Today’s Special: Fish, Manchurian & a 32% Yield

Welcome to Issue #004. In this issue, I'll present 2 investing ideas -- 1) a case for investing in Chinese stocks as a contrarian strategy & 2) the dividend fishing opportunity at Aster DM Healthcare

Story 1 of 2 (Reading time: 4 mins)

🍱 Value Meal of the Day : Pickin’ Manchurian

John Templeton famously said - “The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell”

In today’s context that’s China and India - the world’s cheapest and most expensive capital market

Not a day goes by without one hearing something negative about the Chinese economy — stalling GDP growth, falling exports, property bubble, ageing population, China+1, FDI outflow and ofcourse, geopolitics

Side Note: In a recent twitter post, I presented an Unexplored Connection between the Ottoman Empire & India's Colonial Era. Something similar is being played out today and US’s attempt of taking China out of the global supply chain is backfiring

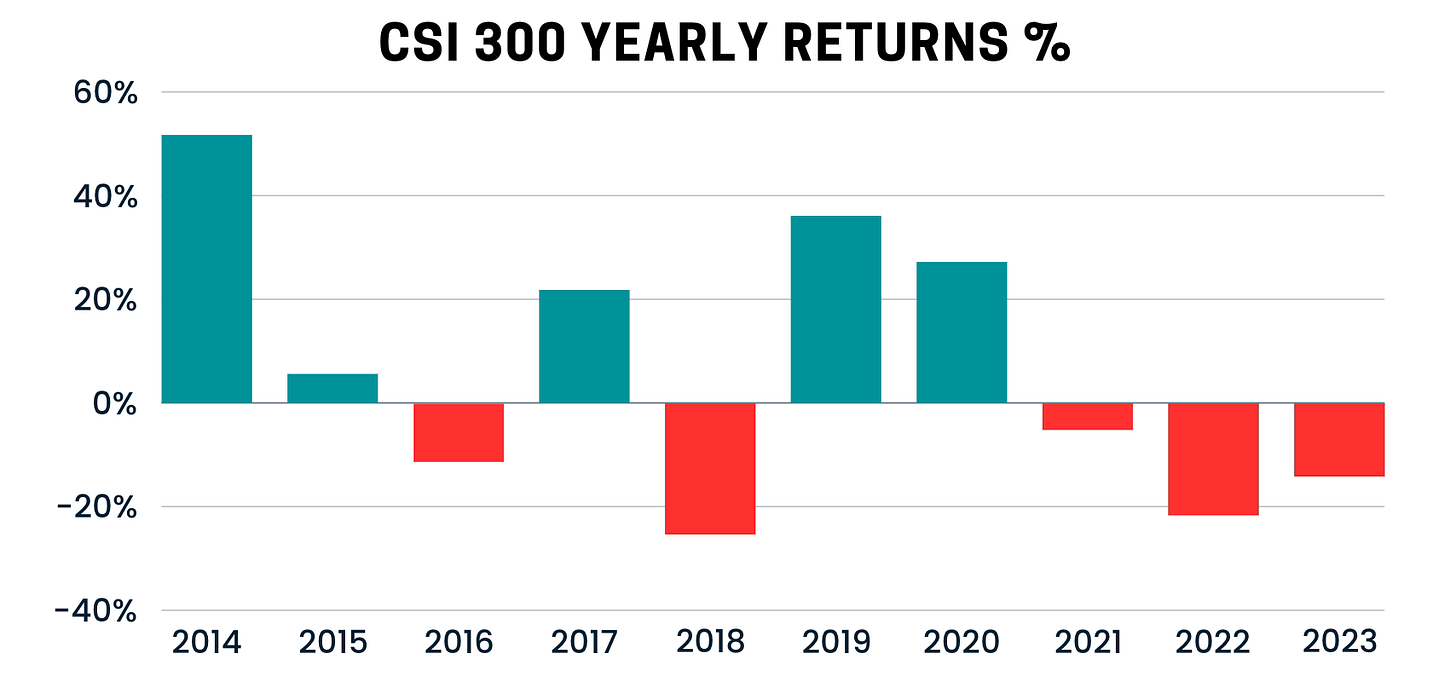

In just three years, Chinese equity went from being fund managers’ favourite to one of the most unloved markets - losing a little over 40% in market capitalisation

As a consequence, valuations have sunk to historic lows and as of Dec 2023, the Chinese markets are at a price earning multiple of less than 10

In numbers, not only is the current PE ratio 30% below its 5-year average but comparatively, China is trading at half-price to the US & India market

Clearly there are factors behind this valuation difference but this sort of gap has never been seen in the last 15 years

But now there’s a growing feeling that if China’s long-term growth remains intact, this is a once-in-a-generation opportunity to buy quality Chinese stocks with good earnings prospects at bargain prices

The rest of this article is an attempt at identifying those rays of sunshine

#1. Earnings Growth - While stock prices have declined in recent times, profits posted by Chinese companies have shown promising growth with a 14.5% rise in 2023

Per a Reuters analysis of 1,721 mid & large companies, Chinese firms are on track for their strongest earnings expansion in seven years with a 16% rise in profits in 2024 (article)

#2. GDP Growth - Beijing has set a GDP target of 5% for 2023 with an increasing focus on “high quality growth” (news)

The signs are definitely positive —- China’s Q3 GDP surpassed expectations, imports are rising, so is domestic demand, highway traffic is up, fuel demand is higher & so are retail sales

In an extremely rare move, China lifted its 2023 budget deficit from 3% of GDP to 3.8% to account for a rise in central government debt to fund infrastructure projects & supporting growth (news)

#3. High Quality Growth

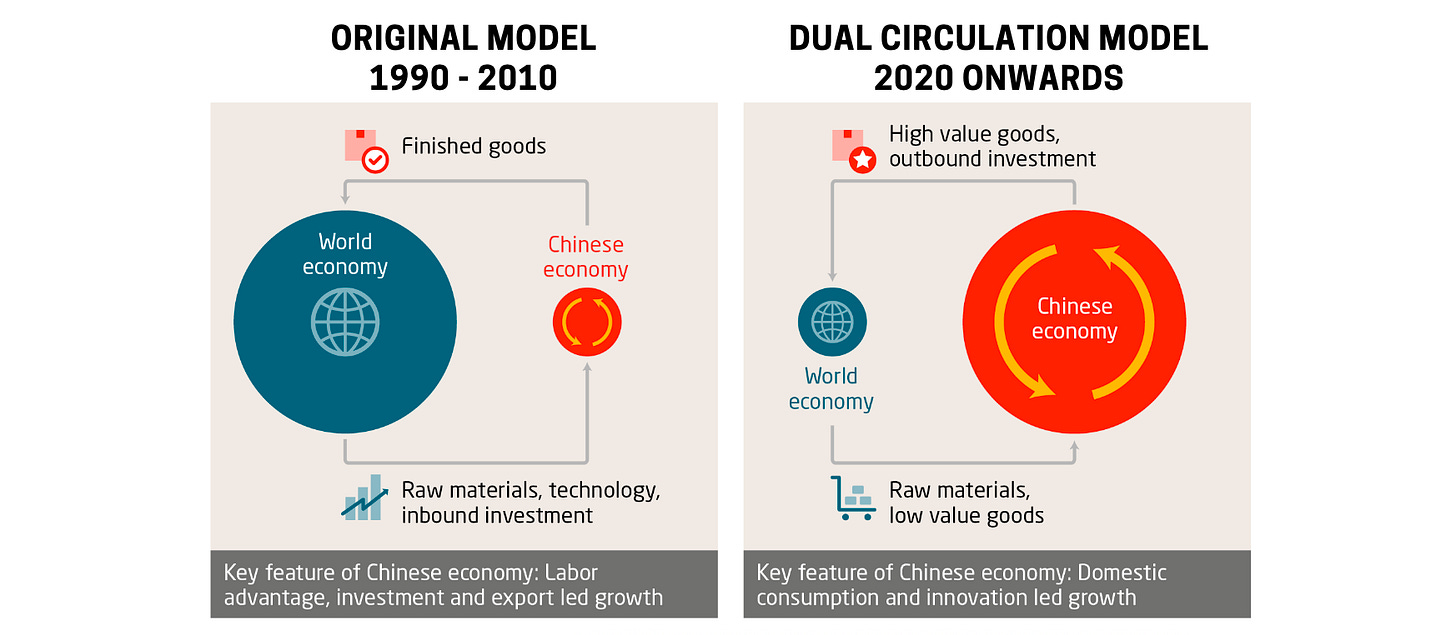

For many years, a “made in China” tag was associated with smartphones, consumer electronics, toys, apparels, furniture, plastics, machinery, auto parts & metal products

Most of them were low value-added products — basically 1-to-N applications

But lately, we haven’t been talking about those much

The discussion has shifted to renewable energy, batteries, artificial intelligence, semiconductors, biotechnology, 5G, robotics, advanced materials science, urban development, satellite technology etc.

Often called “new infrastructure”, these zero-to-one breakthroughs are China’s future growth pockets – and the government there is keen on pursuing it even at the expense of accepting a lower level of growth (and hence a 5% GDP growth target)

#4. End of Global Destocking Cycle

You might have heard the term “destocking” on earnings call of many Indian companies who have clients in the US, Europe, Brazil etc. are destocking.

A destocking cycle simply means a business is reducing inventory levels & as a consequence, is not ordering new supplies

Destocking happens every few years and China bore the brunt of that over the past 2 years. But as the cycle ends (which is happening now), demand will be back which means Chinese companies will invest, hire and grow again

#5. Increase in Consumer Spending

Covid taught some bad habits and in China’s case - households there learnt to live, without needing to spend much

Consumer spending is still 80-90% of pre-Covid levels but it’s rising, with the first 3 quarters of 2023 showing a 6.8% growth over last year (news)

Travel & tourism spends have improved, so have box-office revenues and restaurant spends. But for China to completely recover, domestic consumption has to go up and this is one metric every investor should keenly follow

#6. The Third Plenum

And finally, how the Chinese stock market behaves in 2024 in part depends on policy decisions taken at the Third Plenum of the 20th Central Committee of the Chinese Communist Party

What’s that? Well, it’s a meeting held once every five years focussing on the longer-term aspects of the economy, especially those related to economic development and reforms

This meeting should’ve happened last month in December so it can take place anytime now. When it happens, every analyst will have his eyes and ears open analysing every line of its commentary

👉 This was a long post (sorry about that) but my viewpoint is – there is a serious under-appreciation of China’s long-term policy that is contributing to overly negative narrative

To recap, this has led to a position where :

Chinese stocks are at its cheapest at a PE multiple of 10

There is visibility on company earnings with a 16% growth expectation

Real-world numbers are improving across the board

The cumulative effect of China’s policy response can add up to a lot

The red dot is where we stand presently ..

.. and history tells us that the best time to invest is when investors feel the most uncomfortable

Most definitely a contrarian bet!

If you like found this article informative & useful, do forward it to your whatsapp groups and encourage them to subscribe. Thanks for your support!

Story 2 of 2 (Reading time: 2.5 mins)

🐟 Let’s Go (dividend) Fishing with Aster DM

On the 28th of November, Aster DM Healthcare Limited announced the sale of its GCC business for $1.01 billion (news)

The sale is expected to be completed in the next three months with a net cash influx of approx. ₹7,500 crores after accounting for a reasonable transaction cost of $18-20 million

Understandably, the big question is — what does the management plan to do with all this money?

To which Alisha Moopen, the deputy MD replied: “part amount of the proceeds will be distributed as dividend, subject to approvals .. and balance proceeds will be retained as reserves for contingent liabilities and to pursue inorganic growth opportunities”

While this seems like a boilerplate reply, a further analysis of the latest earnings call (transcript) seems to hold the answers. Here are some relevant excerpts:

1. Aster DM has not paid any dividend to its equity shareholders since 2015. And now that there’s an opportunity to reward them, the Chairman & MD Dr. Azad Moopen wants to take full advantage of it

2. Per the GCC transaction terms, Aster DM’s promoters shall hold 35% of the business which means they’ll need to infuse capital into the new holding company

In that context, receiving a substantial dividend payout is in the promoter’s interest as it’ll help them finance their 35% stake in the Gulf entity

3. The management is confident of the Board agreeing to a high dividend payout given the company’s strong financial position wherein:

a) Internal accruals are sufficient to fund 3 years of Capex (₹850 crores; +1450 beds)

b) Majority of debt in the consolidated balance sheet is GCC specific. India business’s net debt (excl. lease liabilities) is just 1.3x of EBITDA

c) ROCE is now a respectable 20.1%

d) EBITDA margin stands at 19.4%

e) ARPOB is growing at 9-10% per annum

👉 All right. All right. So how much dividend is expected?

Well, the final number is anyone’s guess (and the Board needs to approve it) but with ₹7,500 crores coming in and assuming ₹1,000 crores for inorganic expansion, debt reduction etc. – there’s potentially ₹6,500 crores in the dividend pot

At 50 crores equity shares, we’re looking at ₹130 per share in dividends

And at a current market price of ₹401, this comes to a dividend yield of 32%

Now, Chandler might not share my enthusiasm but signs of a healthy dividend payout are truly there — the push from promoters & a growing/healthy business

However remember, this is a divestiture with the India business of Aster DM Healthcare going it’s own way. Which means mathematically, the current market cap of ₹20,000 crores will temper down to ₹11,800 (after removing GCC valuation of $1.01 billion or ₹8,200 crores) — so I can’t really use the term “dividend yield” here

But here’s my point — a catalyst has now been invoked in the case of Aster DM.

The big but slow GCC business (growth rate of 5-6%) was pushing down valuations for the entire company — so it’s good riddance there. The management can now focus on the high-growth India business and investors should treat this more as a special situation

As next steps, existing or potential investors will need to evaluate an India-centred Aster DM Healthcare independently for sales, growth, margins, competition, leverage, occupancy, capex and much more

I’ll do the same myself and to help out, here, here and here are some useful resources

Evaluating a hospital stock requires an understanding of ARPOB, ALOS, occupancy rate, payor mix, maturity and much more. Pleasantly, I have a Youtube video on the Hospital Sector which is amongst my favourites & I’m certain you’ll learn a lot from it

This story has been written in collaboration with Beat the Street which is run by two talented Chartered Accountants - Nimish Maheshwari and Sudarshan Bhandari

Nice one, right? If you know anyone who would love to receive similar stories, please encourage them to subscribe to my newsletter. Thanks for your support!

Turning Twitterati

So I’ve shed my prior inhibitions and am writing actively on X (previously Twitter) now. I try for 2-3 posts a day and have garnered 2,000+ new followers in the last 3 weeks

Check out these pieces from last week:

► A thread examining why Bitcoin delivered 173% returns in 2023 & what to expect from it in 2024

► A post on why wine tastings are crucial to Sula Vineyard’s sales & growth

Wishing you a pleasant week ahead,

Shankar

Great to see your perspective on China Investing 🙌

What are the possible investment options that are available to Indian investors?

Would Edelweiss Greater China Equity Off-shore Fund would suffice ?

Please share your investment option on this matter 😊

Hi Shankar. Great post as always! China seems intriguing

I was not aware of the AsterDM transaction, so I did some research. Here are my findings:

https://open.substack.com/pub/eternalcompounder/p/opportunity-of-a-lifetime?r=2fs90b&utm_campaign=post&utm_medium=web&showWelcome=true