A Bank's Heist, Love Blossoms & a 22% Profit

In this issue, we examine - a) ICICI Bank's heist via ICICI Securities delisting process, b) a 22% profit opportunity with Somany Ceramics Buyback & c) new management as a catalyst in Cupid Limited

Hi everyone and thank you very much for the wonderful response to the first issue. In this second issue, I’ve covered three recent stories that’ll pique the interest of dedicated investors like us. Let’s go!

Story 1 of 3 (Reading time: 2 mins)

Love is in the Share : Why Cupid Limited is up 130% in Just 2 Months?

Cupid Limited is India’s leading manufacturer of male and female condoms, water-based lubricant jelly and IVD kits. Established in 1993, the company has a manufacturing facility in Pune, exports to 90+ countries and for FY23, it reported an income of ₹164 crores and a net profit of ₹31.5 crores

I first invested in Cupid Limited in 2021 due to it’s low valuations (mcap: ~₹300 crores with cash in books of ₹100 crores). However I exited my position over the next few quarters as the company’s growth and share price seemed to have stalled with no significant capital or capacity expansion for a long time

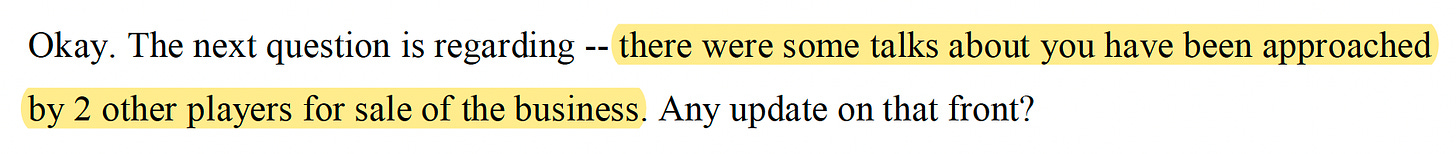

But things are changing and the first hint of that came in the company’s Q4FY23 earnings call transcript when an analyst asked their 78-year old Chairman & MD, Mr. Omprakash Garg if the business was up for sale (transcript)

Mr. Garg replied in the affirmative confirming that a couple of investors were in talks to fully buyout the promoter’s 45% shareholding.

Interestingly, Mr. Garg also spelt out his valuation target on the concall saying the promoters were keen to sell if someone were to offer 300 rupees a share i.e. a 15-20% markup over the then market price

It was a clear tell that the Gargs were old, tired & a little desperate to exit. The company’s growth was stalled for many quarters now and perhaps a new motivated management could do a lot better to this established operation. Unfortunately, I missed those clues then and didn’t invest :(

The news came on the 9th of September that the Universal-Halwasiya Group had entered into a definitive agreement to buyout the promoters at ₹285 a share. Further, the acquirers made a ₹113 crores open offer to the company’spublic shareholders for an additional 26% at ₹325 per share (press release)

Sensing there’s a plan in place, the market responded enthusiastically, driving up the share price to ₹397 - a good 22% above the open offer price.

The share price continued to forge ahead from there - driven by the anticipation of new management and growth prospects - and is presently at ₹945 representing a 138% gain from the day of announcement

That being said, I must say the new management has been buzy:

On 20th of October, Cupid Limited announced a complete overhaul of its board (notice)

On 4th of December, the company announced its acquisition of a new land parcel near Mumbai to increase production capacity by 150% within the next 18 to 24 months (press release)

The major learning here is to be mindful of corporate actions like a change in management. Such an event always garners a lot of interest and if the new management comes in with a growth mindset, there’s a lot of upside for investors to take advantage of

If you’re keen to do some homework, try to work out what the Burmans are upto at Eveready Industries and more recently at Religare Enterprises as well

If you like what I write, then please forward this email to your friends & connections and encourage them to subscribe using the button below. Thanks for your support!

Story 2 of 3 (Reading time: 1 min)

Somany Ceramics Buyback Paves a 22% Profit Opportunity

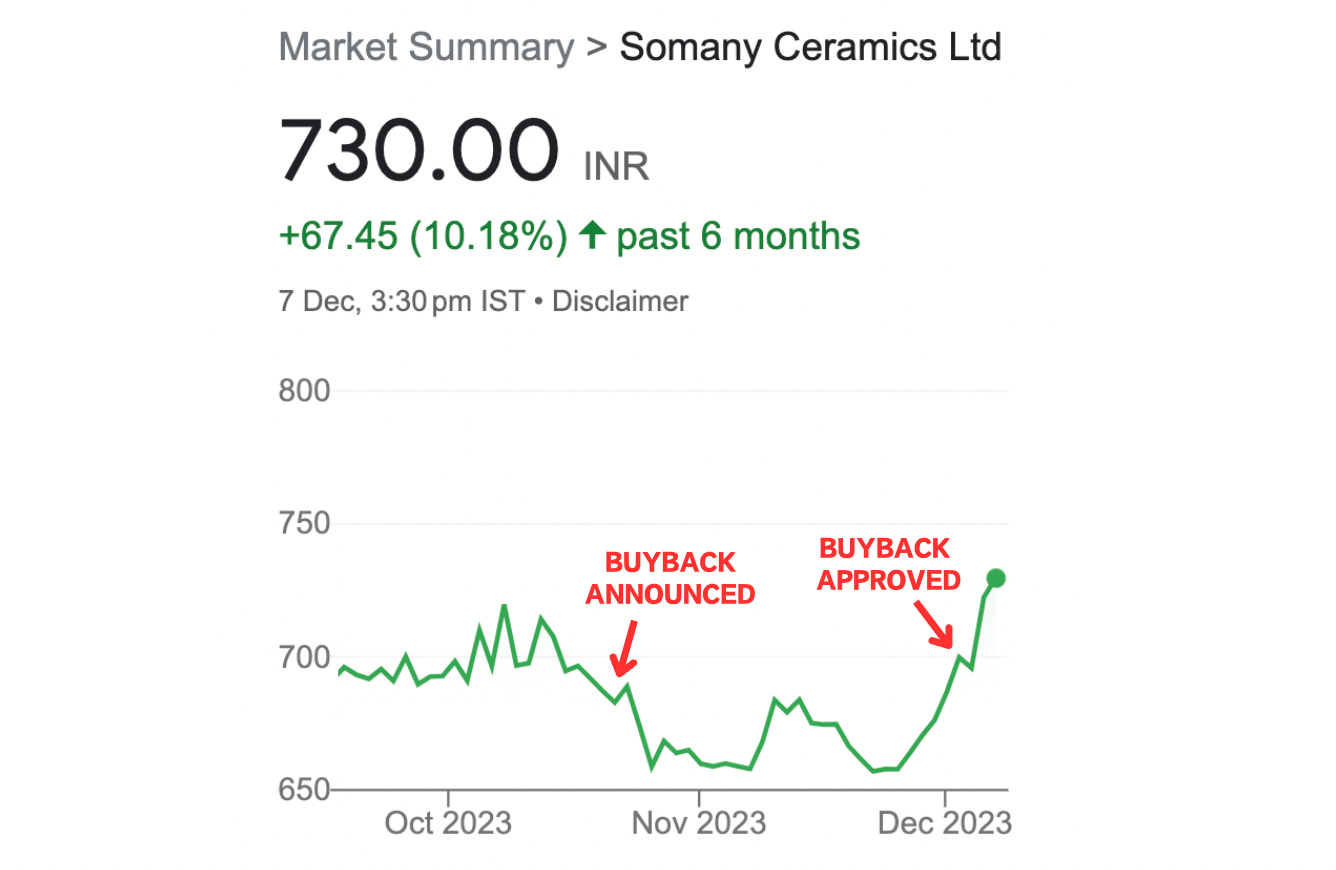

In the earlier issue, I shared a note on using TCS’s recent buyback program to gain 18% in a month. This time, Somany Ceramics has come up with a buyback and on the face of it, it seems more promising than the TCS one.

Let’s look into the details

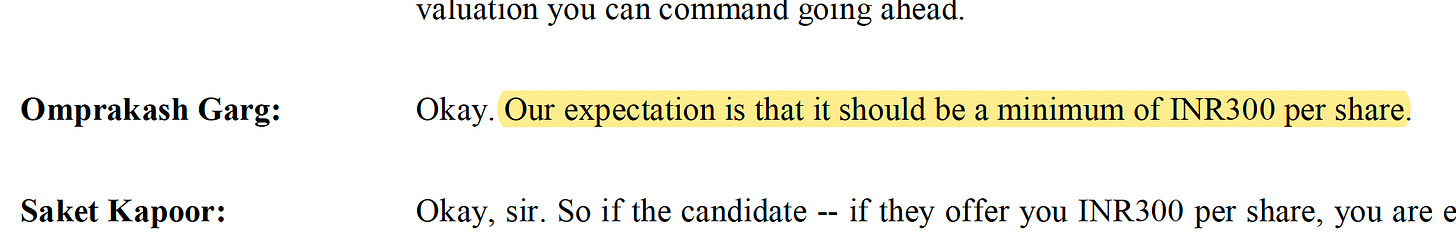

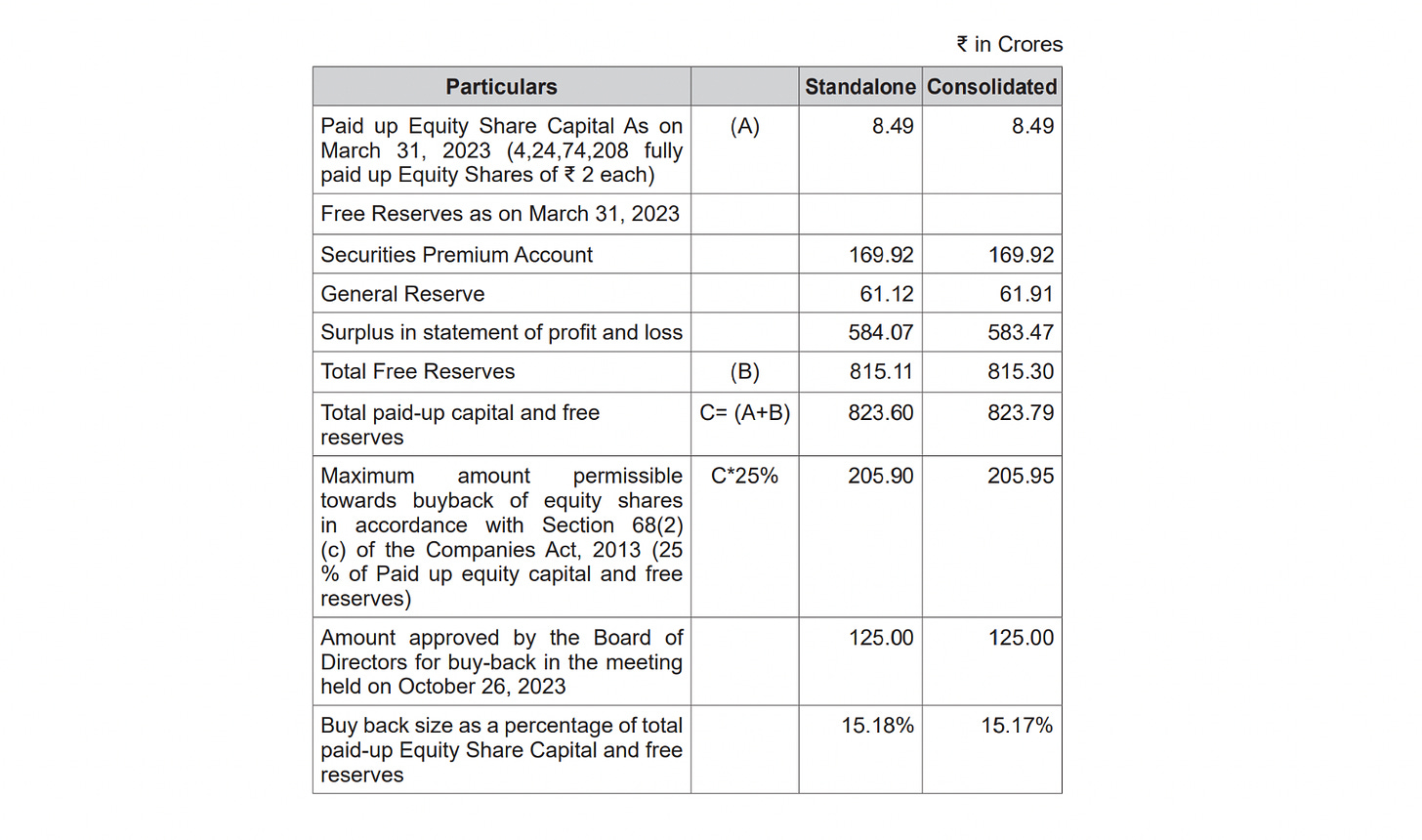

News regarding the proposed buyback was first heard on 20th October 2023. And on the 5th of December, the shareholders of Somany Ceramics Limited passed a special resolution approving the buyback of 14,70,588 fully paid-up equity shares at ₹850 a piece for an aggregate amount not exceeding ₹125 crores (announcement)

With the stock trading at ₹695 on the day of shareholder approval, this scenario represents a premium of 22% for existing shareholders of Somany Ceramics.

And with the 15th of December selected as the record date, anyone holding shares on that day can participate in the buyback offer

👉 Now this next part is important.

The buyback offer size represents 15.18% of the company’s fully paid-up equity capital (including reserves). Comparatively, the TCS buyback was for just 1.12% of the share capital & free reserve - so 15.18% is quite substantial considering the maximum allowed buyback size is 25%

A high % of paid-up capital and free reserve towards buyback generally means a higher acceptance ratio so if you are buying shares in Somany Ceramics to take advantage of this buyback opportunity then the odds of success are greater than what we saw in the TCS scenario

As I write this email, one share of Somany Ceramics is trading at ₹730 and with the buyback at ₹850 - it represents a potential profit of 16.5%

Nice one, right? If you know anyone who would love to receive similar stories, then please encourage them to subscribe to my newsletter. Thanks for your support!

Story 3 of 3 (Reading time: 2.5 mins)

ICICI Securities : Khayaal Promoters Ka

In June 2023, ICICI Securities announced its intention to delist and become a wholly-owned subsidiary of its parent company, ICICI Bank (company announcement)

Under the proposal, public shareholders of ICICI Securities would be allocated 67 equity shares of ICICI Bank for every 100 equity shares they held

Since then, the process has gone through a series of steps and most recently, ICICI Bank received approvals from the NSE & BSE which came in on the 29th of November (news)

As I write this piece, a major cog in the process is awaited wherein ICICI Securities, via a vote, needs a 2/3rd approval of the majority of ICICI Securities' public shareholders for delisting to go through. This is as per SEBI regulations

That’s where we are now but the backstory is really interesting .. so here we go!

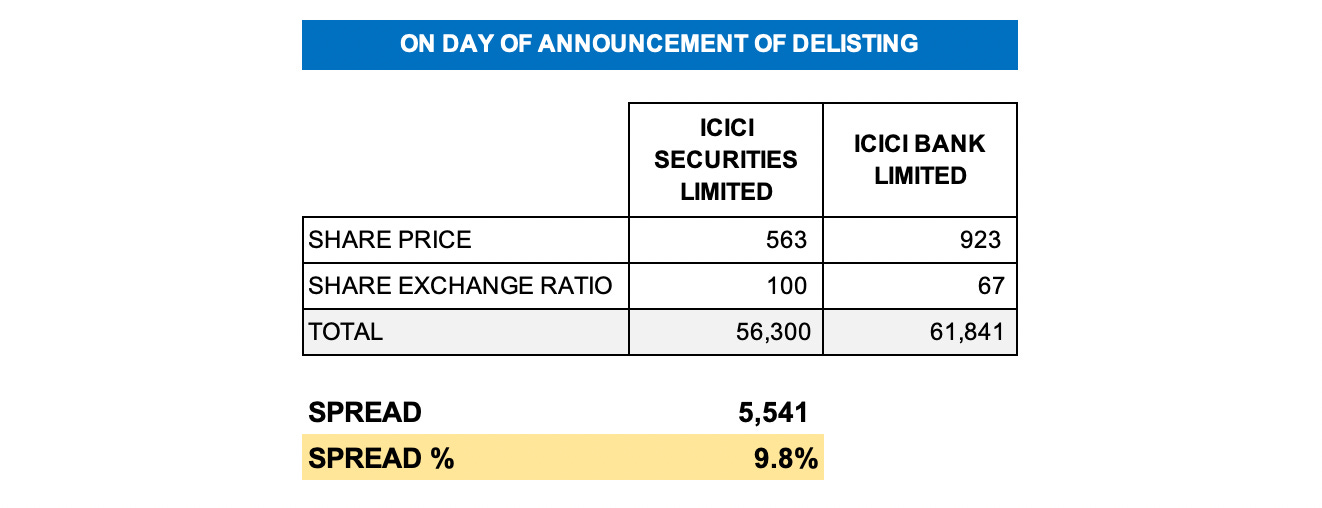

Since the day it was announced, this 67/100 share-exchange ratio was always going to be a bone of contention (valuation report)

The stock price then was hovering around the ₹560 mark and for many, opting for a share exchange might have seemed like the right thing to do

Recognizing the arbitrage, the share price did respond positively by jumping 11% on the next trading day but not everyone was giving this share exchange a warm embrace. Here’s why:

a) The ₹560 was very close to the 2018 IPO issue price and did not do justice to ICICI Securities’ EPS that had more than doubled from ₹17 to ₹38. In other words, while the company’s IPO PE multiple was 35, it was now trading at a PE ratio of just 17.6

b) Relatably, the company’s 1 year forward PE of 14 was a lot lower than peers like Angel One (1Y fwd PE = 21). Moreso, brokerages are expected to do well over the next few years and case in point is ICICI Sec’s Sep 2023 results itself where the quarterly EPS grew 40% YOY to an all-time-high of ₹13.1 (news)

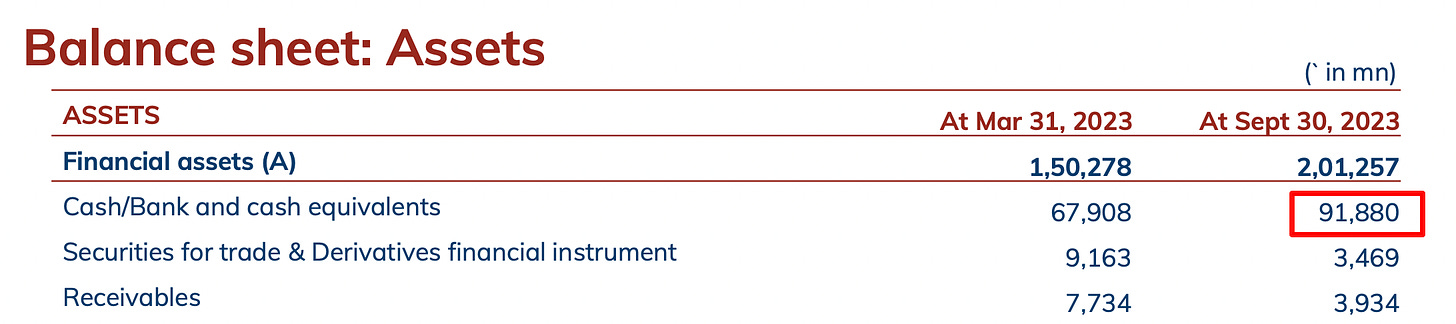

c) And here’s a good one. With ICICI Bank vying for the balance 25.15% equity, the entire deal is pegged at around ₹5,100 crores (give or take a few). Interestingly, the cash within the business is ₹9,188 crores (as of Sep 2023) & with the brokerage business not requiring any additional infusion of capital, one can understand why ICICI Bank has the sweeter deal in this share exchange

Essentially, ICICI Bank Limited seems to be getting back an undervalued, cash-richer, twice-as-profitable entity back within its fold at about the same price it had sold it for 5 years ago

This was not acceptable to many public investors and bigger shareholders like Norges Bank and a few PMS entities are against delisting (news)

👉 Three Scenarios to watch out for if Voting Result is NOT in favour of Delisting

As mentioned earlier, ICICI Securities now needs a 2/3rd approval from its public shareholders for delisting to go through. If the voting result is not in favour of a delisting then:

1. One can now look at ICICI Securities as a value play, presently available at a forward PE ratio of 15 & a dividend yield of ~3%. The delisting proposal might have done its work as a catalyst

2. There might be a revised proposal with an improved swap ratio. Remember, at today’s ICICI Bank share price of ₹1,002 and based on the 67/100 ratio, ICICI Securities should be priced at ₹671. As the current price of ICICI Sec is ₹723 - there is a case for an improvement in the share exchange ratio (maybe 80/100)

3. A third alternative might take the shape of a cash-for-shares arrangement (and not a share swap) with the promoters utilizing the company’s cash reserves to buy out the remaining shareholders. A premium would be expected so this might be in the ₹750 to ₹800 range

This is one space to watch out for and I’ll be sure to follow-up on this piece as more information comes to light

Have a pleasant weekend!

Much love,

Shankar

Hi Shankar,

Thanks for the great write up ! Do we know any specifics related to acceptance ratio ?

Hi Shankar - As usual, your thoughts and reasearch are well articulated. Just one observation - you have mentioned that Somany Ceramics buyback appears lucrative as it represents 15.18% of the paid up capital and free reserves vis-a-vis 1.12% for TCS. However as per the TCS letter of offer, the buyback size represents 24.45%/ 20.48% based on standalone/ consolidated interim financials. Hence, if one were to factor the lucrativeness purely from the buyback size as a percentage of overall paid up capital and free reserves, TCS appears to be much better than Somany.