HPL Electric & Power: Plugged Into India’s ₹70,000 Crore Smart Meter Opportunity

Issue #023 explores HPL Electric & Power - a leading player in smart meters. We delve into business model, orderbook, capacity, revenue, margin & strategy to benefit from India’s electrification boom

Put simply, a “tailwind” is wind that blows in the same direction as an object’s movement. For example, tailwinds help an aircraft fly faster – saving airlines both time and fuel costs

In business, tailwinds can be:

▸ Policy-driven – Atmanirbhar Bharat (defence), net zero commitments (renewable energy)

▸ Structural – shift to organized retail (jewellery), financialization of savings (wealth management)

▸ Behavioural – convenience over price (quick commerce), premiumization (car, real estate, smartphones)

In the stock market, spotting these tailwinds early can be a game-changer

HPL Electric & Power Limited

HPL Electric & Power manufactures a wide range of low-voltage electrical products – smart meters, switchgears, LED lights, wires, fans and more

The company operates 7 production facilities and 2 R&D centres. It has a robust distribution network spanning 90+ branch offices, reaching over 83,000 retailers nationwide

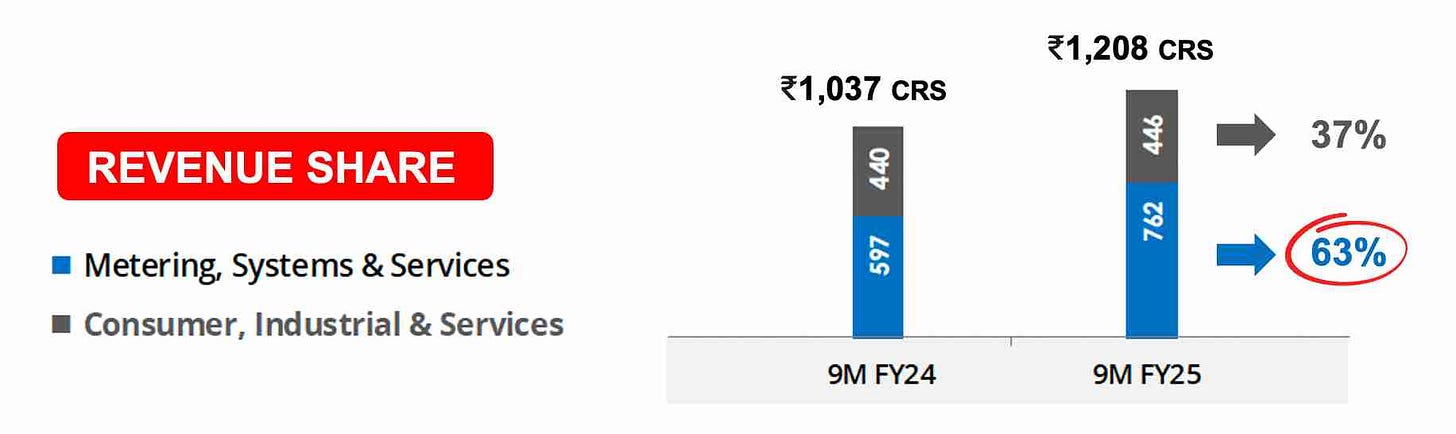

A large portion of HPL’s revenue comes from their metering systems business where it has a ~20% market share in India

India’s Smart Meter Revolution

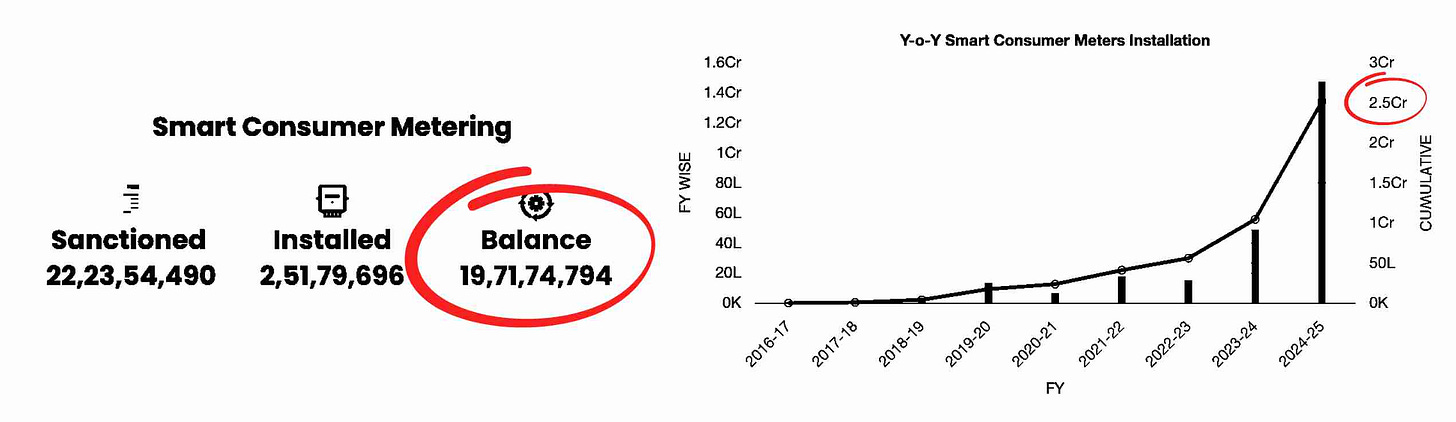

In July 2021, the government launched the Smart Meter National Programme with an ambitious target of installing 25 crore smart meters by March 2026

It’s core objective is to improve the financial & operational efficiency of India’s power distribution companies (discoms) and to bring down commercial losses to 12-15% (report)

Until now, only 2.5 crore smart meters had been installed – just 10% of target (status). While the pace has picked up & ~80,000 smart meters are being installed everyday, the scheme is likely to be extended until March 2028

In numbers, 25 crore smart meters translates to a massive opportunity worth ₹70,000-80,000 crores. A large portion of this is up for grabs, with key players like HPL Electric, Genus Power, Tata Power, Adani Energy & others competing for a meaningful share

Earning Triggers for HPL

1️⃣ Order Book

HPL’s current order book stands at ₹3,400 crores (as of Feb 10, 2025) giving it strong visibility for atleast the next two years. This translates to a revenue growth of 25-30%

Meanwhile, the company continues to receive incremental business – like a fresh order it bagged in March 2025 worth ₹370 crores (exchange filing). While details were not disclosed, it’s likely this came from an AMISP

AMISP stands for Advanced Metering Infrastructure Service Provider. These are private entities that manage end-to-end smart meter rollout – financing, procurement, installation, operation & maintenance. This allows discoms to upgrade their network without heavy upfront investments. AMISPs typically outsource the hardware (meters) to manufacturers like HPL Electric

Infact, HPL doesn’t bid for smart meter tenders directly – it instead supplies to multiple AMISPs giving itself flexibility & scalability. But this model isn’t without friction and in Q3FY25, implementation delays & postponements by certain AMISPs led to a revenue shortfall of ₹40-50 crores

This kind of volatility — erratic inflows and staggered shipments — is likely to continue. That said, the macro trend is strong and AMISP project awards are expected to grow at a 30-40% CAGR over the next 2-3 years. This builds long-term confidence in HPL’s revenue outlook

2️⃣ Capacity

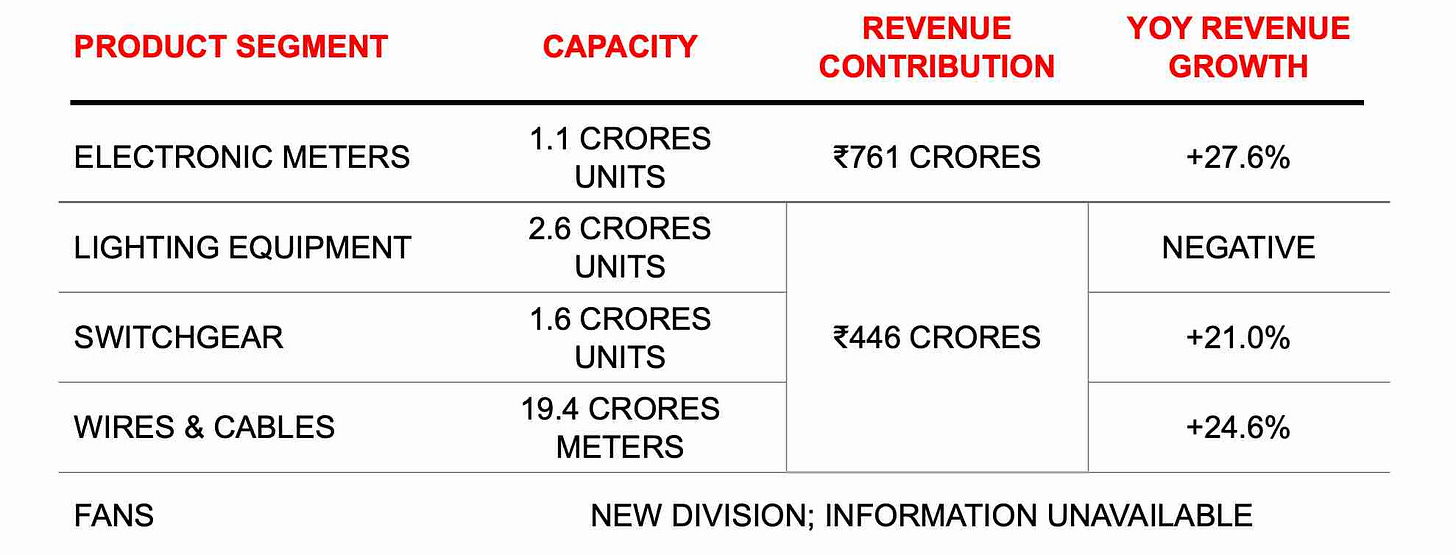

Over the past two years, HPL has invested significantly in smart meter production and its annual manufacturing capacity stands at 1.1 crore meters

This is sufficient to meet demand for the next 12-15 months. The current utilisation is 70-80% but by running extra shifts, this can be increased to 100%. The management expects peak volumes in Q1 or Q2 of FY26

Beyond smart meters, HPL has also expanded capacity across other verticals – including lighting products, switchgears, fans, wires & cables – positioning itself well for broad-based growth

3️⃣ Margins

As of 9MFY25, HPL reported a blended EBITDA margin of 14.3%

Segment-wise:

Smart meters : ~16% margin (management says it’s sustainable in the near future)

Consumer & Industrial : 10-11% margin (scope to improve by 100 bps as volume scales & costs stabilize)

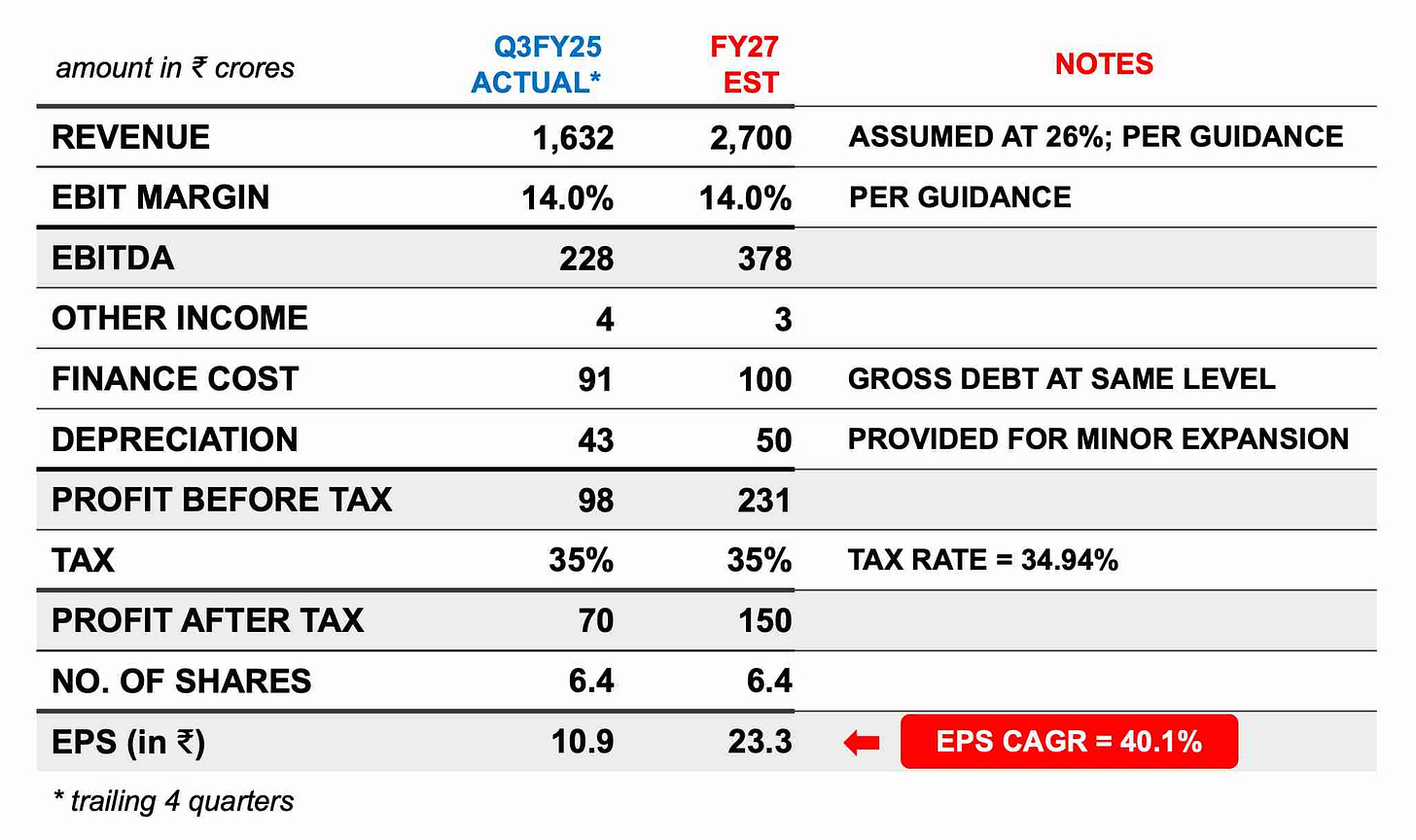

Financials

Over the years, HPL Electric has delivered a consistent financial performance – with steady revenue growth, healthy margins and a sharp uptick in EPS

Looking ahead, most of the company’s growth projections are anchored in the smart meter segment, where HPL already has — 1. Capacity (1.1 crore units), 2. Order book visibility (₹3,000+ crores) and 3. Confidence in revenue growth (25-30%)

My estimate puts FY27 EPS at ₹23.3 — a solid 40% annualized growth over its current TTM EPS

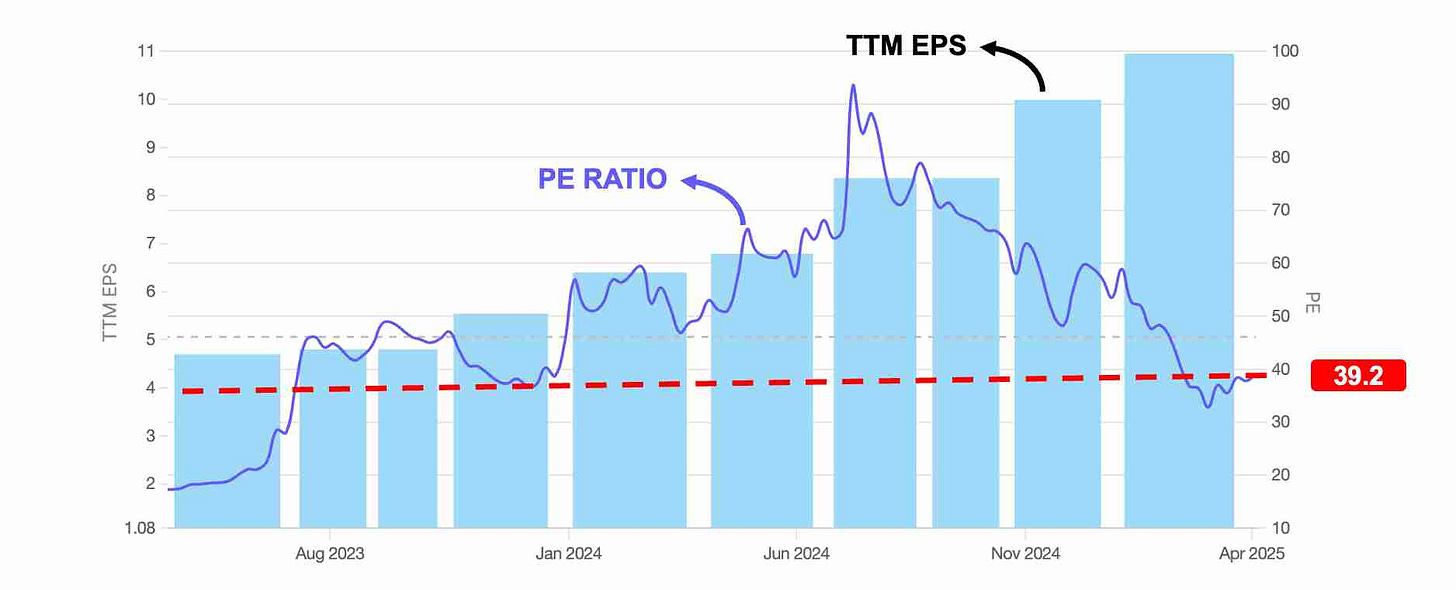

Valuations

HPL currently trades at a PE of 39.2 – a level it has consistently held since July 2023

For comparison, Genus Power – its closest peer – is also trading around the same range, at a PE ratio of 42.6

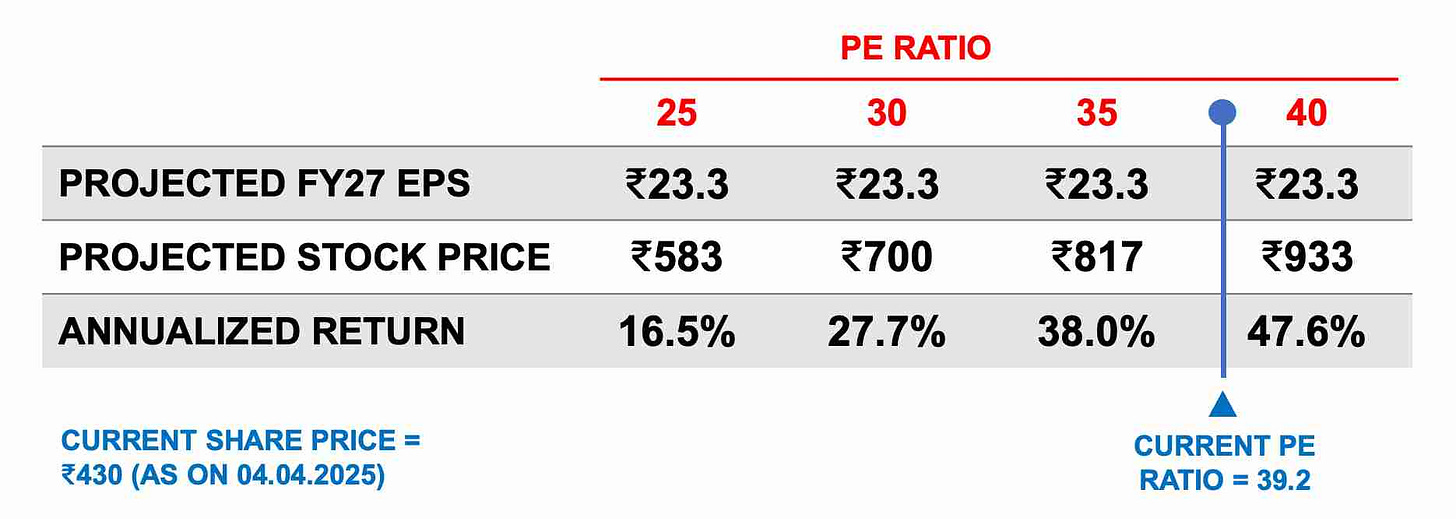

Now, trying to assign a “fair” multiple to a sunrise industry is tricky, therefore I’ve modelled a range of possible PE multiples & their corresponding stock prices

Pleasantly, even if valuations cool down to a PE of 30, the stock could still hit ₹700 per my estimations – translating to a 38% annualized return from current levels

Other Considerations

▸ Scaling up the Consumer & Industrial Business

While smart meters are in the spotlight, HPL’s other verticals namely switchgears and wires & cables are making quiet progress growing YOY by 21.0% and 24.6% respectively in 9MFY25. However, the lighting segment continues to drag down overall growth

The company is actively diversifying and recently launched BLDC & star-rated fans across three states with plans to reach 40% of the market by July 2025

This expansion is backed by a sharply scaled distribution network – from 45,000 retailers in 2023 to 83,000+ retailers today

▸ Rising Competition – But There’s Room

A ₹70,000 crore opportunity in smart metering was bound to attract attention

Big players like Tata Power and Adani Energy Solution have entered the space, even setting up in-house manufacturing. Other listed companies like Keynes & Salzer Electronics have also jumped in

Despite this, HPL isn’t worried. The company is sticking to its strengths – efficient execution and supply partnerships with AMISPs. Plus, it expects margins to remain stable (~16%) & is also exploring export markets to widen its footprint

My Viewpoint

To sum up, HPL Electric has a few key levers working in its favour –

1️⃣ Wide runway with 22.5 crore smart meters yet to be installed over the next 3-4 years

2️⃣ Existing order book of ₹3,000+ crores – 2.5 times of current metering revenue

3️⃣ Product expansion beyond meters with a rising share in switchgears, wires & cables and fans (HPL expects C&I revenue contribution to reach 50% in few years)

4️⃣ Distribution footprint expected to hit 1,00,000 retailers by June 2025

5️⃣ Stable margins – blended EBITDA at 14%

6️⃣ Valuation comfort – operating at FY27 forward PE of 18.8

On the risk side, the working capital cycle is long at 265 days (Q2FY25). This number is expected to reduce as HPL works more with AMISPs (who pay faster than discoms) and tightens its inventory cycles. However, a delays at AMISP’s end could lead to inventory build-up, putting short term strain on cash flows

▸ In addition to the financials, my reason for highlighting HPL Electric was to reinforce a larger point:

When you catch a tailwind early – especially in a segment with massive policy push and rising adoption – the upside can be strong and meaningful

As always, I look forward to hearing your views on it 📢

Much love,

Shankar

While analyzing HPL Electric, one aspect that had both Priyam & me a bit puzzled was the lack of client-specific disclosures in their exchange filings

Nowhere did the company mention who was awarding them those smart meter contracts — be it DISCOMs, electricity boards, AMISPs or private players

To get clarity, Priyam reached out to the company's Investor Relations team. After a gentle follow-up, here’s the response we received:

Dear Priyam,

Thank you for your patience and your keen interest in HPL Electric & Power and for your detailed research on the industry and our company’s performance.

As a policy, we maintain confidentiality regarding specific contract details, including the sources of our order inflows. However, we can share that we work with leading AMISPs and continue to secure contracts across key market segments. Any marquee contracts will be duly communicated to stakeholders through appropriate disclosures.

In the meantime, we encourage you to review publicly available information, including our exchange filings and investor communications, for updates on our business progress

----

Lesson: when in doubt, write to the company's Investor Relations

Great article Shankar & Priyam. Given your analysis this seems like a potential multibagger esp if they bag more orders for the remaing 22cr units.

Few questions:

1. Target 700 at 30 PE would indicate 27% CAGR right as per your table, not 38%. Typo?

2. FII & DII holding is <1% in HPL at this time. Any reason why? As a high potential small cap wouldn't this be on every AMCs smallcap fund radar? Perhaps that might change if they are subbed to you :)

3. Any indication if HPL is going to increase meter production capacity to bag higher share of the 22cr pending units? If not then wouldn't Tata or Adani grab the lion share?

Thanks and you guys rock!