PE of 42.6

As always, I’ve mapped future EPS projections across different PE bands to estimate a potential price range

At a PE of 35, Sky Gold implies an annualized stock price return of 20.8%. That said, I do encourage you to assess where the PE multiple might realistically settle based on your research

My Viewpoint

Sky Gold is riding strong sectoral tailwinds – for now

The shift from unorganized to organized retail is accelerating with FY26 expected to see significant growth and store expansion (read, read). According to a recent Deloitte report (PDF), the Indian jewellery sector – valued at $80 billion in FY24 – is projected to reach $225-245 billion by FY35

Jewellery chains are scaling up aggressively to meet growing demand, driven by factors like reduced gold import duties, increased rural demand (thanks to good monsoons) and a packed wedding season

More showrooms mean more business for manufacturers like Sky Gold, which is reflected in its raised revenue guidance of ₹7,200 crores for FY27. This estimate does not account for potential tie-ups with giants like Reliance and Tanishq – if those come through, the numbers could see another major jump

Overall, I’ll say – Sky Gold has several strong factors working in its favour. I’ll encourage you to do a second round of research and form your own view on its long-term prospects

As always, I look forward to hearing from you 📢

Much love,

Shankar

Hello Shankar

Great analysis! Sky Gold has a lot of potential, especially with the way they’re bringing big players on board and the strong demand for gold. Fundamentals look solid, and at the moment, there seem to be no major headwinds ahead.

My only concern, from a technical perspective, it’s interesting to see that Sky Gold seems to be forming head and shoulders pattern while holding the 310 support level. If this support breaks, the next key level to watch would be around 240. It might be worth waiting to see how the stock behaves in the coming weeks before making a move. If you like it at 310, you’ll love it at 240!

Just my thoughts—really appreciate your work and always look forward to your insights.

Regards

Kuldeep Brar

Thank you so much sir! It is an amazing analysis it helps alot to me. 🙏🙏🙏