Capacit'e Infraprojects: The ₹10,000 Crore Urbanization Bet You Can’t Ignore

Issue #022 delves into high-rising Capacit'e Infraprojects as we analyze its strong order book, revenue trajectory, margins, risk management, financials, clientele and urbanization driven growth story

Capacit’e Infraprojects Limited

Founded in 2012, Capacit'e Infraprojects specializes in the construction of high-rise buildings, commercial complexes & institutional structures

With 60+ projects successfully delivered to leading real estate developers and government bodies, Capacit’e has built a prestigious client portfolio including the likes of Oberoi Realty, Godrej, Prestige, Lodha, DLF, Brigade, MHADA, CIDCO, PWD, BMC, BSNL, GIFT City etc.

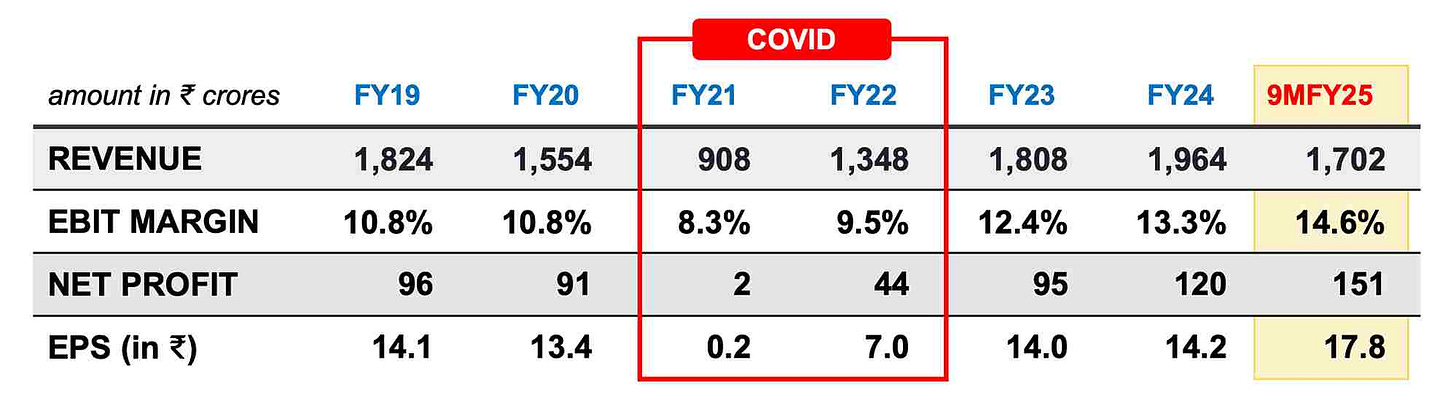

It wasn’t smooth sailing though. The COVID years (2020-21) were particularly challenging — not just denting revenue, margins and profits but also exposing the company to delayed payments, litigations, write-offs & strategic missteps

Since then, Capacit’e has bounced back, learning some key lessons & making key strategic shifts like:

1️⃣ Diversified orderbook – In FY18, majority of projects came from private developers. Today 76% of its order book is government-funded, ensuring better payment security

2️⃣ Selective private sector partnerships – Capacit’e only engages with financially strong developers backed by funding, solid balance sheets and/or NBFC approvals

3️⃣ Stronger risk management – Implemented an aggressive provisioning policy with ₹180+ crores allocated to Expected Credit Losses (ECL)

4️⃣ Proactive collections – To recover dues, Capacit’e is actively pursuing litigation (Feb 2025 list), arbitration and even accepting properties in lieu of cash settlements

We’ll dive deeper into these strategies later in this post

Show Me The Money 💰

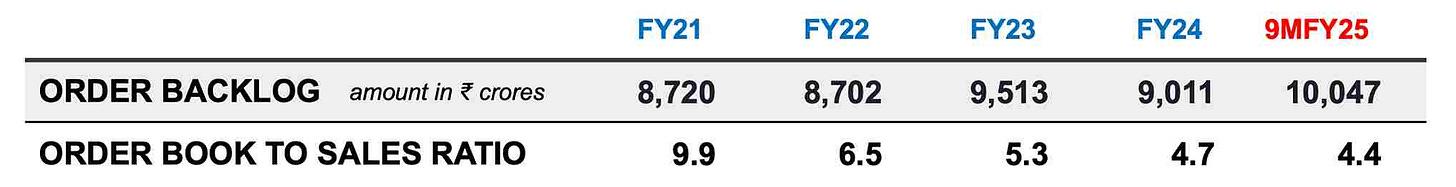

A robust order book is a strong indicator of future cash flows

Capacit’e has been consistently upping this number and has secured ₹10,047 crores worth of projects as of December 2024

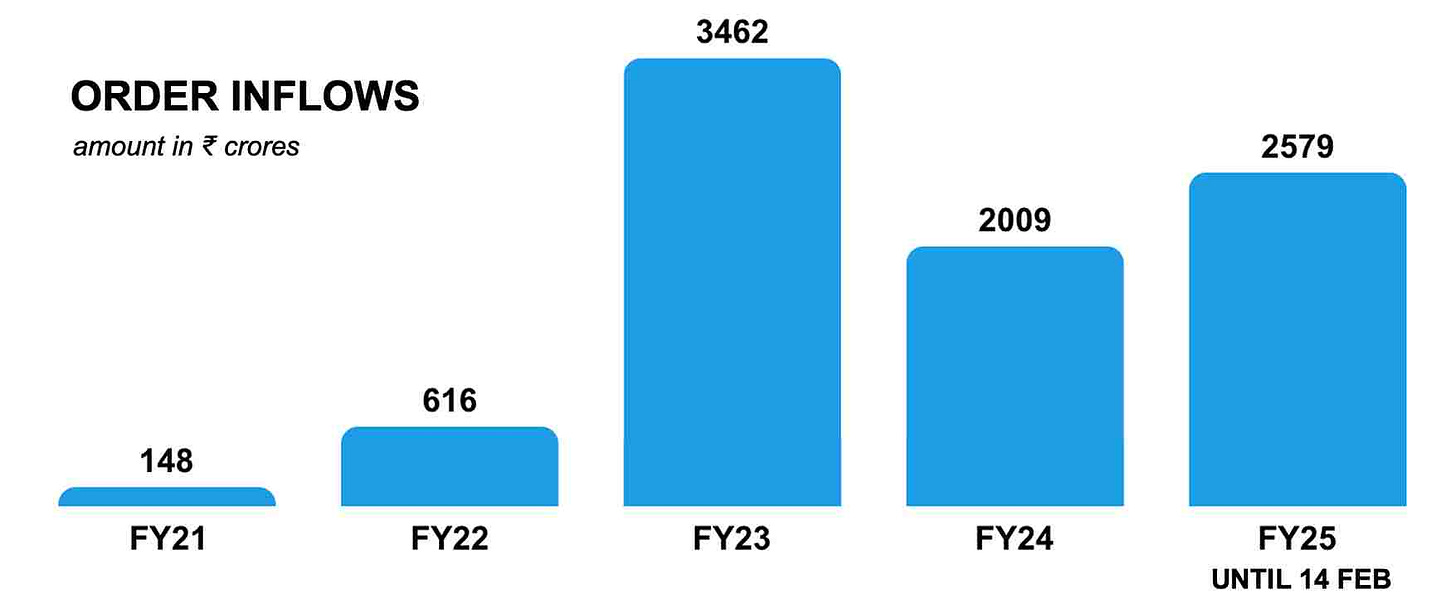

For FY25, new order inflow stand at ₹2,579 crores (as of Feb 14, 2025). This includes the recent project from NBCC (exchange filing)

Additionally, the company is the L1 bidder for projects worth ₹600 crores and is confident of exceeding its FY25 order inflow target of ₹3,000 crores – excluding MHADA additions

Of the many projects in play, the ones awarded by MHADA & CIDCO are sizeable & crucial for the company. A quick word:

👉 MHADA: In 2018, a consortium of three firms – Capacit’e, Tata Projects & CITIC Constructions – bagged the ₹11,744 crore contract for redevelopment of BDD Chawls in Worli, Mumbai (news)

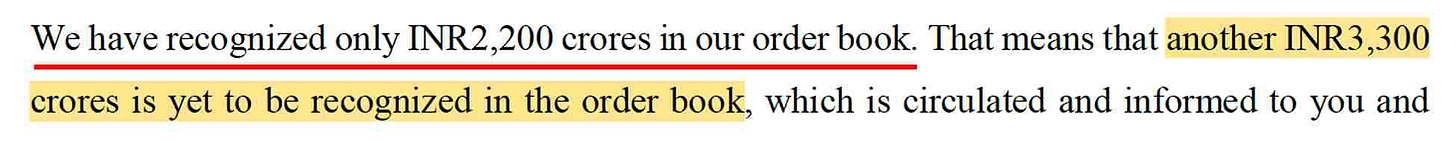

Capacit’e share in the JV (37.1%) stands at ₹4,357 crores, with additional orders taking its total executable book to ~₹5,500 crores

Of this, ₹3,300 crores is yet to be recognized. The management expects this in this quarter or Q1FY26 as more land is made available for the project

👉 CIDCO: Similarly, a ₹4,502 crore project awarded to Capacit’e in 2018 (news) saw initial delays but is now revenue-generating

Out of ₹2,400 crores of available land, nearly ₹1,200-1,300 crores is yet to be billed. The project is ongoing & is expected to be completed by March 2026

Net net, with a strong bid pipeline and pending realizations – the order book position is in good shape as the management targets ₹4,000 crores in fresh orders for FY26 🚀

Turning Order Book into Revenue 🔁

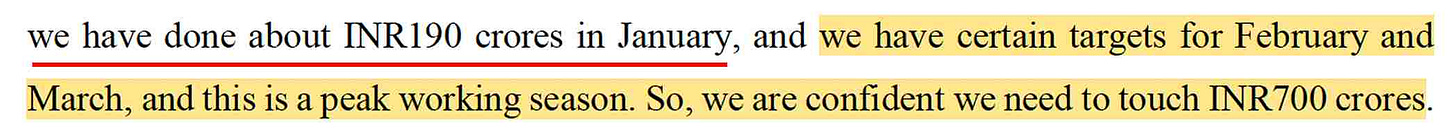

👉 Capacit’e has set a revenue target of ₹2,400 crores for FY25, reflecting a 25% growth over the previous year

With ₹1,892 crores of sales booked in the first 10 months — the company needs to generate a further ₹508 crores over two months i.e. February & March

While the management is confident to doing it, I have my doubts

Factoring in some billing acceleration & an estimated ₹20 crores p.m. from Signature Global in Q4, my FY25 sales estimate stands at ₹2,320 crores – a shortfall of ₹80 crores from management guidance!

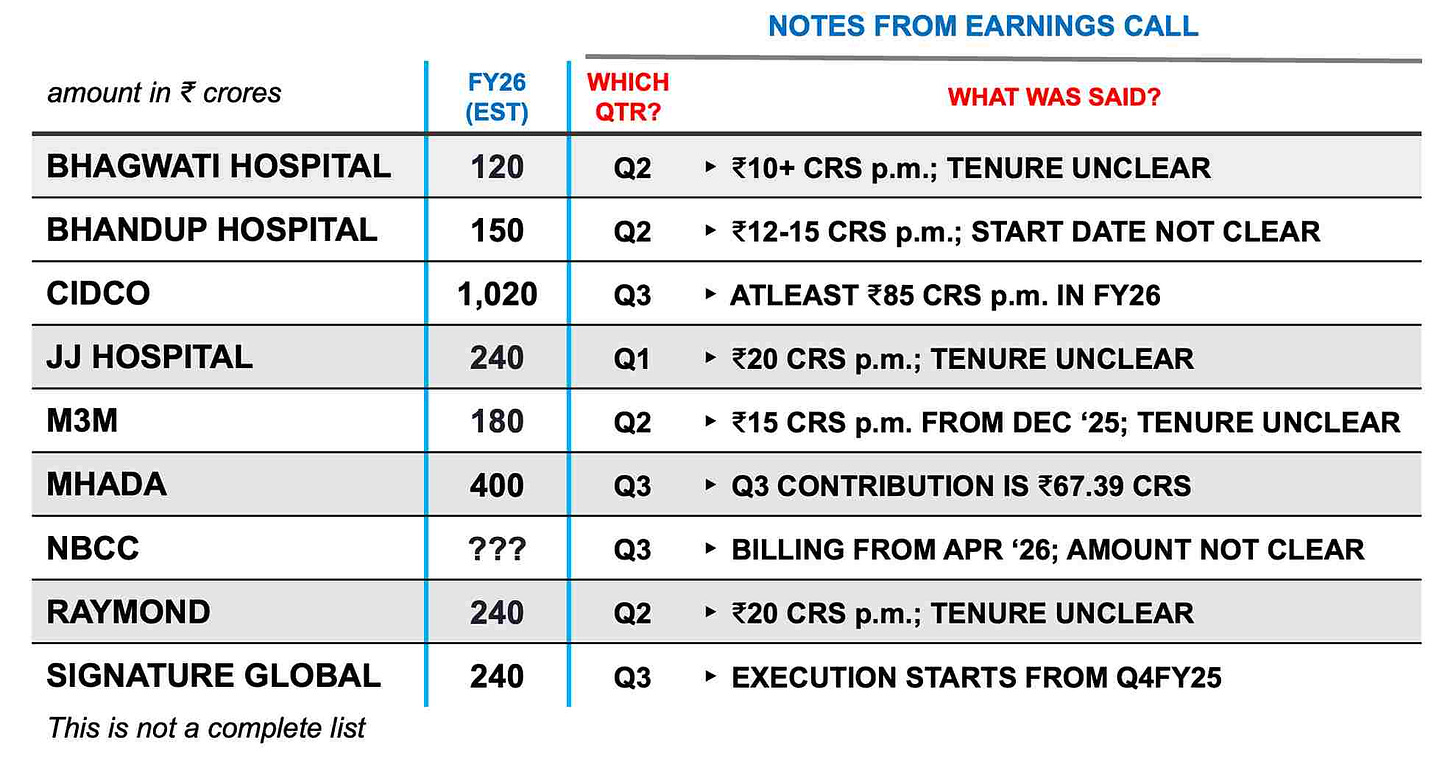

👉 For FY26 revenue projections, I took a bottom-up approach, mapping potential revenues on a client-by-client basis

Of course, not every detail is crystal clear from the earnings calls & presentations. I’ll appreciate if you can do some digging yourself & share your findings in the comments

One example – Capacit’e bagged a ₹474 crore order from Godrej in April 2023 (exchange filing) but there’s no clarity on when it will reflect in revenues. Hopefully, future earnings calls will shed more light on this

👉 A key takeaway: all contracts here are aligned with Capacit’e Infraprojects’ strategy of working with few top-tier clients & on projects that guarantee a minimum monthly billing of ₹10 crores

Investing is a continuous process of learning, analyzing & refining decisions. A lifelong task, skill, passion & an ever-evolving pursuit!

That’s why I’m launching ALPHA — a paid community where like-minded members come together to discuss opportunities, share insights & grow wealth collectively. Unlike a course/workshop, Alpha is a semi-structured space featuring original research, webinars, discussions, expert talk & member-driven participation

It’s my most ambitious project yet — one that I’m deeply passionate about & fully committed to. Tap the link below to learn more, and if it feels like the right fit, I’d love to have you join us! 🤗

Financials

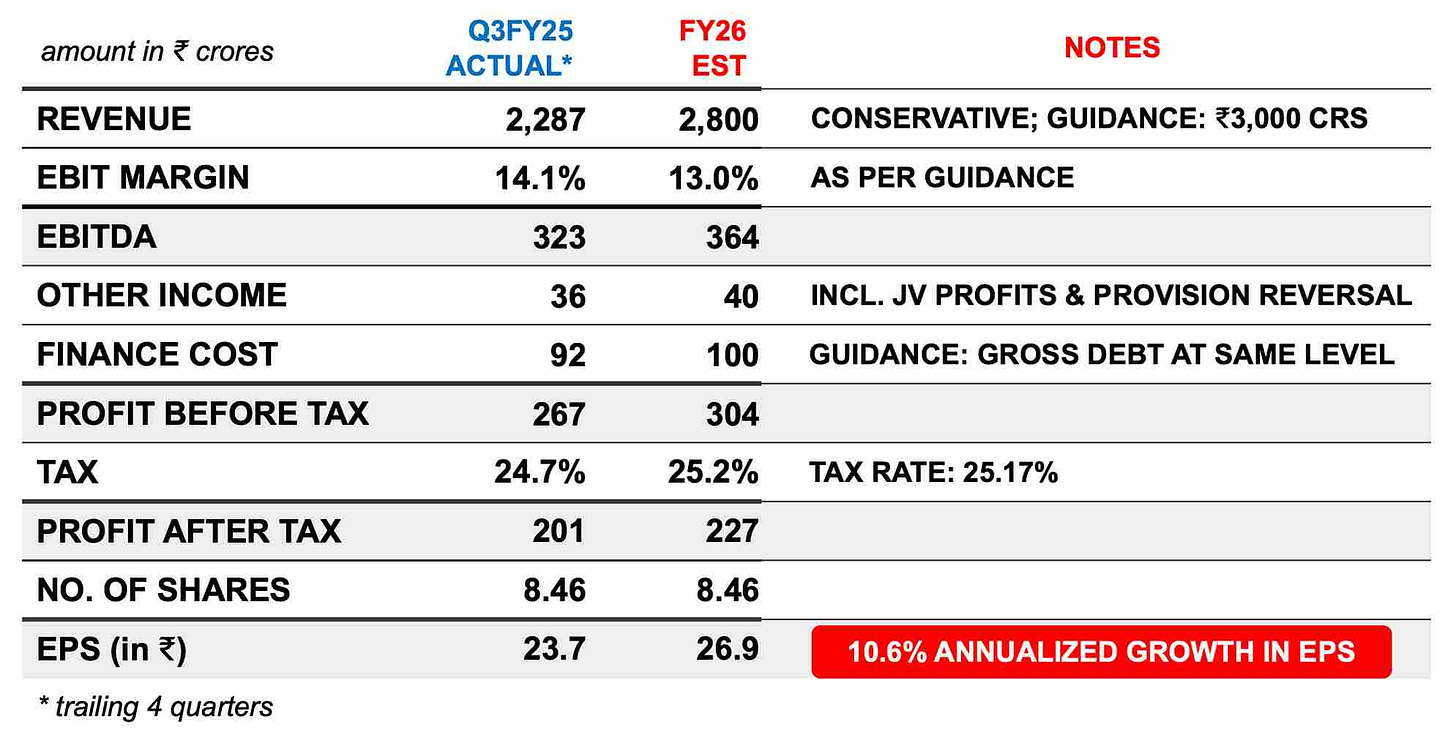

🎯 Revenue

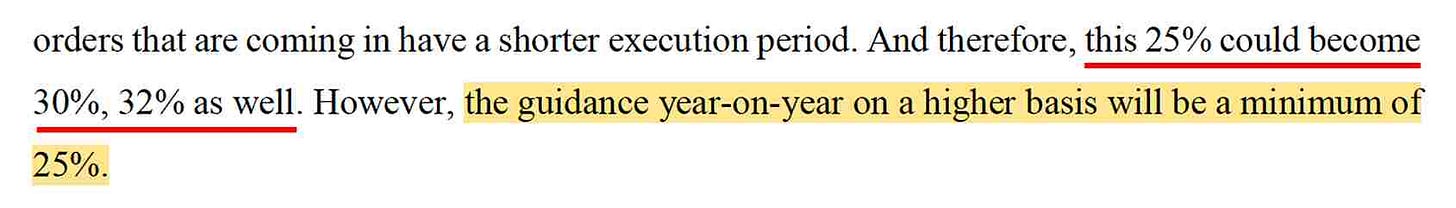

Capacit’e management is rooting for 25% revenue growth in FY26, translating to ₹3,000 crores, based on their FY25 closing guidance of ₹2,400 crores

However, I’m taking a more conservative stance – assuming 20% growth, which brings my FY26 revenue estimate to ₹2,800 crores

🎯 Margin

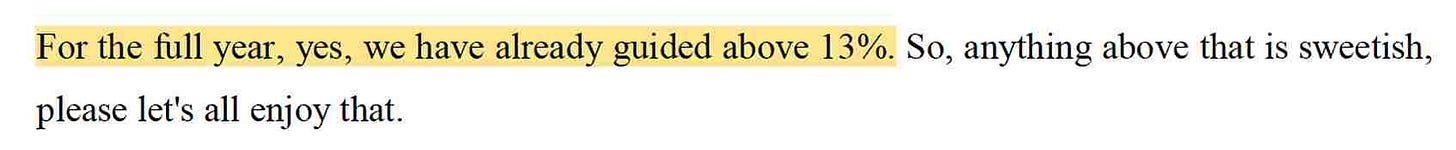

Capacit’e's 9MFY25 EBIT margin stands at 14.6%

However, I’m keeping FY26 margin estimates at 13% to stay on the cautious side. The management too is a little guarded on this

🎯 FY26 Projections

Unlike some other companies we’ve covered in the newsletter, projected EPS growth here is a modest 10.6%

This is primarily due to: a) conservative revenue projections (20% instead of 25%) and b) 13% EBIT margin estimate (vs 14.6% in 9MFY25)

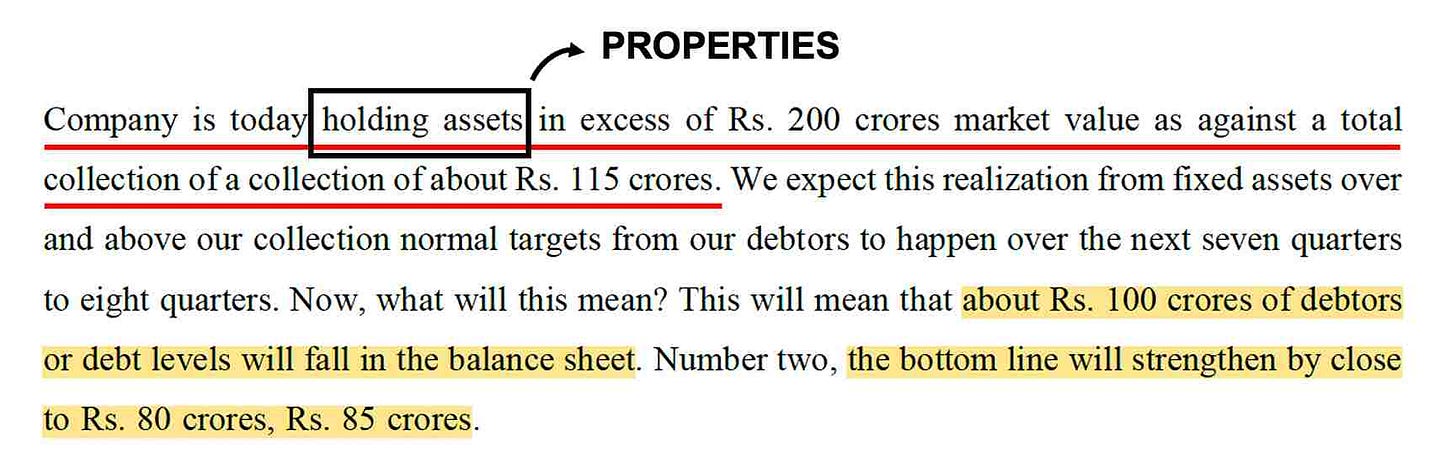

👉 An Upside: Capacit’e Infraprojects is set to benefit from substantial ‘reversals in provisions’ related to Expected Credit Loss (ECL) and bad debts. I have not factored these in my FY26 Projections

Currently, the company is in the process of registering & disposing of properties, which is expected to generate ₹115-120 crores — over the next 4-5 quarters. This inflow will not only boost profitability (PAT) but also help reduce debt levels significantly

Additionally, Capacit’e anticipates upwards of ₹50 crores in Q4FY25 as part of an ₹80 crore reversal. So far, a disposal of ₹41 crores has been completed & an NOC from the lead bank is awaited for the money to be realized

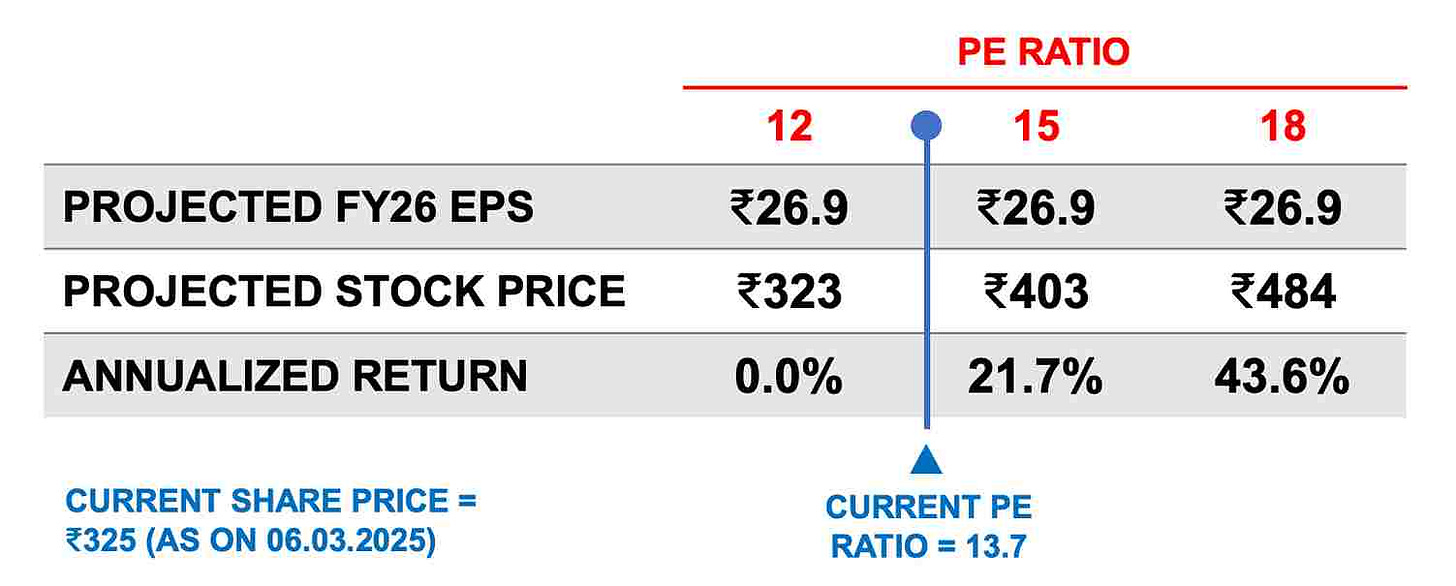

Valuation

At the current stock price of ₹325, Capacit’e trades at a TTM PE multiple of 13.7

As always, I’ve mapped future EPS projections across different PE bands to estimate a potential price range

At a PE of 15, my estimations point to an annualized stock price return of 21.7% by March 2026

That said, I do encourage you to assess where the PE multiple might realistically settle based on your research and do revisit my assumptions

My Viewpoint

Capacit’e Infraprojects has carved a niche in high-rise construction, consistently delivering revenues and profits at 25% CAGR over the last decade

A deep dive into its strong order book, revenue realization, margins, risk management and recovery initiatives points to a well-positioned business with robust fundamentals

While EPS growth might appear modest at first glance, the real story lies elsewhere — attractive valuations (PE: 13.7), credibility (tier-1 clients & big orders), growth potential (orderbook to revenue) and macro tailwinds (urbanization & demand for high-rise accommodation)

This combination makes Capacit’e an interesting candidate for deeper analysis and potential investment

As always, I look forward to hearing your views on it 📢

Much love,

Shankar

Just to add, over the last few years, every March quarter has been better than December quarter in revenue.

So it is quite possible they will be able to do what they have guided for

Hi

I feel the company projected to grow at 25% can easily command a PE of 20, considering the not so good past.

I have participated in 2 concalls and clarified some of my doubts with the management in the concalls